on the other hand with ongoing education human capital might still be going up at that time? (how do you even count this?)

I’m impressed by the mid-2022 to mid-2024, 1 year abroad and 1 year working (but still in training) and net worth increased by 27k. Were you supported in other ways, like living by relatives or is it with full rent/food/Krankenkasse/etc costs?

During my year abroad, I had a study grant which paid for the language school on site, work placements and accommodation. My parents supported me for some of the food, and I paid what was left over for food and all the leisure activities/outings on the side.

I’m still living with my parents at the moment. So since the start of my training I’ve been able to enjoy low expenses and now that I’ve got a job, I’m paying my parents rent, which is a pittance compared with real rent

When I turned 18 at the end of 2022, I received some money from my parents, which contributed to part of the increase (just under CHF 6,000).

On top of that, the financial markets were favourable that year.

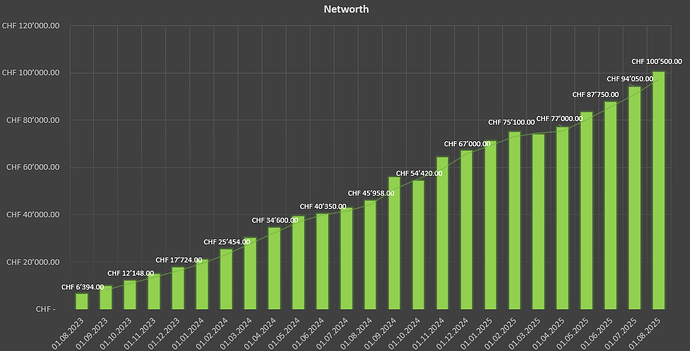

After excactly 2 years of working since August 2023 I finally reached a liquid networth of CHF 100’000!

I earned net CHF 122’000 in that time with a starting networth of CHF 6’400.

wow, that’s impressive

Congrats, what kind of salary are you earning?

About 65k net per year

So… if I understood correctly, you spent only 22K CHF over the last two years… about 11K CHF per year?

I believe the money in the market must have done something over the past 2 years. ![]()

(+IIRC VT-lover still enjoys the benefits of not living alone, so expenses could be relatively low as well)

Just hit 90k sheeeeeesh ![]()

