I don’t understand why you would even keep cryptos on exchanges. The whole point of invention of bitcoin was not to need to trust anybody but to own your money yourself instead. I don’t trust anybody at this point and use exchanges solely to exchange cryptos and then move my money back into cold storage.

It’s easy: Not your key not your cryptos!

Totally agree and, even if late, I just bought my crypto cold storage yesterday ![]()

Well, then I ask you few things given the occasion. Probably naive once.

- Can a cold storage device break and become non-functional?

- I suppose there is a password to access your keys. What happens if I forget the password? What happens if I die, how can my wife access the keys? And how can I prevent anyone accessing the keys before I die?

I hope you have bought it in an offline shop and paid by cash. Where?

I bought mine in House of Satoshi in Zurich/Bern

or ordered directly from Shiftcrypto:

Ledger Nano S is probably the most popular hardware wallet its pretty cheap and easy to use. It also has direct lido staking. It can be ordered directly from the manufacturer

It can but you can access your coins with a new wallet and the 24 key words that are generated when you create it.

Bitbox also offers a backup on a ssd card.

If you forget you password and keywords, your money is lost. It is estimated that about 25% of all bitcoin were lost that way. I have mine written with a pen on paper in a bank deposit box. There are other tools that allow engraving them in a sheet of steel. Keywords should never be stored digitally.

https://backupsteel.com

Well, I’ve written ca 0.5% of my Portfolio off (Celsius, BlockFi). But like MtGox (Mt Gox refunds update: Creditor deadline details for registering repayment method) maybe one day it will be a refund ![]()

That’s a small misunderstanding due to the name, you don’t actually store anything with “cold storage”, it is just a signature.

If it is damaged or stolen, you can simply buy a new one and reset it with your seed phrase ![]()

This thread is about staking, by definition this isn’t compatible with cold storage, right?

True, but my point was: You can stake Etherium and many other coins directly out of your own personal hardware wallet, there is no need trust an exchange or other company and hand over your cryptos

Interesting, I’ve thought you cannot stake without lending out your cryptos (thereby risking not to get them back). So if that’s not the case, how does it work?

You interact directly with the defi protocols like LIDO

Ok, so there are no miracles after all and in the end the seed phrase IS your private keys and your wallet.

I am still not convinced that a hardware wallet is always good. After all, it’s a physical evidence that you own crypto, and don’t tell me about devices that fake a different set of private keys.

Now let’s say I am doing following. I don’t need a regular access to my crypto. I want to keep and accumulate them (let’s say Bitcoin only) for a very long time.

I take a PC without a hard drive, create a Linux live CD (hope they still exist), start live CD, boot into the system created on the ram disk. I connect internet, install a crypto wallet program, write down the seed phrase AND the public Bitcoin address. I shut down the PC, all information is gone. Now I am sending Bitcoin to the address that I have written down. I don’t need my private or personal keys to check the balance and transaction history of my address. With the known address I can use Blockchain scanner to see them on chain.

After 10 years of accumulation I have 10 million CHF (3 million inflation corrected) worth of Bitcoin in my account. I take my seed phrase, take any crypto wallet, restore keys from the seed phrase, transfer them in portions to Union Bitcoin of Switzerland or Crypto Suisse, sell and live happily ever after.

Do you see anything wrong with the technical aspects of this plan?

You have basically described a crypto paper wallet that was common in the pre 2017. It is pretty inconvenient but completely independent of third parties and offline and is still often used for the long term storage of large amounts of bitcoin.

So personally I chose to go seedless because of the associated risk. But if you go seedless, you need a robust multisig setup with several hardware wallets to do the signature. I find it more secure for the way I like to operate.

Does that mean that you still need to sign all transactions with several wallets stored in different safe locations or does somebody else that you trust need so sign? How does the backup work if the house burns down?

I apologize for eventually oversimplifing the topic, but that’s what I could understand so far from your very detailed and technical posts.

All what you need is basically only the 24-character key and than a physical wallet can be easily restored. So basically just need to write on a piece of paper or engrave on a piece of steel the key and store it safely in a caveau of a bank.

Did I understand well?

That is correct. it’s a phrase of 24 or sometimes 12 randomly generated words with which you can restore your wallet. it looks something like this:

What I never really understand with people repeating “not your key not your crypto” is that it seems to imply that those with hardwallet keys are not impacted by such events. While it’s true that you kept the same amount of coins/tokens, their exchange rate to fiat dropped significantly and so, unless you live completely in a crypto world, the purchasing power was changed.

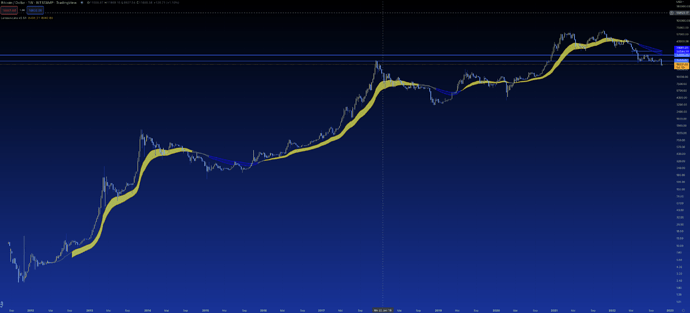

I bought my first bitcoin for 3000 USD over 5 years ago and have seen the market price of my crypto portfolio drop by 80% before - after it went up 500%. It is volatile for sure and you’ll have to stomache it!

The longterm trend in comparison to fiat money is clear and that was the reason it was created.