I bought my first bitcoin for 3000 USD over 5 years ago and have seen the market price of my crypto portfolio drop by 80% before - after it went up 500%. It is volatile for sure and you’ll have to stomache it!

The longterm trend in comparison to fiat money is clear and that was the reason it was created.

I was not trying to make a point about up/down trends, or intrinsic storage value vs volatility, etc.

I just wanted to say that sometimes people sell self-custody as “safe”. It’s safe for keeping your coins from scammy exchanges or whatever, but if you ever want to exchange them for anything else in the future, you will still be subject to exchange rate variations. It is not safe from your coins losing all value because of external events, just like it is not safe from them doing a 10x gain vs USD. If you are aware of that, then fine.

Hmm yes you’re right, self custody can only protect your coins from not getting stolen, not protecting the worth of them. Some tokens will probably never recover or go to 0. Getting rid of them would be the responsible thing to do. I hope my CRO and NEXO will recover… ![]()

I am not too worried about bitcoin and etherium though.

There are always different types of risk. There is a “normal” market risk, that you are describing: the price of the asset goes down. This is normal and usually you just have to wait for it to recover: assets with higher volatility have higher long term (expected) yield. Of course, 20 different hardware wallets or 20 different stock brokers can not save you from the price decline. What we want to prevent with the self-custody is the counterparty risk. It means the risk of someone/something not fulfilling its obligations with respect to your assets. You can’t access them or they don’t actually exist. The stocks investment exists for a long time, brokers are highly regulated and real loss of assets due to the counterparty failure is a very seldom event. But crypto is a wild west with hardly any regulations.

As a person just hit by FTX collapse, I can assure you that the counterparty risk is very real.

Amounts lost directly at FTX are a counterparty issue, but that bitcoins on a hardwallet had a change in their tradable worth as a consequence is a trust and stability issue that is not solved by self-custody.

But I’ll stop derailing the thread here ![]()

Yes I sign all transactions with several hardwares, and all hardwares are protected with a pin code. They are also geographically separated. This works well for me and I can restore a hardware at anytime, not particularly technical to do.

This is at the core of the bitcoin motto and how to become a sovereign individual. If you don’t self custody, your surface of attack is larger and you diminish the core value of your bitcoin. It is not related to the price and volatility, but I see your point.

I would recommend recording crypto keys using non-electronic means, or at least having non-electronic backups. I bought a Ledger some years ago just out of curiosity. Before I ever added crypto to that wallet, my son got ahold of it and pressed around on the buttons. Somehow one of the buttons broke, rendering the device useless. I was pretty surprised at the poor quality, and definitely glad I hadn’t put any crypto in that wallet. In any case it made me more aware about the risks of storing key electronically, so that now I always keep backups. I can understand though, that for very valuable wallets, keeping keys in print could be a risk (theft, fire, etc.). But in that case I would likely rent a safe deposit box.

Ok, obviously I am not the first one to think about it. Here is a reasonable guide how to do it on Linux, I wouldn’t do it in exactly the same way, but it gives you an idea.

I checked various crypto wallets, I first zoomed onto Bitcoin only wallets, then I have chosen Electrum (same as the wallet used in the guide above) as a compromise between being lightweight, functional and privacy oriented:

And here is a very straightforward way how to create an offline watching-only wallet:

So for now I have installed Electrum on my phone, created a new wallet, saved the seed phrase and Master public key, made a test Bitcoin transfer from Kraken, removed the online wallet, created a watching-only wallet and transferred the rest of Bitcoin from Kraken. Later I will setup a new offline wallet using Electrum on offline temporary Linux from USB and transfer all Bitcoin there.

I will also keep a multicoin wallet Trust Wallet for some smaller coin holdings.

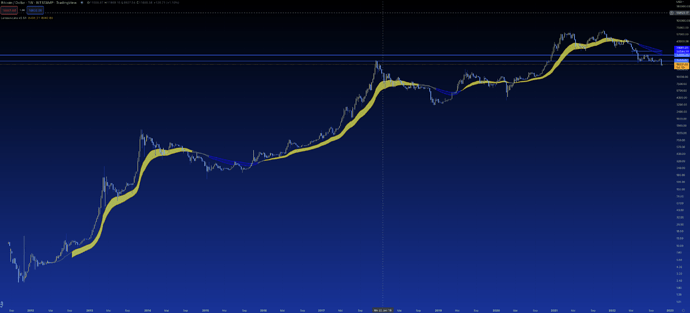

I just noticed that you are using the Larsson line indicator. Can you recommend it? I thought about buying it. Do you think it is worth the money?

For me it was worth it. I learned a lot about technical analysis and has a great community, but it’s quite the opposite of the passive investment strategy favored by the FIRE community. We try to identify and ride the longterm trends of volatile assets like tech stocks and cryptos.