One month left to hit 100k before 21yo

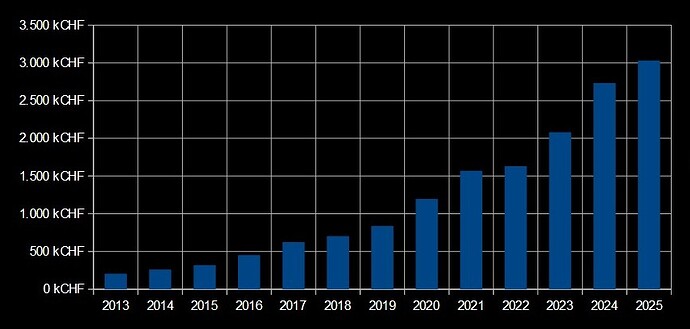

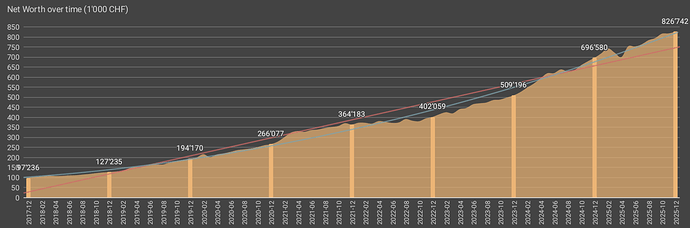

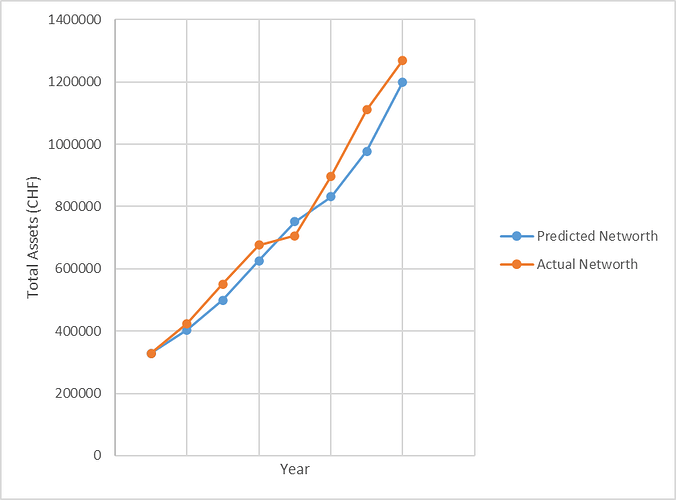

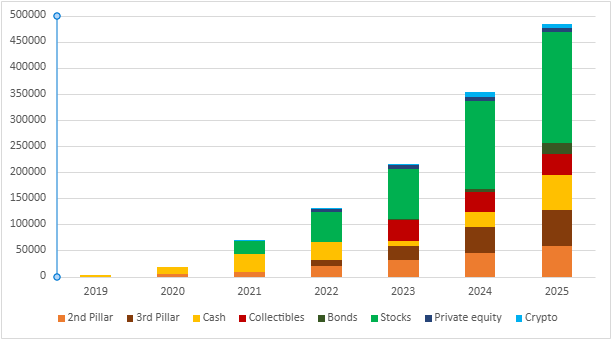

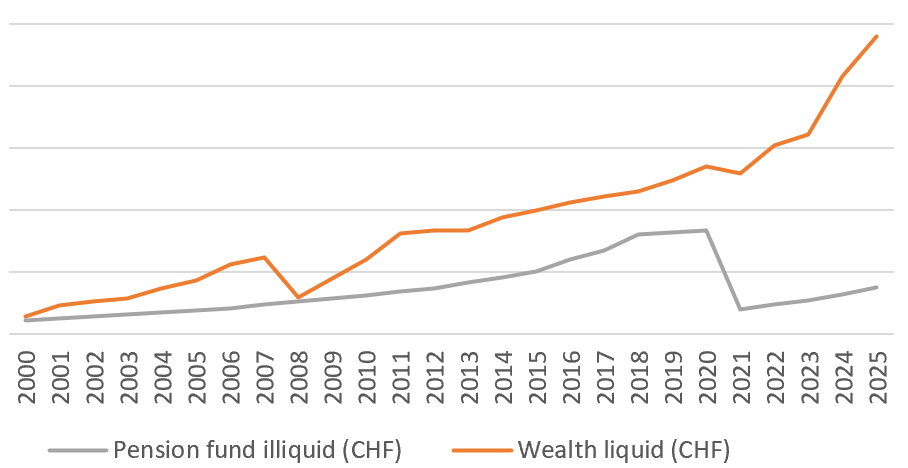

Networth so far, including 2025 Q3 numbers and real estate (400k CHF).

Edit: This is the networth together with my partner.

Great progress.

Do you mind sharing how much of this is thorough contributions vs investment returns?

Yesn’t ![]() (*)

(*)

