They offer max 1% cashback on their debit card. The only downside is that you have to invest with them. I didn’t understand how much it will cost other than 0.4%p.a. Their funds doesn’t have a TER.

It might be interesting as as substitute of a CC or better as a all-in-one solution.

I had not noticed that. Is there a minimum amount one needs to invest?

They only offer actively managed funds with a self-developed sustainability filter, for a TER of 1.5%. They’re “Global Stocks” fund is not global but just developed markets and YTD has had 40% less returns than MSCI World (even compared to the various ESG variants). Other fees apply as well and are dependent on the size of your portfolio. They range from 0.25% to 0.45% and will double in 15 months.

The cashback has multiple caveats:

- If you have a portfolio of at least 1’000.– and deposit at least 150.– per month, you’ll get 0.25% cashback, up to a maximum of 5.– per month.

- If you have a portfolio of at least 10’000.– and deposit at least 1’000.– per month, you’ll get 1% cashback, up to a maximum of 20.– per month.

Numa-what?

Never heard. They don’t even know it and prefer to call it UBS-backed.

So I got the opportunity to use Radicant for paying abroad for the first time the past weekend. Two things which may be of interest:

- Don’t forget to activate “Worldwide” payments in the card security settings at least 1 day beforehand. I activated it on the same day but all transactions got declined until the day after.

- I had a transaction declined with Radicant which was booked nonetheless, and then paid with neon. Interestingly, neon charged 11.34 CHF while Radicant booked 11.81 CHF (a whopping +4.14% for Radicant).

Thanks for this information. I have just activated it.

Wasn’t Radicant supposed to be cheaper than Neon? Did both transactions happen at roughly the same time?

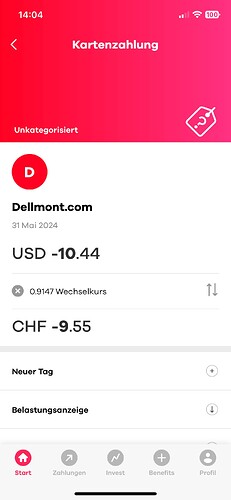

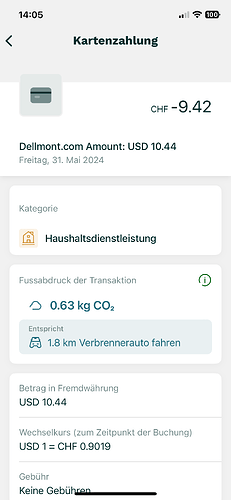

Yes, just a few seconds apart. However, I suspect that Radicant is temporary booking a higher amount to make sure the account balance does not go below zero when the transaction settles a couple days later:

Maybe someone could confirm that the temporary booking is usually higher than the final settlement?

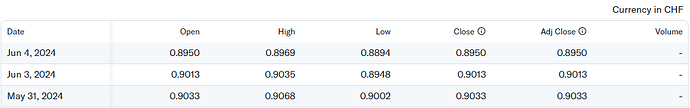

Might be interesting to ask radicant about it, checking some online data, the high on May 31st was 0.9069 for USDCHF.

The visa rate for that day is 0.914899.

I’ve checked Yahoo Finance - radicant’s rate is within the the bracket for May 31 (and for 1 working day later).

Is 0.9147 in the bracket? In the screenshot the highest is 0.9068.

That screenshot looks like Neon, the one below is Radicant.

Ah ok then it does look like market rate and neon using the visa rate?

There is currently an CHF 50 offer from Radicant, if you are opening an account with them, fyi.

Don‘t know if coincidence or not, since Revolut seems to start in CH officially, soon. Alpian also had a very generous offer lately (CHF 150).

Doesn’t look self-explanatory. A fintech serving retail client buys an accounting tool for corporates? What are synergies apart from the fact that accounting needs to consolidate bank accounts (from different banks) with actual transactions.

Looks like a desperate move to me.

Are there other neo banks who can support corporate accounts?

(Might be a differentiator)

I’m quite worried about Alpian and Radicant.

Revolut has now a good size and make profit.

which neo banks supports corporate accounts ?