No idea about that, I can only provide info about purchasing process as I bought 2… ![]()

Thanks for the correction, i did not know that.

This is why I said that there is surely available spare capacity, and I did not multiply current deliveries by 20 but by 10. Anyway, the point I am trying to make is that as long as PPE needs is above 2.5 times current PPE, the maths does not work out.

Let’s try to be fair to ARK, and take their target of $77 billion of gross PPE in 2025. As said, we are currently at $29 billion gross PPE. That makes a hole of $48 billion of capex to invest. Let’s be generous and say they will cover part of it with the totality of the available cash ($19 billion). Now there is only $29billion to find. As said before, reinvested profits won’t do it. So let’s say they fund it with debt. As a reminder, the interest rate on their current debt is 5.3%. 5.3% of $29 billion is $1.5 billion per year of interest payments alone (i am not even talking about reimbursement of principal). That’s 3 times the current annual profits. In other terms, they would not be even able to repay the interest. What kind of lender would be willing to lend with this risk for 5.3% per year? And even if someone was willing to do it, what happens when it is time to reimburse the principal? Bet the company on the hope that creditors will be willing to refinance?

If that is the case then I want to understand where the rest of the fixed assets come from, as it would look like TSLA would only need to have invested $6-8 billion to run its operations, instead of the stated gross $29 billion. Probably this $2billion figure misses the cost of equipment and refitting machines each time you have a new product line.

The whole point of working capital is that you did not yet receive cash from sales to cover for it:

- Inventory is capital you invested but did not sell yet. You had to pay upfront for your inventory (and thus tied a lot of capital) but as long as it sits on your shelves you don’t have the cash.

- Account Receivables are sales you did, but for which you did not reveive the cash yet. Same here: you already paid all the expenses, but at the moment it is leaving a hole in your pocket because you did not receive yet the cash of the sale, cash which has to cover both profits and expenses.

So long story short: in this kind of industry where you have a 2% net margin and huge capital requirements, sales are not going to cover the working capital needs.

That’s correct. Capex is the cost of your fixed assets and their maintenance. So here both building a plant and maintening it/refitting is considered capex. Regarding your question of capex per vehicle, it means that ARK estimates that over the lifespan of the factory, the factory will have cost a total of X dollar and will have produced Y cars, so the capex per vehicle will be X/Y.

But again, if you take ARK’s estimate of $6’000 capex per vehicle, and their forecast of 21 million cumulative total cars sold by 2025 (vs 1 million in 2020), the maths does not add up. That makes a total capex need of $6’000 * (21 million -1 million) = $120 billion. Not something that could be raised through debt with current profitability.

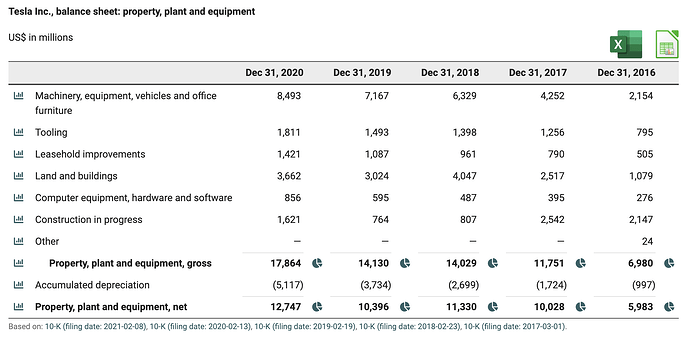

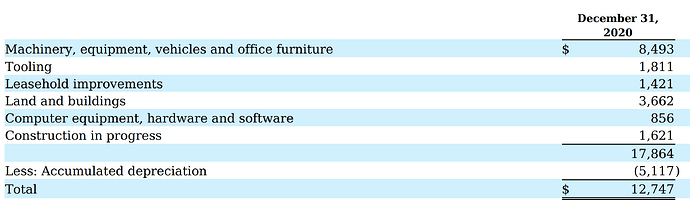

Where do you get this $29b from? When I google for PP&E, I get:

Or do you add working capital on top of that?

