I think Elon’s kind of a genius - but a straight-out nutter nonetheless.

I think we are just talking without sense, not even hearing the full case, not knowing all the facts. I will need to watch a few videos on this, I’m not going to figure it out on my own. And also not with the help of people calling the richest man in the World a lucky idiot or a nut.

You certanly need a lot of luck to become the richest man in the world.

Noone gets successful without luck.

Everybody that tried to move around 100k+ with a regular bank should know that 1.5B in Bitcoin are probably more liquid/accessible than in a bank…

No. Don’t forget that because insurance companies are quoting high premiums for Tesla’s D&O insurance, Musk decided to underwrite personally this insurance for his board and officers. In other words: Nobody in the board is going to challenge the very guy who is supposed to cover their ass in case the shit hits the fan. The board might look very respectful on the surface, but in reality it’s not overseeing anything.

This makes little sense as well. Let’s suppose I am a potential TSLA customer.

- If I am bullish on BTC, it would make no sense for me to exchange my BTC (an appreciating asset), against a car (a depreciating asset)

- If I don’t believe in BTC, i won’t use it anyway

- If I am neutral about BTC, I have a hard time imagining that I would go through the hassle to exchange my cash against BTC (incurring big conversion fee), and there running the risk, given BTC volatitlity, that tomorrow BTC has gown down and now I don’t have enough to buy a car anymore (i doubt the car price will be fixed in BTC). Cash has a net advantage here.

The only customer who would pay in BTC would be the one who finds it funny/exciting. But that’s such a minority that (A) it doesn’t make sense to focus on that because it doesn’t move the needle, and (B) it would actually divert the company’s focus from more important projects, like actually delivering on all the promises outstanding (FSD, semi, cybertruck,…).

When you look at the numbers, TSLA bought 1.5 billion BTC and there are roughly 1.1 billion outstanding shares on a diluted basis. So even if BTC doubles, it will only represent a profit of $1/share. Given the current share price and the current investment thesis, this isn’t significant (unless you are willing to pay as well a P/E of 500+ on BTC trading profits but that’s not my kind of game).

From a cash-substitute point of view, this does not make so much sense as well because of BTC’s volatity. If TSLA invests $X amount in BTC and needs it tomorrow to create a new factory, in the short term they don’t know if they will get back $X, $2X, or $0.5X.

So buying BTC is does nothing from a business point of view and is merely noise, it won’t change the big picture. For a short time I thought that newspapers were just overreacting to irrelevant facts.

But then I thought that even if this does not do anything to TSLA’s operation, the news is still doing some signalling to investors.

Which Investors?

- For those who believe in the company’s mission to “to accelerate the world’s transition to sustainable energy” (like @SwissMustachian for instance), investing $1.5 billion in one of the least energy-efficient technology is a bit contradictory. So they don’t think they are the target.

- On the other hand, a big part of Tsla shareholders are people enthusisastic about technology and who don’t really look at the valuation. This is in my opinion the target of the disclosure. TSLA’s biggest competitive advantage is not in its cars, nor in its technology or business model. TSLA’s biggest force is its negative cost of capital. Investors are excited pouring money at the company without looking at the results yet (we will see if they are right or not, this is not the question). The share price has been strongly increasing at the exact period where the company raised a significant amount of equity, which (A) is very good for TSLA, and (B) should not theoretically happen. And I am pretty sure that management would like to keep it this way. So if you can further excite techology-enthusiasts to buy your stock while you are busy trying to deliver on your promises, that could be an explanation of the disclosure.

Tesla believes it doesn’t cause issue:

Tesla said it did not believe the insurance offer threatened its boardroom independence because it was “intended to replace an ordinary course insurance policy”, and because the arrangement “is governed by a binding agreement with Tesla as to which Mr Musk does not have unilateral discretion to perform”.

I like how we are pretending to better understand corporate reserves than experts in the field. The only thing I see is that Tesla prefers to have $1.5b of value stored in BTC rather than any other assets. And that’s a fundamental change.

Looking forward to read the experts (which do not hold tsla nor btc) opinion after also Apple, Amazon and others will do the same.

