Yeah a lot of people say things like, off course I’m not paying my debt back otherwise I’ll have higher taxes, those people might change their behavior ![]()

And that is a good thing why?

We have too less risk. Debt is risk. Risk kills sometimes, but then makes space for new enterprises. Everything gets a little less bored with risk. Good risk will pay out, not every time but over a lifetime for sure.

Debt is not a bad thing per se. Depends on what you spend the money on. I spend it on stocks, a little more in a bear market, a little less in a bull market, but always on equity. Debt will go down while the equity in total will probably go down too, but not that much as debt, because debt is money and money is debt… and money has a state guaranty to lose value.

It is hard to go bankrupt without debt… but then it is hard to get rich without debt too. Why the hell must the government say “do as I say and not as I do”, because our complete live is based on debt. And why did they have to tie the removal of a nonsense tax with debt?

BTW, NZZ chimed in yesterday: Eigenmietwert-Reform: Was Mieter und Vermieter jetzt wissen müssen

Summary by Gemini:

The article discusses a proposed reform in Switzerland to abolish the tax on the notional rental value of a home for homeowners, which also eliminates their ability to deduct mortgage interest and maintenance costs. While this change primarily affects homeowners, the reform’s impact extends to both renters and landlords. This is because the new law would severely limit the deduction for interest on all personal debt.

Under the new rules, only individuals with rental properties can deduct debt interest, and even they face new limitations. The amount they can deduct is determined by a ratio based on the value of their rental properties compared to their total assets. Renters with personal loans or investment portfolios will no longer be able to deduct interest on their debt at all. As a result, many renters and landlords with debt will face a higher tax burden, despite the reform being designed to benefit homeowners.

And sometimes, instead of killing the risk taker and making space, the risk taker is too big to fail, and the losses are instead socialized, when the profits have been private.

If they have no way of stopping this scheme, they will (try to) stop the risk taking…

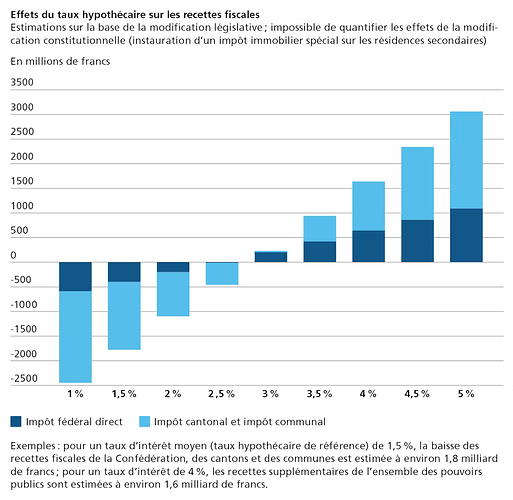

have a look at the estimate change in tax income here:

If the yes wins, we are going to get a ~2B increase in tax immediately.

And when (not if, when) the interests go up, we are going to pay more taxes, on top of the 2 billions.

So is a win-win situation ![]() , just not for the tax paying people

, just not for the tax paying people

A bit off-topic, but: as long as the same people that gain from the actual situation make the laws there is nothing we can do against it. Try to open a bank and you’ll see what I mean.

Banks have to take on risk and there should be competition. They should be able to die and new companies should take over. But nobody likes competition and laws and regulation are the easiest way to create a “green belt” around your business. With the result that entities get that big that they would die because they can hardly move, but cannot die because the whole economy would collapse. They become big stones attached to taxpayers legs…

Debt is not the problem, risk is not the problem. Laws and probably tax are. And the special version of corruption that is a bit expensive and fucks us all up: Lobbying.

Back to topic: I don’t care too much. I can afford the additional tax I have to pay and won’t reduce my debt. I just hate it that finally we could get rid off that stupid tax and that was mixed up with a target of debt reduction.

I think we got your point money is trash etc. there’s no need to keep repeating it ![]()

(personally I disagree, if you keep cash yes you lose on inflation, but real interest rates have been positive, even in CH)

Debt is leverage and too much leverage can lead to bad outcome (not just individually but for financial system overall).

for me, the tax on imputed rent is not a big deal. neither is the deduction for interest.

what will hit me is the scrapping of deduction for maintenance. as i have 6 figures worth of renovations to do over the next few years.

That doesn’t even rhyme ![]()

It is “cash is trash”.

And please, feel free to repeat your point as much as you want, even we got it the first time. The subject of this thread (I think I created it) went direction of debt for obvious reasons. Unfortunately. “They” always find a way to fuck up something good.

But as you don’t like repeating, we already found out earlier that the debt interest part of the new law is against constitution, but that that is not a problem as there are many laws that are against constitution. But do we really want that?