It’s simple, a lot of people are into crypto for quick gains only. They don’t care about fundamentals and what Bitcoin stands for. They want to maximize profits, using lending and centralized staking solutions.

Nice sanity check on the safety of using crypto “exchanges” (or should we say brokers?):

It’s a disgrace how the big financial advice youtubers keep advertising this stuff to their audience.

When I bought my BTC and ETH, I immediately transferred it into my Ledger Nano. When I sold, it was also done within one day: sell, then transfer out the money to my bank account.

I’m really happy about my crypto story, because as I’ve written before, I invested 10’000 EUR, which at a time went down to just 3’000, but then reached 80’000, and I finally sold it for 50’000. If I still kept it till this day, it might have been worth 15’000 EUR. I still got the Ledger as a “souvenir”.

I’m glad I had this experience with crypto, thanks to this my FOMO is much smaller now. I have experienced first hand that holding crypto in your private wallet is not stress-free. You have to make sure that your recovery words are safely stored and won’t get lost. You have this tiny chance of getting hacked when making transaction, or getting scammed by the exchange.

Keeping your crypto with a third party defies the whole point of crypto. Overall, I became much more skeptical of the value of crypto. It takes a lot of knowledge and self-discipline to keep your crypto safe. I don’t see an easy way to make crypto easily accessible to the masses. They will keep getting scammed until crypto is regulated to the point where it doesn’t make any sense anymore.

TBH I would have expected the price of BTC to be more impacted by these days’ crypto news. Happy for you if you got a nice return out of your experiment, a neighbour of mine did buy a house in Zurich thanks to BTC… sometimes I felt a tiny bit of FOMO but I am glad I never caved in.

Yeah can’t listen to that dude…

I’m not asking for much but this is not watchable.

He’s more “emotional” and vulgar than usual, I hope you’re referring to this. Otherwise, I find his videos honest and insightful. He’s a Cambridge graduate with experience running his own company and working for big firms too. But don’t feel guilty for not liking it ![]() . It’s ok if you don’t watch.

. It’s ok if you don’t watch.

So this is how I finally implemented the self-custody of crypto.

Linux distro for live USB installation: antiX

Like in all live USB installations, a compressed image of a ready to use root filesystem is loaded into the memory at a boot time. All files, system and user ones, are actually stored in memory. After shutdown, all modifications are gone forever. It is also Debian based, uses own and Debian repositories, so the package installation with apt is very easy. An important difference from your usual live USB Linux: the image of the root filesystem can be created from within the system itself. You can modify the root filesystem by changing system settings (/etc), installing and, rather, removing packages and create a new version of the root filesystem image from the Linux filesystem running in memory.

Crypto wallet: Exodus

https://www.exodus.com/releases/

Well-known and trusted software crypto wallet. Milticoin, some coins can be even stacked on-chain directly from the wallet. It can show the wallet’s seed phrase and can restore the wallet from the seed phrase.

There is a ready deb package provided on the website, as well as a GPG signed file with SHA hashes to verify files that you download. The deb package of the last version is 165 Mb and takes around 300 Mb installed. Exodus is also seems to be updated quite often, so finally I didn’t include it in the image of the filesystem, but install it from a downloaded and verified package when I need it.

Seed phrase:

Once technical conditions are set, what remains is the most difficult part prone to human mistakes.

(to be continued)

Seed phrase:

Once technical conditions are set, what remains is the most difficult part prone to human mistakes. Namely, secure your seed phrase: don’t let it to be exposed but also prevent it from being lost or forgotten.

After installing Exodus in live USB Linux system, I have secured the seed phrase (see below) and exported addresses (there is a function for it) for coins I am interested in, currently BTC and ETH. This is in principle enough: you know where to send coins, the balance and transactions can be checked directly on blockchain. But I still did few more checks: practiced restoring the wallet from the seed phrase, checked that the generated addresses are always the same, transferred small amounts of coins and have sent it back to my exchange addresses. Yes, I went online with my “paper” software wallet, but I feel more secure with a software wallet installed on a pristine Linux system than with a hardware-backed wallet installed on Windows that is used all the time. I am planning to check on my wallet once in awhile.

To secure my seed phrase, I was trying to follow the principle that the best place to hide a book is library. I decided not to just write down 12 words, but to scramble them: I created a list of words, where only certain words selected according to certain formula that only I know, are meaningful. I have copied this list and placed it in 2 different places among some old paperwork.

The next step for me was to memorize the phrase. I composed a small more or less consistent text in my head using these words and was repeating it. I will of course keep paper backups and check if I memorized the seed phrase correctly, but for now it looks done.

How can your significant other or your family access the coins in case something happens to you?

Normally they can’t, maybe by sorting out old papers and figuring out what it means. It’s another risk, but it is also covered by life insurance ![]() .

.