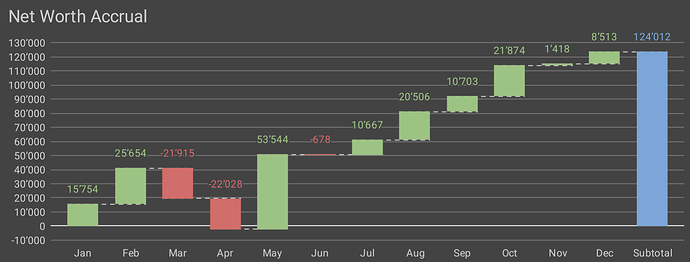

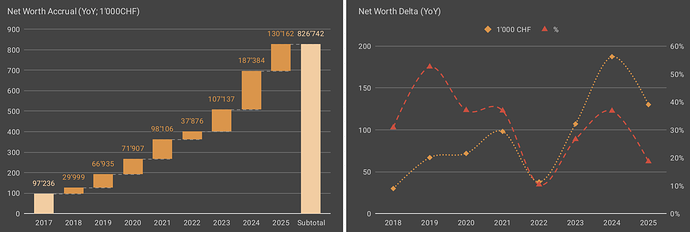

2025

YoY: +18% / +124k

- Of which 53k savings

- Rest portfolio work

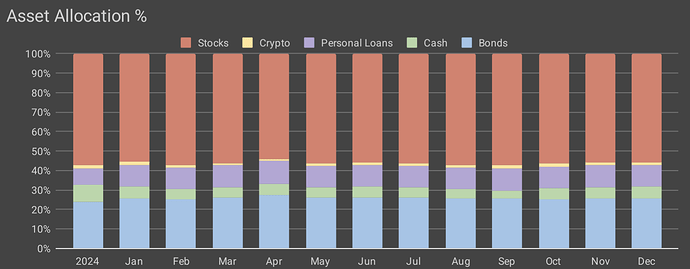

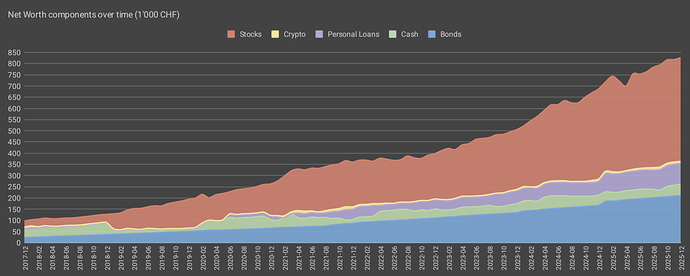

Asset allocation at year-end

- 56% stocks (IBKR, P3, employer shares)

- 26% “bonds” (P2)

- 11% private loans

- 6% cash (incl. EF)

- 1% crypto

Overall

(*)

2nd “weakest” year in terms of relative NW growth.

2nd “strongest” in terms of absolute.

(Funny how the Covid slump is near invisible compared to this year’s Trump one ![]() on abs terms at least)

on abs terms at least)

If the hype keeps hyping,

I might hit the magic M in 2026,

otherwise hopes up for 2027.

(Which would both be <10y of having started my investing journey, from the end of 2018 and ~100k)

Happy holidays everyone!

Cheers to the next one.

Edit - I see I have some delta in counting cash 2024 vs. 2025. I think it’s due to how I (mis)accounted for the rental deposit at turn of the year. Ah well, it will be right from now on.

Was another good year financially. Unfortunately, I did not have that much cash on hand to invest during the Trump chaos.

There were two milestones, one more relevant than the other:

- Stock portfolio crossed 1M in USD terms

- Reached a stage where I can theoretically claim financial independence, albeit with less elbow room than I would like. To my surprise, this has proven to be a significant stress reliever already. If financial progress continues, in 2-3 years, I will need to decide if I want to claim financial independence or increase my cost of living (e.g. buying a house)

Another solid year, both financially and personally. On the personal side: proposed to my gf, got promoted, resolved a health issue, and published two patents.

Financially, we saved 55% (97K) and increased net worth by 139K, roughly in line with last year. Market returns were lower, but this was offset by higher savings.

Our cash position is intentionally elevated. Part of it will be used to fund a two-month Asia trip in Q1 next year, and part reflects increased uncertainty after my fiancée was laid off.

We’re still far from FIRE, but having enough buffer to not cancel or delay the trip despite the layoff feels like a tangible benefit of staying the course. Optionality is pretty cool stuff ![]()

What did you use to create the charts? They look nice ![]()

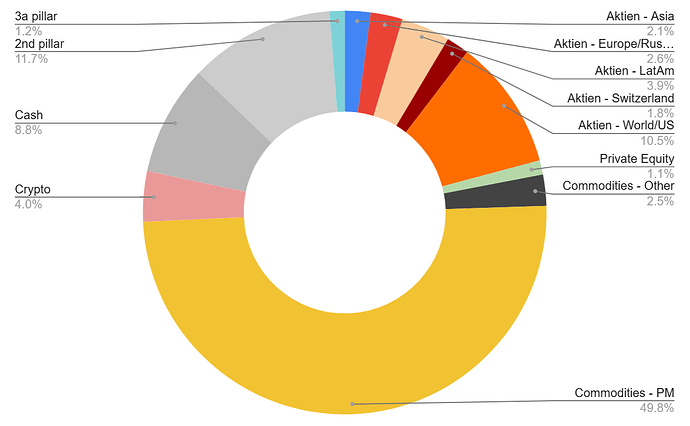

Christmas came through big time this year. Gross networth increase was 28%. Deducting salary impact, my investments have netted me above 20% in 2025. Which is great as I’ve taken the decision to break most of the PF capital out of jail in 2021 and invest it myself.

I obtained this result with an asset allocation of 50% precious metal, 25% stocks, 4% crypto, 12% PF, 9% cash

50% PM was a bold move!

It just happened and I let it run it’s course. Against everything I ever learnt about portfolio rebalancing.

I’m at 17% allocation to precious metals after taking some profits.