Congratulations, that’s quite an achievement qt this young age! Great that you started so early to save and invest money. May you have a long, prosperous journey ahead and the next 10k will follow soon ![]()

Congrats, that said also make sure to invest in yourself (experience, social connections, etc.), your early years are precious and you won’t be able to buy them back, while what you’re saving now is likely much less than what you’ll earn once you land a permanent job.

Well done. The compounding of this money over the years would make you very proud in years to come.

might I ask how/why/what assumption for the real estate value steadily increasing?

Estimate from Houzy.ch which were confirmed by the bank evaluation due to mortgage extension on multiple occasions.

What is “validator income”?

He runs his validator node to verify crypto transactions on the blockchain (ETH for instance) and receives staking rewards for it—similar to mining BTC, if you like.

so, @MrCheese, you get 10x income of what you invest per month doing this? At least it looks like based on your Cash Flow Chart from June (3511 validator income, 332 validator spending).

I just took a mid-year snapshot. 4 years since moving to CH with a NW of ~80k. Not a lot of different assets and a boring ETF strategy (all-in VT), so I usually only note down an overview per year-end.

IBKR: 287k (VT)

S3a: 27k (VIAC Global 100)

co-ops: 26k (housing co-op + mobility member)

cash: 10k

for a total of 350k ![]()

Yep, unfortunately it’s not infinitely scalable.

I tried it now. It gave me a significantly higher number than what I consider realistic in case I wanted to sell, even at the low end of the range. It tells me it is 60% accurate, whatever that mean. What accuracy do you get?

It says 80% quality for me. The value shown was exactly the same as the bank would have given me as valuation for the recalculation of the mortgage.

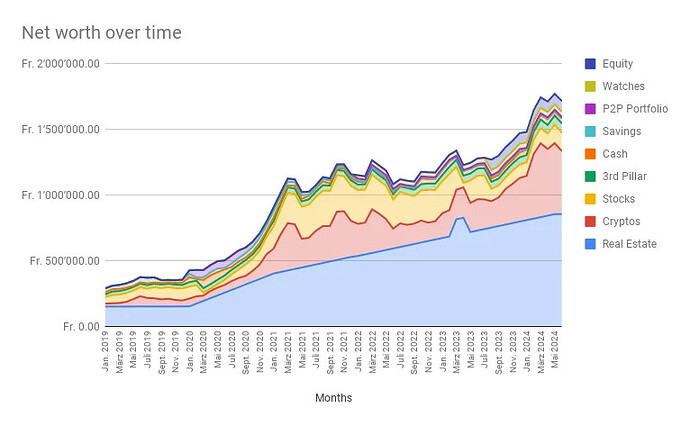

And if I read correctly your real estate investment has gone from ~200k in 2020 to almost 800k today? Meaning something like chf1m property → chf1.6m? That’s an incredible return.

850k to 1.55M CHF indeed. But that’s one to hold for decades.

I don‘t think there is any property in Switzerland that doubled in value in the last 4 years? Is this a realistic number? Seems overblown.

I’ve been thinking about how to value my own property.

One way to do it is to use the price I’ve bought it for, factor in the works realized on it, deduct depreciation as calculated as the price of the part of the building/it’s shelf life, multiply by the apparent appreciation of similar items in the neighborhood.

This “what the bank is willing to validate as a price for it” intrigues me, because it is simple and easy to implement. My guess is that what the bank really cares for is to get its money back no matter what so if the second mortgage is totally amortized, that the value of the house during a crisis meet the value of the actual mortgage on the house. Is it possible that they don’t value the item at 100% of it’s value but, instead, consider that it may be worth less but that the 65% mortgage must match its 100% value minus plus a safety coefficient?

@Cortana : any insight as to how real estate is valued by banks?

Statistics and real prices of the last 12 months.

I work in a bank, I have access to those tools and the whole Wüest&Partner database. So I can make pretty accurate valuations for myself.

For tax return purposes - isn’t this a requirement anyways? How do you do it while file filing taxes?

As far as I understand it, taxes don’t involve depreciation and estimating appreciation in the area. Just plain adding the value of added works should be more or less accurate in the short term but won’t reflect the actual value of the house+land 10+ years later.