Time to sum up 2025. It’s been another good year.

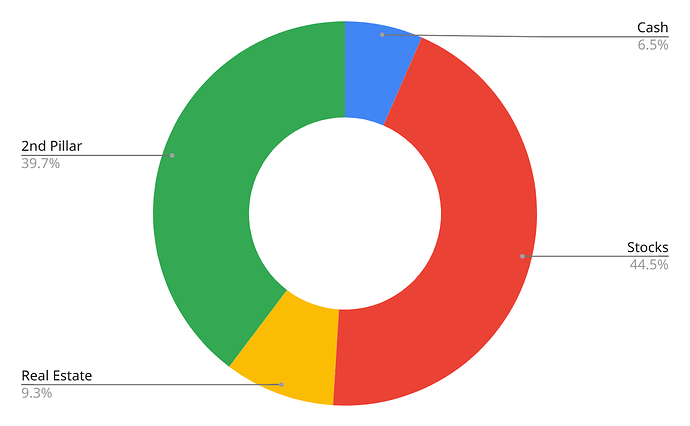

Net Worth went from CHF 2.6M to 2.84M (+ CHF 247k, +9.5%), which is a new All Time High.

The equity share went down from 45.6% to 44.5%, despite my ETF portfolio hitting an All Time High as well (CHF 1.26M, IRR 10.3%). Thanks to abandoning my options trading I have some dry powder to invest going forward.

My investment strategy for 2026 remains largely unchanged:

- Keep the equity share around 45% of Net Worth. (Probably) sell if >47%.

- Max out pillar 3a during Q1 2026 (VIAC Global80).

- Do not inject fresh money into IBKR; use available cash to bring total of CHSPI ETF to 1,000 shares.*

- Invest remaining available cash (if stocks drop below 45%) at DEGIRO, increasing the one and only FWRA position.

* “Eternal” IBKR portfolio will look like this:

4,000 VWRD

2,000 VDEM

1,000 VHVE

1,000 CHSPI (848 today)

250 SMMCHA