So capex leads to growth of PP&E, yes? Can you not fund that with earnings from sales of existing cars? Let’s say right now, with all available PP&E, Tesla can manufacture 1’000’000 Model 3&Y per year, generating sales of $50b and cost of $30b, assuming a profit margin of 40%. That’s $20b earnings that can go into construction of further factories. Or are some of my numbers wrong?

Sorry not nearly as deep into the topic as you guys, but is this even an issue? With this insane valuations I’d just issue new shares.

There the issue is that :

- existing shareholders have to agree for a new round of capital

- Do you find enough institutional investors to give you that capital to put it at disposal for the secondary market.

I guess institutional investors will be much more cautious at throwing more money into Tesla. Well they might think to be able to resell it at higher price on the secondary market to some FOMO private investor at even higher valuation…

(just to be clear, not anti Tesla, but I am pretty much on Julianek’s side that valuation are way too high + that Tesla is indeed a car manufacturer and not some software company, at least yet. Finally, I do not think they having that much of a head start on Automated driving. I might be wrong, but that is why I am a mere index investor).

I got a side question though : With all these skyrocket stuff like Gamestop, Tesla and frauds like Wirecard or Greenshill, does anybody know how index funds are actually handling these situations ? I wanted to ask Vanguard directly with the Wirecard scandal, but could not find any address to make that question. You could argue it is less than 5% of the portfolio each, so why care. Just an out of curiosity question.

Sure, but they need capital or it’s impossible to reach their goals. Nobody is forced to invest more money, current shareholders can exercise or sell their options.

The problem is that ARK sets the share price as = Enterprise Value / Outstanding Shares

If you need to issue new shares, that will impact share price, so you can’t just say $3’000, if there are twice as many shares as in 2020.

Yeah unfortunately it’s not free money.

But Tesla will need more capital.

So for me the question is:

Should Tesla at this valuation issue bonds or new shares.

Both has downsides, but to me it seems crazy to not issue new shares. Especially as @Julianek said it might be impossible to find enough lenders.

Exactly, actually the whole topic is not if Tesla gets enough capital, but that ARKs valuation is actually bullshit just from a financial point of view.

We did not even went into the topic of is it actually humanly possible for a company to build these factories so quickly

(Tesla is actually taking a lot of risks in Germany by forcing the march, they have to submit huge bank guarantees to go ahead in their program without having the actual building permits).

It’s certainly Equity Value (EqV), not Enterprise Value (EV). EqV = EV less Net Debt

Enterprise value/EBITDA (more commonly referred to by the acronym EV/EBITDA ) is a popular valuation multiple used in the finance industry to measure the value of a company

Am aware what EV/EBITDA is - if this is your starting point and you wish to get to price per share then the steps are as follows:

- EBITDA times multiple = EV

- EV less Net Debt = EqV

- Eq/V over number of shares outstanding = share price

What I pointed out in your message is that EV / outstanding shares equals share price is not correct as EV refers to not only equity holders, but also debt holders, etc., while EqV refers to equity holders only (and so does share price)

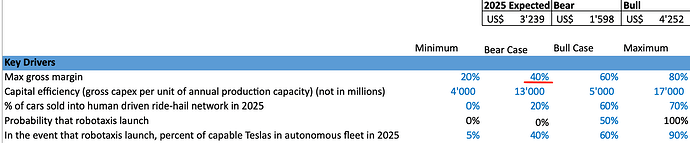

Sorry, over the weekend the discussion has drifted towards ARK’s model for TSLA’s 2025 share price, which forecast, in a bear case, production of 10 million vehicles per year by 2025, with cumulative vehicles sold at 21 million. And all of that without raising equity.

