Very nice. Do you know how much you saved/invested each year from 2016 on?

Hi Kirby. Congratulations. Could you tell us more about the real estate project you did?

Congrats Mr_IT. Very close to my numbers actually. What’s your plans to achieve you 300k goal in 24, and what is your stock portfolio? Myself, I have completely cleared from individual stocks in favor of ETFs, and started experimenting with Option selling. In 24 I intend to do mostly SPY and QQQ with selling call options on top.

I need to apologize because I also had around 20k of gains since 2020 as stock compensation (that I sell as soon as I receive it) and I contributed more in 2022/2023 (I shared the cash transferred to IB but I had some cash in IB that I didn’t put to work).

Not much happened before 2018, I was mostly learning with Swiss ETFs and VWRL with Postfinance. In 2019 I opened my IB account and sold between 2019 and 2020 Swiss ETFs and VWRL.

In 2019 I purchased 142k (only VTI) (sold 54k from PF)

2020 163k (adding VWO and VEA) (sold 121k from PF)

2021 53k

2022 86k

2023 121k

So probably the contributions explain most of the differences.

Actually our (we are a couple) strategy is very simple, invest in ETFs monthly. So far our portfolio consists of:

- VT 85%

- VB 5%

- VSS 4%

- VBR 3%

- CHSPI 3%.

No plans to change in the short term.

Obviously the goal of 300K by the end of 24 leaves something to be desired, as we are partly at the mercy of the market. It would be more correct to say that if we maintain a savings rate of 45/50% I can be satisfied.

I am not very interested in options at the moment. Maybe in the future but for now I consider its ROI low.

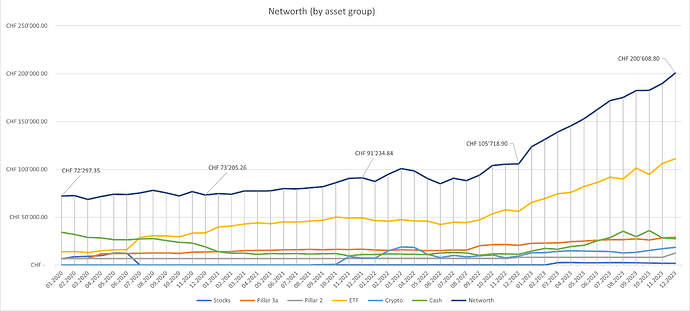

Crossed that 200k mark right at year end! ![]()

The nice incline will reduce for this year though since I moved out in december. Also realised my cash portion is a little bit too high, expected some more costs for furniture… ![]()

I wish all of you a good start to 2024!

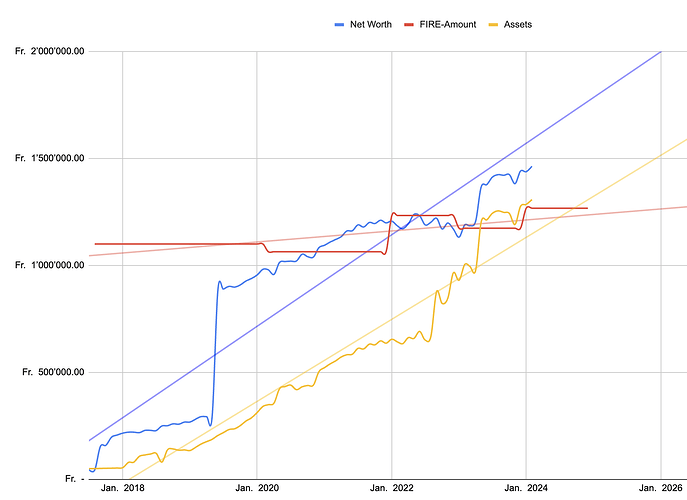

Here’s my update:

(living in ZH, couple with 1 kid, expenses are 50/50, graph shows only my net worth)

up 306k in 2023 (approx. half where capital gains, mostly VT)

113% retired (in theory, still working)

I realize how I start to play stupid mental games and push the carrot further… (2 MCHF), but when I started the journey I was very determined to retire after crossing the red line…

Anyway, I wish you all tremendous gains in 2024!

Well done, congratulations! May I ask what exactly is it that hinders you from pulling the tringer? (fear of bear market, aiming for higher QoL, something else?)

Thanks ![]() , sure its a mix of:

, sure its a mix of:

- I like what I do

- I worked hard to be at that point and leaving now would feel like a missed opportunity

- No alternative of time usage lined up

- Partner is working (and is far away from FIRE) + little child at home = no unlimited travelling possible

- Margin for big downturn is not very high

- Not in best health at the moment

- All friends are still working 100% = FIRE at a young age can be quite lonely (I am 34yo)

Congratulations again and I can relate. It certainly feels good to know that in any case you are FI and can RE whenever you want ![]()

To be fair, with inflation, 1M doesn’t buy what it did 20 years ago…

In Switzerland, 1M in 2003 was still worth 900 kCHF by December 2023 (using CPI data from the Federal statistical office: CPI (december 2020=100), detailed results since 1982, structure of basket 2020, including additional classifications. [LIK20B20] - 1.12.1982-31.12.2023 | Table | Federal Statistical Office), still pretty good.

In the USA, on the other hand, $1M in 2003 is now worth around $610k.

Bridging to other recent discussions on these boards, low inflation is part of why we have low interest rates and why stock returns measured in CHF are lower than when measured in USD. It’s all part of the package (which I’m happy to have rather than other settings where it’s hard to keep up with inflation).

Great achievement! Congrats.

Can you give some details on the graph, what is the difference between net worth and assets?

What was that jump in net worth in the very beginning? Very impressive to see how you got frol zero to hero in 6 years… can you share something about your salary progression?

Thanks!

Sure:

-

the difference is: assets = VT, NW is VT + non listed stocks of startups, cash and a tiny bit of gold (gambling / not working for me while I sleep ;-))

-

I made half the money saving from salary and the other half selling a startup I founded, this is the jump you see when the valuation was confirmed by a first transaction.

-

Salary was 0.- p.a. in the first years of the startup, after selling its low six figure and didn‘t change much… the growth comes from a high savingsrate which is around 70% after taxes.

Given recent money printing, I wonder whether this will still be the case going forward.

I think housing costs have about doubled during this time. If housing is 20% of household spending, then that already accounts for 100kCHF of the ‘inflation’ implying that everything else has stood still.

I’m pretty sure my costs have going up by more than 10%. Esp. in the last few years!

I think your view is highly subjective and not true to Switzerland on average, at least not by statistics.

Monetary aggregates have been sharpy declining in last three years (M1, M2) or at least have been stable (M3), see SNB statistics. The money printing you refer to happened before that, during the extremely low interest, low inflation times.

And having a quick look at cost-of-living statistics the average spend per household on housing in CHF has slightly decreased between 2015 and 2021 (random timeframe that was available at a glance). The only thing that ballooned on average were housing prices, which may hit you hard if you have a mortgage renewal coming or are a renter who frequently moves and doesn’t profit from rent stability. The real problem is that this means there is one side with very stable housing costs and one side with escalating housing costs. Not sure how the market will eventually correct for that.

I’m referring to the post-GFC trajectory.

I guess I did live in 8 different places the last 15 years.

I would also count in the mandatory health insurance…

Hopefully housing prices have topped, but health insurance is expected to go up for quite some time still.