There was not a single line of any relevant detailed calculations. There was also the bill to pay. One look at the numbers and it was clear to me, they missed all deductions including already paid withholding tax. Apparently, its no longer important to them whether taxes were already paid or not.

I have sent a request for detailed assessment, in German if I am not wrong its called Steuerveranlagungsverfügung.

No response. Have sent them an email asking if they received the letter, attaching all the documents. No response.

The entire situation is unnerving and unprofessional by their side.

Now we are approaching 30 days deadline, and since I haven’t really send any legally binding documents yet, I think they hope I will miss deadline. I don’t know why such behavior, and don’t want to speculate whether its a deliberate behavior, perhaps mistake and now someone tries to cover (stupidly), the fact is that I am not 100% sure what to do next?

Is it time for officially legally binding objection (Einsprache) ?

The problem with that is - I never received any detailed information, so what exactly am I objecting?

Thanks in advance for any input.

Have you tried to call them?

1 Like

Pointless with my A2 German. Also, the paper work is already flowing, so it needs to continue to flow for potential legal actinons.

Find some German speaking relative/friend to help?

Are you talking about tax at source from salary or from eg swiss brokers/banks?

1 Like

Full tax - withholding tax from salary, was not accounted for.

Are you trying to insult the Swiss?

Everyone knows they speak at least 5 languages and English is always in that list …

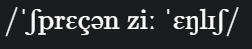

Seriously, just call them … ask “Sprechen Sie Englisch?” at the beginning.

Here’s the phonetic notation for you:

6 Likes

To be honest, I think that, in your case, it would have been easier for you to let a tax advisor do your taxes for 100-150CHF since you are already struggling with a very basic task.

If you read your tax return documents thoroughly, you should be able to find the contact person who processed your tax forms. At least that’s how it works in my canton. You should call them; they should be able to explain everything to you in English. If they don’t speak English, ask to be transferred to someone who does. Perhaps they also forgot to include the additional letter containing the detailed calculations.

2 Likes

I am doing my taxes Ok since 2017 - without fail, in different cantons (multiple properties abroad, trading and investing accounts).

I had to learn on my own because I noticed the tax advisers (yes multiple experiences) did not care about my interests at all. The only thing they were concerned - was increasing a price every year. Never again. Now I will rather hire a tax lawyer suited for particular occasion.

Fyi. there is no names on the Schlussrechnung.

This is the first time I will be forced to object their none-assessment and file Einsprache and possible administrative complain. Will learn something new. Win - win.

So anyone good at writing compelling objections (Einsprache) and complains?

With the Schlussrechnung you get a “Veranlagungsverfügung 2024, Kantonale Steuern / Direkte Bundessteuer (Definitiv)”, there is a person under “Sachbearbeitung: Name / Telephone number“.

Are you trolling or what, if you are doing it since several years then why don’t you know what documents you receive?

1 Like

No there aint - not on mine.

I just told you - this is the first time I have received this form (a bill to pay some taken from thin air number) instead of detailed tax assessment. And I never had to argue before with them because all was always correctly assessed.

Did you switch to C permit or something?

Edit: and the iban is the one from the tax office? Same as previous years?

I only got Schlussrechnung but not Veranlagungsverfügung - that’s the entire point. Did you read my post or you just here to enjoy insulting people?

No I am in higher income - once you breach that threshold they onto you. Also assets abroad.

Here is the thing - this is the first assessment from this gemeinde as I moved here recently, so I don’t really have any previous experiences with them.

Call or go in person, something probably didn’t transfer about your tax at source status (or it’s some very good phishing…)

No phishing possibility. The addresses are legit. Now that paper trail started, it needs to continue. I need their responses on paper not over the phone, person, or email - they are all legally irrelevant. I guess I have to find me some good lawyer to scribe some good fiery objection and move out from this place.

In a good phishing addresses will be legit, only the iban won’t be. And since they haven’t replied it doesn’t tell you that the bill is legit.

Anyway you can escalate or you can simply call or visit in person (a friend/acquaintance can help with the language if necessary) to clarify what happened. If it’s as you say (you’re taxed at source, the bill you got sounds like what non taxed at source would get for prepayment) there’s clearly a misunderstanding, but up to you if you want to do it the hard way.

5 Likes

Email is legally relevant. I always communicate per e-mail with the tax authorities. Email leaves probably more trails than a certified letter anyhow.

That is probably a storm in a glass of water. Something obviously went wrong and you did protest within the time given. So just relax and wait. You can pay any amount and will be charged or credited with interest once your protest was handled.

2 Likes

I agree that you’d want an answer in writing, though calling or going in person might be more efficient to clear up your case and it’s still an option imo.

Ask for their name on the phone / note it down if you go there in person and if they don’t give you something written in the end, ask them to confirm by mail or write a summary of what was agreed upon to them after the meeting.

2 Likes

Two Thoughts. You did not mention whether it was a provisional or a final invoice. Highly likely, its the provisional one, so you don’t need to worry at all.

Second: You pay taxes since 2017, but your German is at A2. That is no good. When in Rome, do like the Romans…

1 Like