I think the expert consensus is pretty clear here ![]() Is there any mainstream article pointing that this is anything but a publicity stunt?

Is there any mainstream article pointing that this is anything but a publicity stunt?

Btw how much money does Apple have lying around? Or Berkshire? Why don’t you call for them to distribute it to the shareholders?

Apple has 200B as far as i know… I expect at least 5B in btc soon

Which media exactly? The trusted TSLAQ sources? Tesla is never in the media for anything positive… all what they do looks like random and led by a crazy nut, right?

I’m super bullish holding tesla… .Tesla is unbeatable when I think that it even has the power to wake up the most hardened passive investors and get them to argue against it all day long!

I don’t know, anything like an expert’s quote in ft, wsj, or non financial newspaper of record like nyt, etc.

fwiw ft’s article on btc as treasury holding:

“Corporations invest their cash in very high quality, short-term fixed income securities, and are willing to accept a relatively low rate of return,” said Jerry Klein, a managing director at Treasury Partners, an investment management firm in New York. “I don’t think there is a case to be made for investing corporate cash in a risky asset like bitcoin, where they could experience significant declines.”

“It’s unusual, it’s risky and it won’t necessarily provide that hedge that they are looking for,” said Campbell Harvey, a professor at Duke University in Durham, North Carolina. “That to me is OK if you are a hedge fund and your clients know that this is exactly what you do, you make speculative bets and sometimes they work and sometimes they do not . . . Tesla is not a hedge fund.”

As I see it it’s only 8% of the capital so, even being bitcoin sympathiser, I’m not too worried about it. This news is making a lot of noise because, as you can see here https://bitcointreasuries.org/, there is not much history of public companies outside the crypto space investing in BTC as an alternative reserve. So is this a gamble? What if it’s a winner and sets a precedent for other CFO’s? We’ll see. In the meantime, I’m holding on to my gains. Predicting Tesla’s decline or “lack of growth ideas” seems absurd to me, doesn’t it?

It will become inevitable once Apple Pay accepts BTC. And this is inevitable as well because Cashapp, Paypal, Revolut and co. already accept BTC, so it is a competitive matter.

That’s exactly the issue, you now have negative interest rate on large cash holding. If you couple that with inflation it starts to hurt very much when you hold billions in USD.

Wake me up in 1 year. Elon changes the rules once again

Spot-on analysis IMO.

Neither Paypal nor Revolut do accept Bitcoin for payments.

Or any transactions (other than speculation).

nit: I think paypal does allow funding your account with btc.

edit: actually not yet, but iirc that was announced:

[…] signaled its plans to significantly increase cryptocurrency’s utility by making it available as a funding source for purchases at its 26 million merchants worldwide.

But anyway, you can also use VT as a funding source with some brokers ![]()

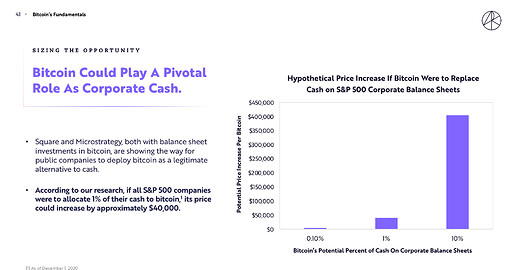

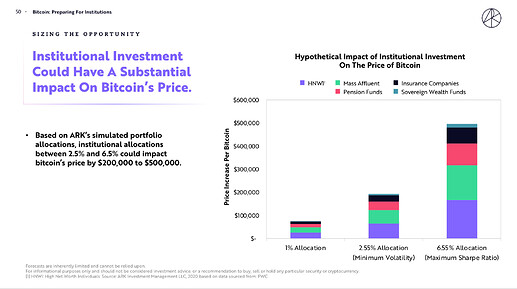

What do you all think about this bit of research from the team at ARK?

In their Big Ideas 2021 report they have highlighted the potential future price for BTC in case companies are going to start to diversify their cash using cryptocurrencies.

Today in the February’s market webinar they have highlighted that this possibilities is additive to all other potential future implementation of Bitcoin, meaning that the target price could be even higher.

What are your thoughts on this?