Yes, thanks for sharing.

I must say I don’t find your arguments / compilation too convincing. Sure, your net gain of 7 figures is impressive. But apparently it mostly resulted from two or three trades, where you put in a lot of money. The rest seems to be a mixed bag of winning and losing trades. That’s the statistical equivalent of flipping a coin ten times, and calling it skill upon guessing right six times. I can understand that you believe in your skill to read the market. I probably would, too, if I had made 7 figures. But that’s just another bias (confirmation). How many traders are out there, who have guessed right only three times out of ten, and lost everything on the wrong trades? We never hear about those, do we?

As you correctly state, your outperforming the S&P 500 does not mean too much. If I let a thousand traders gamble for 10 years on the S&P 500 stocks, roughly 50% of them will have over- and 50% underperformed the index (barring transaction costs, spread depending on how much they gambled). You just happen to be part of the winning 50%. It would be skill if a substantial majority of - let’s say - 600 of them had outperformed the index. Or if some of them had consistently made winning trades. But I never heard or read of sound evidence where that was the case.

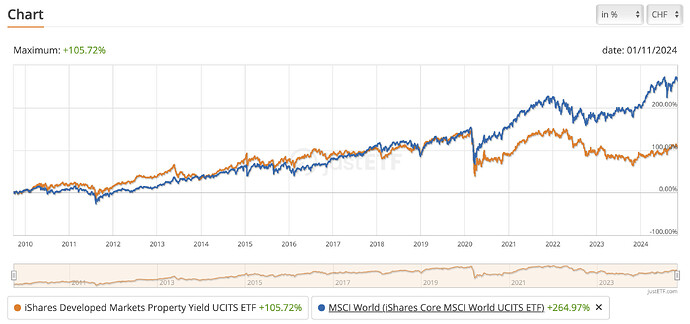

For the moment, I don’t see evidence for turning away from passive investing. And I’m gonna enjoy a good night’s sleep now ![]()