My bad, I got it from Yahoo Finance (see the $29b in one of my screenshots above), and it turns out that Yahoo has wrong values. So I stand corrected and the real figure for gross PPE taken directly from TSLA 10K 2020 (page 79) is $17.8 billion. Yahoo had included a bunch of other stuffs as well (for instance, vehicles needed to operate the company) which, while still needed, are not strictly PPE.

So I will have to revise my estimates by digging more into the 10k. However, since the topic is ARK’s model for Tsla, let’s review their own estimate for capex. They made estimates in two places:

- In the tab “Tesla Valuation”, they forecast that by 2025, gross PPE will be $77billion. It means an investment of 77-17.8 = 59.2 billion in less than five years.

- In the “Monte Carlo Input” tab, they say that in the bear case, the capex per vehicle will be $13’000, vs $5’000 in the bull case. With a cumulative 20 million vehicles sold by then, that makes capital needs between $100 billion (bull case) and $260 billion.

But where it gets really nuts is not only to assume whether they will raise or not this capital. It is that they will raise it without equity within 5 years and then build in time N gigafactories to reach those production numbers on time! And all of this for a bear case.

It’s actually good that you are raising this question, because it made me discover another funny assumption.

First, to answer your question: I assume that by profit margin you mean gross margins. Tesla gross margins are currently 21% (and with competition coming, will surely get lower, as is implied by its recent price cuts worldwide). So that would mean that you would have gross profits of $12.5 billion. You could in theory keep it all to yourself and reinject it into building factories, if:

- you don’t spend on R&D

- you don’t pay your workforce

- you don’t have any overhead, administrative headquarter costs/office leasing/etc

- you don’t have to pay interest on your existing debt, nor reimburse the principal

- you don’t have to pay taxes

- you don’t award your CEO a compensation package of up to $56 billion tied to share performance.

- etc.

Once all of this is paid, there is not much left for reinvestment.

At first, I did not get why you would choose such a high gross profit margin (40% is really really high for cars). Then I discovered that this is, once again, the bear case assumption from ARK’s model.

Just to sum up, current gross margins are 21% : in 2020 revenues were $31 billion and gross profits $6.6 billion).

But somehow ARK thinks that in a pessimistic case gross margins will be 40%? And all of that with the pricing pressure of competition coming into the market? That’s bonkers.

That’s the bull case. In a bear case it’s 5 million. ![]()

Mind you, I think this depends on which draw of the Monte Carlo simulation you get. They draw a couple of uncertain parameters from a normal distribution and then calculate the whole model with it.

Making random numbers up and running them through a Monte Carlo simulation isn’t sound economic analysis though. Then again, that isn’t necessarily the business ARK is operating in. Though Cathie Wood does sell it quite convincingly, I have to say, with her calm, soft-spoken demeanour (especially compared to many other investment TV personalities).

It’s one thing to make up random number, and another to say that you predict this value to be approximated by a probability distribution with a given expected value and standard deviation. If you ask me, that’s much more reasonable than saying “X will be 5000 and our price target is $1000”.

This is how prediction models work in sports. Of course, you need to use the right probability distribution for the right use case. ARK’s sheet is big and I’d need a couple of days to go through all the cells. The workbook being locked does not help, as some columns are hidden.

Let me give you an example. How many cars will Tesla sell this year? 1 million? 900k? Well, you can just say you predict it to be a value from the normal_distribution(ev = 1 million, std = 100 thousand). Add to it your confidence interval and you can test some hypotheses. Multiply a bunch of random variables together and you see how shaky your prediction actually is. It’s very hard to calculate random variables that are results of multiplication of other random variables. That’s why you just draw some numbers and see what comes out. Then you repeat it, 100’000 times and draw a distribution of all results. That’s the beauty of Monte Carlo.

This news is several months old

Related FT piece: https://archive.is/jslJ5

So after 1000+ posts in this thread, is there an answer yet? Should you buy TSLA shares?