Mostly off topic:

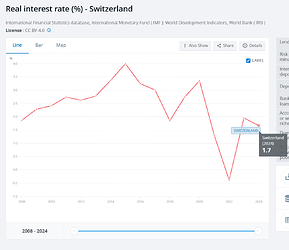

According to your link the International Monetary Fund (IMF) arrives at real interest rates of 1.7% for Switzerland.

(Well, at least according to numbers last updated in 2024, apparently ...?)I admit, Goofy isn’t the smartest dog on the block, but when he checks the interest rates on his Raiffeisen accounts, he arrives at

- Sparkonto: 0.05%

- Mitglieder Sparkonto: 0.1% up to 100k CHF, 0.05% above 100k CHF

- Mitglieder Privatkonto: 0.000%[0]

Goofy also read in the newspapers that the SNB lowered its interest rate to 0%.[00]

Taking into account the IMF positive real interest numbers would then suggest negative inflation in the range of -1.5% … am I holding this right?

Goofy checks the latest inflation numbers at the Preise | Bundesamt für Statistik - BFS.

Goofy concludes he is too dumb to find the right tables and charts to support positive real interest rates.

More seriously: not to haggle about the exact numbers, but even if the real interest rates were positive – let’s say a generous 0.1% or 0.2% – would you then still hold on to cash?

0 0% would suffice (indead of 0.000%). Why not 0.0000000000000000000000000000%?

00 Why not 0.000%? Geez.

Shouldn’t we compare inflation versus 5-10Y rates because when you take debt , you pay interest which is valid for different tenure.

And inflation is backward looking , so the rates valid at right time instance would also be important.

for example, if I took a 10 year debt in 2015, what interest I paid over 10 year period and what was the inflation between 2015-2025?

Looking at SNB interest rates would only be valid for overnight debt.

Forward looking, Swiss 10 year government bonds seem to yield about 0.34%.

To be honest, I’m not an expert in this field and we’re slightly off topic anyway, but for the purpose of this discussion it still seems true that (CHF) cash is trash and that money (in sovereign bonds or so) yields next to nothing, if anything?

Anyway, back to topic:

I don’t know the last time I voted along their party line, so I feel an itch to have to explore the topic further … ![]()

OTOH SVP is clearly in favor of it … so there’s that.

Oh, wait, we’re not supposed to get political here.

I’m a renter of an old but relatively expensive property in Zurich with an 85 year old landlady who I am almost certain has no mortgage and is very eager to do tax deductions on doing maintenance work on the house (and excels at staggering out renovations and renewals over the tax years).

Maybe I should just ask her how I should cast my vote?

another point which was not mentioned so far is indirect amortization, with the new law it will have much less sense, right?

In the low interest rate world with more money chasing assets:

- that would also depend on whether the indirect amortization goes into a ‘low-ish’ cost investment 3a from the likes of VIAC (and hopefully finpension in the future - the desirable case) or a bank 3a with negligible interest rate (undesirable case).

- and in similarly low pension fund return environment, it might make sense to do indirect amortization with 3a in equity, while taking more money out of pension fund every 5/7/10 years (or more frequently for a working couple) to reduce debt. you could still pay back the money into pension fund later in life using free assets.

You carry the debt and the interest to not have all your eggs in 1 basket / house / apartment.

This is correct - making yield in CHF is very tough.

SMI is up 20% over the last 5 years and 380% over 30 years. Not earth shattering, but decently postiive.

Sometimes I read those out of curiosity, but I end up frustrated and with a headache.

You know, as in not even mad, just disappointed.

Better leave it xD

But yes, yes, we’re not supposed to get political here.

For me this is a clear “no”. I am really surprised to see this proposal has so many supporters in early polls. No one will benefit from this change: apart from old retirees with very low outstanding mortgage compared to their home worth.

I was referring to fixed income.

For stocks, sure SPI has been a very good investment and have outperformed the world in many periods

Well, my parents will benefit. They saved for years to buy a property and afterwards they saved another years (basically until retirement) to be debt free. Now they live debt free and have low costs - but they are taxed on a fictional income which they do not have.

I can understand all parties, it’s not an easy topic. Speaking for myself, I do not know if I will vote for or against it - even when knowing, there is a property which could be mine one day without any leverage.

Personally, I think there should be incentives to be debt free (I mean come on, we learned early not to have debt or to overbuy ourselves and we are encouraging people to have debt?). The banks won’t be very amused about that; there will be lesser needed personal, higher competition for mortgages (ergo, lower margins) and in general I see a lot of threats when cancelling the imputed rental value.