Materials used in electric cars can be recycled to a high degree. Once we run out of certain materials, we find replacements or new sources. Energy? Put a 10 kW solar panel on your roof and in 10 hours you can charge an 80 kWh battery. So from 1 day of solar energy collected from your roof, you can drive for 400 km.

You probably say the truth about the carbon but it’s just an example of a lighter and more resistant material than steel. Planes use lighter materials but very bad to recycle actually hope this will evolve or look that during R&D

It’s not an issue the production

cost if we can keep the same material for long time by reusing parts and not change each 2 years.

Solar panel is a joke Bojack. Buy one and look what is that really. I have tested it’s just pretty bad. Consume too much power to manufacturer take 10 years for return it’s manufacturing cost with a life of ~15 years due to decreasing production over time and recycling not great too. Need battery, converter, it’s just not sustainable.

Only solar thermal worth something by heating water or just mirror who heat something for produce power during 20-22/24h at the right location it’s pretty good.

Solar panel and wind generator (lighter material so bad recycling) you can just forget for produce the tomorrow power. Geothermal and nuclear energy are probably the future no other way for increase production on the long term.

How long does that solar panel last?

This is a bit off-topic but I would like to hear your opinion on nuclear energy. Do we want more of it or less of it?

Solar panels degrade their power output by about 0.5% per year. This gives you 25 years of high performance but of course it will keep on working after that. I hope these numbers will improve though. I can’t give any first hand experience. But the total cost per kWh over the lifespan of a solar panel is constantly dropping, we might still go much lower until 2030.

Regarding nuclear: I think we’ve discussed in this thread. I only base my thoughts on what I read online. I’d keep the plants that are working but be careful about building new ones in places with a lot of sun or wind. I think in 10 years time it will become evident that these plants are not economically viable anymore.

Lol at people dismissing wind or solar plant because “difficult to recycle” and then they talk about nuclear, which is the pinnacle of NOT recycling. You can’t even recycle the steel used to build the nuclear plant.

Make up your mind folks, but don’t be ridiculous.

Added 25 x TSLA @ 575

The price dropped substantially. I’m almost in the red

How can some of you guys invest so much money in a company whose fortunes are so tightly coupled with an eccentric personality like Elon Musk?

See the very beginning of this thread:

I was about to add something - but then I realised I already did at the beginning of this thread.

EDIT: I was also about to say I doubt that Bojack (or any other of the true Tesla believers here) has any other religion, that’s “bigger”, that he more adheres to than Tesla. Or any other religious leader he worships more than Elon Musk. Even if his ways are strange, his utterings enigmatic and his decisions capricious at times (though again, that’s not unlike any other religious leader or god, is it?).

But then, he basically said it himself on the forum a while ago.

In essence: ![]() Technology and science is their belief, Tesla their faith, Elon their prophet.

Technology and science is their belief, Tesla their faith, Elon their prophet.

(…the internet their church to congregate, and Cathie Wood their biggest televangelist)

Just for your interest, not saying it changes anything.

At first, I thought he had huge balls, then I realised: puts aren’t shorts, the title is very misleading at best, it’s actually a bearish bet on Tesla and treasuries with limited downside, as opposed to real shorts, that bear unlimited risk. I don’t know if it really makes a difference but I feel better knowing hedge funds are limiting their losses to the assets they actually have.

Can’t say this makes me happy, the guy has some track record. Feels not very comfortable to bet against him.

We have no idea how long of a bet it really is, though. He might just hold those puts for a few weeks. The bet on treasury yields may hold only until June and then get sold into a bullish position. It’s really hard to make anything out of these data points other than punctual indicators of the sentiment of specific managers. Though I share his sentiment here, I would not put stock in it just because that’s been his positioning as of May 17 2021.

Yes, it could have been a short-term bet, which has already been closed. In this case he would have made the right call, as TSLA dropped from 900 to under 600.

I find this hilarious:

People are so impatient to get their hands on a Tesla, that they call out Elon in public ![]()

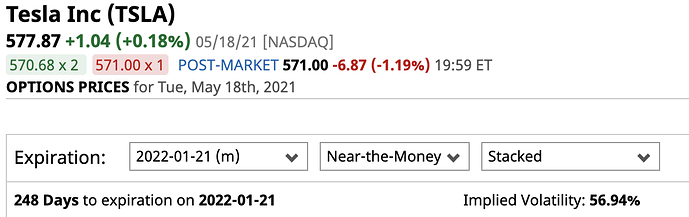

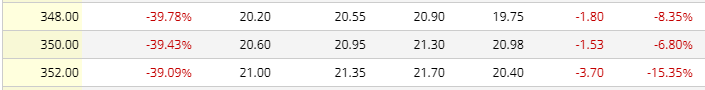

I would just like to address the Michael Burry FUD. As @Wolverine pointed out, PUTs aren’t shorts. It has been largely misreported, with headlines saying “Burry bet $530 million against TSLA”. But if we check the actual PUT price, we can see that it’s somewhere around $100:

So this bet was closer to $80 million than $530 million. And if you’re extremely bearish, you can buy a $350 put for just $20. If that’s what Burry did, he only paid $16 million for it.

By the way, this looks to me like a much safer/smarter way of betting against the price of a stock than shorting. You pay $100 for an option to sell stock for $600 that today also trades for $600. If the stock drops to $200, you’ve made $300 profit, that’s 3x your investment. And if the price stays or goes up, you’ve just lost $100, but not more. What do you think?

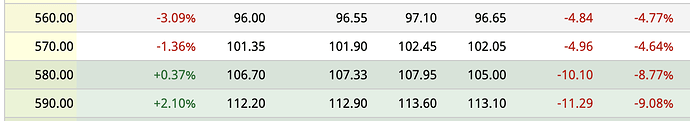

And now for the other news. You’ve heard all news outlets shouting about Burry and his “short”. But have you heard that Renaissance Technologies have increased their TSLA position by 217% to 827.381 shares? Yes, these are the big brains from the Medallion Fund. But it’s hard to find any news on that.

I guess it’s because it’s hard to know what to make of it? They used to have a much larger position back in 2020 (they held 2% of the company at some point).

Interesting, didn’t know that. I found the following chart, although the price looks a bit funny, it does not reflect the split.

So they bought 4 million shares for $250 pre-split, that is $50 post-split. Then then the price exploded, they sold. But now they buy again. Still a bullish signal IMO.

Where/how did you get the actual put price?