I told you you weren’t worthy of the “Tesla Bull” nickname

„The bill, however, does away with phasing out automakers’ tax credits after they hit 200,000 electric vehicles sold, which would make General Motors Co and Tesla Inc eligible again.“

But yeah, go tell yourself it’s all a big conspiracy!

When you could also (as a shareholder) tell your glorious Supreme Leader to just quit fighting unionising and stop violating labour law in doing so instead.

I wouldn’t be surprised if there’s also hidden protectionist agenda at play indeed.

Then again, Musk has / they have always misrepresented „AutoPilot“ to he extent that they thought they could legally get away with, rather than marketing as a driver-assistance system. So they had that coming.

Not really on the hardware.

Apparently, Tesla is now worth 1 trillion.

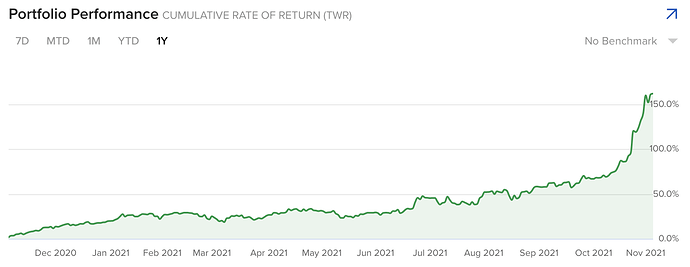

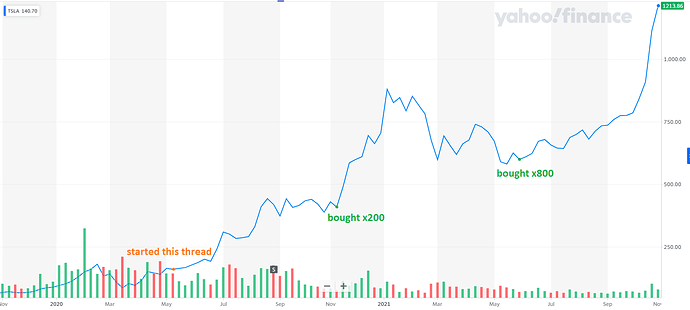

A day to remember. Hertz ordered 100’000 Teslas. $1’000 barrier broken. Against the advice of TSLA bears (@San_Francisco, @Julianek, @nabalzbhf), I stayed invested. If I went all in the day I created this thread, I would have reached FI already.

I’m also invested in TSLA, just market cap weighted

In hindsight I’m sure you can find better performing assets. BTC also has the same performance since May 2020 (+500%), I wonder if it’s a coincidence.

…less than 4 months after emerging out of bankruptcy.

I’m sure the next such opportunity is just 'round of the corner.

Many of it, actually. You just have to pick your’s wisely - and then go all in on it.

Even if it worked well in hindsight, things could have gone very different.

Yeah… if I’d gone all in when I bought Bitcoin or that Russian Neobank’s stock last year… ![]()

(Actually bought it the very day before Bojack started this thread, and it was my second biggest single-stock investment back then. But then, there had also some reasons reasons not to go overboard/all-in)

Well duh. But it’s only easy in hindsight. But you guys were serving news like “Michael Burry shorts TSLA” as arguments why this is such a bad investment. He’s not shorting anymore.

And being taken over by new owners who paid a couple of billion for it, and now want to implement a new strategy.

That’s not really true. How often do you spot a company that later reaches $1 trillion market cap? Yeah you can find some obscure company that turns itself around and the stocks shoots up. But finding it is super difficult.

Everything is obvious in hindsight.

At this point I wouldn’t be surprised if they reach 10T by the end of this decade.

This is the reasoning that says that “Tesla is the next Tesla”.

But I would still be surprised if this is achieved. Let’s not forget the EPS for Q3 2021 was $1.86. I can imagine EPS could hit $100 by the end of 2030, but I doubt a P/E of 100 would still be justified.

I will be satisfied if the market cap reaches $2T by the end of 2026. Beyond that, it’s hard to predict what will happen.

Inflation and technological development makes share prices go higher and higher. So a market cap of $3 trillion sounds impressive today, but so did $400 billion 20 years ago.

By the way, $3T is a rather mild prediction in comparison to the ones I’ve seen, which are in excess of $10T by 2031… Just think about this… $10T, how can someone come up with such a valuation with a straight face? It’s like 10% of the current global stock market.

2T by end of next week and 10T by end of 2022, what do you think?

I have to decide if I have reached FIRE. It doesn’t feel that way, but I’m way past my initial target…

Congrats!

It has been quite a fast trip, no ?

You tell me ![]()

Honestly, it feels like “easy come easy go”. I’m not selling so all this profit is just on paper.

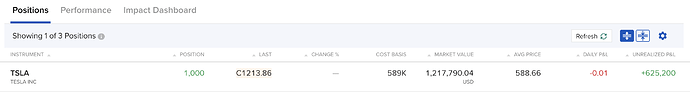

Dear Lord of God of Jesus Christ : +625’200

Did you purchased it in one lump sum ? Or did you refeed it ?

I actually only made two trades. Here’s the unfolding.

I keep thinking “what if I bought in may 2020”, followed by “what if I never bought anything”. So yeah… weird feeling.

Those are WSB worthy profits, congrats!

Wow, congrats! You could move all to VWRL and enjoy FIRE or keep it