Dear fellow Mustachians

First post from a long-time lurker here. My intention with this thread is to stimulate a discussion about real estate in the context of the Jorda-Schularick-Taylor database and the associated landmark publication “The Rate of Return on Everything, 1870-2015”.

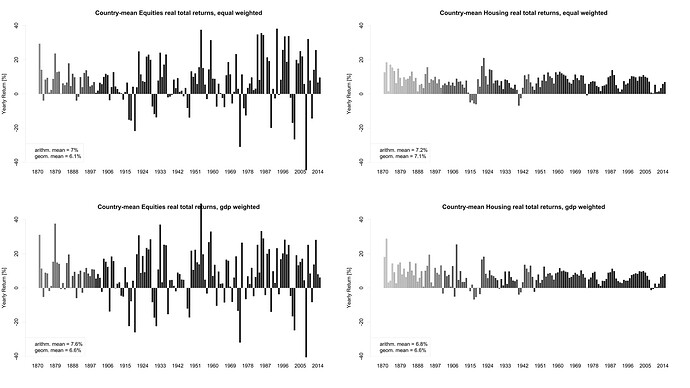

In short, the researchers put together historical return data on the four asset classes stocks, real estate, corporate bonds and government bills for 18 industrialised countries. One of the main findings is that real estate historically performed as well as stocks (7.06% and 6.88% real annual returns, respectively).

To go into the details a bit further, the numbers given above are arithmetic means of the overall pooled data. When considering geometric means (which I believe is more appropriate due to the multiplicative nature of the underlying compound interest phenomenon), real estate even outperformed stocks by a large margin: 6.62% as opposed to 4.66%. This stark difference is due to the much larger variability of stock returns. You can find the relevant numbers in table II on page 1241 of the publication.

Now this is not the end of the story. The cool thing is that you can download the data they used under the link given above. That’s what I did, and after some data wrangling in R, I came up with the following:

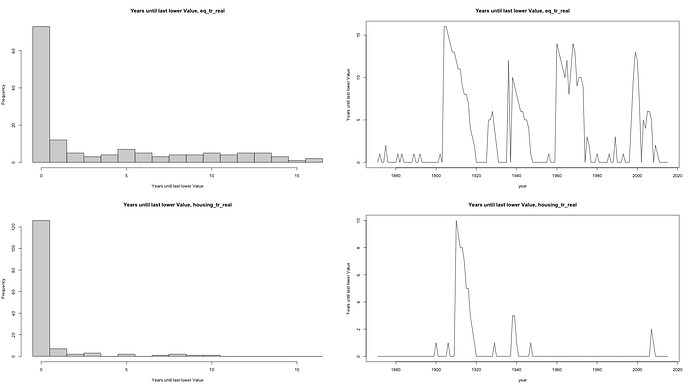

When you average across countries and weight the real returns data by historical GDP (to mimick a globally diversified portfolio), stocks and real estate perform equally well with 6.6% real annual returns each. However, the upside to real estate is that the variability in historical returns has been much lower (much smaller drawdowns in particular).

Now this raises some interesting questions: Should we consider giving more weight to real estate in our portfolios? If so, how much and through which instruments? Is the study trustworthy?

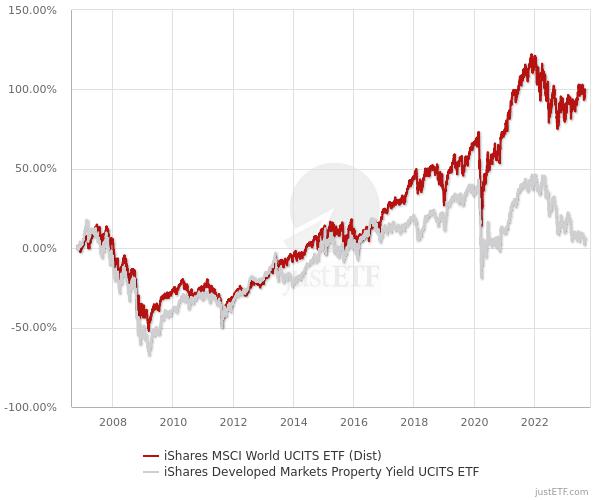

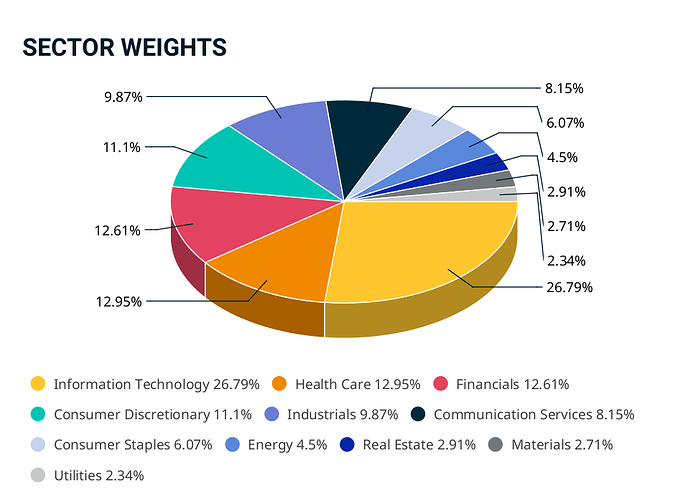

For me, when I first saw the study and did the data analysis, I was about to make my portfolio 50% real estate. But now that I want to pull the trigger, I’m starting to doubt, which is why I’m putting this up for discussion. I still tend to make a large fraction of my portfolio real estate, probably through a global real estate ETF. And yes, I’m aware that I’m punished by tax in Switzerland due to the higher fraction of returns made up by rental yield which is taxed as income. I’m willing to accept that drawback for better diversification and much lower variability.

What do you guys think? Curious to read your answers.

Cheers,

Natural Ascetic