I feel like some macroeconomics today ![]() Do you believe quantitative tightening (or less QE) by central banks worldwide will cause the stock market to sink considerably? Central banks have been pumping liquidity into the markets since 2009, and even more so during the pandemic, most of which seems to have benefited the stock markets. Just look at the incredible (unnatural?) price jump of VT during Covid - this wasn’t due to so much higher future earnings, was it?

Do you believe quantitative tightening (or less QE) by central banks worldwide will cause the stock market to sink considerably? Central banks have been pumping liquidity into the markets since 2009, and even more so during the pandemic, most of which seems to have benefited the stock markets. Just look at the incredible (unnatural?) price jump of VT during Covid - this wasn’t due to so much higher future earnings, was it?

We partly touched on the same topic in this thread already

I guess the question is: what’s the purpose of your question? Are you asking because you think the stock markets are overvalued and you want to know if it’s a good time to delay your investment? ![]()

From my point of view it’s clear that the quick and fast recovery of the (US and worldwide) stock markets is due to QE. The FED was pumping money into the market at a rate never seen before. What would have been the alternative? To let the markets tank and risk an even bigger worldwide recession? I think a lot of the people in the central banks are much smarter than us wanna-be macroeconomic geniuses here in a forum.

Do I think it’s good and sustainable? Hell no! But I also don’t know what the alternative would have been in March 2020. I guess the central bankers learned their lesson from history (take 1929-1932 as an example where they didn’t interfere).

Don’t get me wrong - I don’t think it’s right or wrong what central banks have been doing. I simply do not know. I also do not know whether or not the market is over- or undervalued (or if these terms even apply - from an efficient market theory standpoint).

I was just wondering - from an individual stock holder perspective - what impact you think QE/QT might have on a global stock portfolio (eg VT) in the future. I was quite frankly perplexed and a little terrified by the tremendous effect QE seems to have had on global market valuations during Covid. Anyone feel the same way?

And honestly, I’m a little concerned by the fact that some QT-decision by central banks might bring valuations all the way down again in the future, even if that’s in the best interest of society as whole. I’m putting on my investors glasses here, no political judgement intended. And yes, I guess you got me there, FIREstarter, a little market timing advice for me would be greatly appreciated (just joking of course ![]() ), since I am indeed thinking about investing a considerable amount. But of course, market timing is completely vain.

), since I am indeed thinking about investing a considerable amount. But of course, market timing is completely vain.

Yes, I feel you on this one. I also didn’t imagine such a quick and fast recovery.

I can definitely also feel you on this one, because I think in a similar way.

The questions you (and I) should ask yourself:

- how long is my investment horizon?

- which percentage allocation of stocks am I ok with?

I don’t know what “considerable amount” means to you, but if you sleep better you can split up your investments in 4, 6 or 12 tranches. And then invest every quarter, every 2nd month or every month. From a long-term return point of view, lump sum is the best. But one thing is the theory, and the other one is actually doing it in real life.

Thanks, you summed it up perfectly, there’s no way to tell the future, and I should get used to the idea that central banks policies ARE in fact a great part of the market valuation (just like so many other societal factors). It’s simply not all about the P/E ratio…

Regarding timing: Yes, it’s more of a psychological problem. Investing a large lump sum just to see the Fed decide now’s the time to step on the brake can be so frustrating. Splitting it up can make it easier to stomach (although this might not be the better investment decision).

To add some more insights to the topic: I’m far from implementing all the things I told you. I fucked up a lot of times.

e.g. until February 2020, I was doing a 100% stock allocation (VTI+VEA+VWO) - 100% for the stock/bond part of my portfolio (I didn’t count cash, pillar 2, 3a - which yes, I should also include overall)

Beginning of February, I started to get uncomfortable with the valuations. Until then, I had invested the amount I could afford every month and bought new shares (only started to invest in stocks in 2019 unfortunately). So I went from 100% stocks (again, the “stock/bond” part) to 60% stocks / 40% cash.

When stock markets tanked in March 2020, it looked like the right decision. I was looking at the numbers of VTI/VEA/VWO on my phone during March in disbelief. Everything massively in red. I started to buy again slowly. I was scared and thought it will go down further. Turns out - I was too hesitant. I didn’t get back to 100% - until today. Additionally, I had just went all-in with VIAC 3a in February. Even though the total amount of 3a was tiny, it still didn’t feel good to see the numbers.

Fast forward to September 2020, when markets had recovered (or even gained a little bit). I changed my VIAC 3a allocation and sold some stocks. Bought 10% gold, and rest in cash (would have to check the percentages - I think it was 40% stocks left). My VIAC portfolio hasn’t fully recovered until today, because I’m still not fully invested again.

End of 2020 I sold some VTI shares, because they had gained the most - and again I wasn’t trusting it. That decision was not smart in hindsight. But we are always more clever in hindsight.

One of the things which is still bugging me the most is the part of investment horizon. Yes, I know all too well that after 20+ years being invested the probability is pretty high that I have more than what I invested. Still, those 20 years are a really long time. I would like to reach FIRE earlier. The problem is that the stock market is more of a marathon than a sprint unfortunately.

So don’t worry - you are not alone with your thoughts. And I’m sure other people here in this forum could give you some more stories how much they have fucked up during their investment career. That’s the part where I admire people like @Cortana. He’s just investing his money all-in, and will most probably have better results in 10/15/20+ years than people like us ![]()

Wow, thanks for sharing your experience! If it’s any consolation at all, think of all the guys who have lost their entire life’s savings to some Ponzi scheme or a crypto-scam (I just watched the documentary “trust no one” yesterday about Canada’s former largest crypto exchange - one huge scam).

You actually helped me a lot in staying on the right path: invest globally diversified and NEVER touch it again. We are our own worst risk to our investments, not central banks, recessions etc.

Amen! Please wish us strength ![]()

One of the guys just pulled off another scam - just google “TIME Wonderland” and “Sifu”. Crypto in big parts is the Wild West.

I agree with you on this one. Deciding for an investment strategy and staying the course is super-important.

Your point is valid. Just a question back: how old are you, and how long have you been invested? I know how the great financial crisis felt back in 2007-09, and I can tell you that it didn’t feel good. Sure, I wasn’t invested in the stock market yet, but if your employer (one of the largest IT companies in the world) asks you to voluntarily reduce your salary to keep jobs - that’s not a good feeling.

So it’s easy to say now you won’t care in 2030. Let’s talk again in 8 years, if you followed through will all your plans ![]() PS: my comment is also not meant to be provocative

PS: my comment is also not meant to be provocative

My point is not to devalue your statements. I just know from my own experience that it’s easier said than done to stick to your plans you made 10 or 15 years ago.

I’m also a planner type. Always have been, and I guess it will stick with me until I die one day. The very positive thing I see about you is that you are not only the planner type, but also the person who implements stuff. Which is very good! I usually try to plan everything to the very last detail.

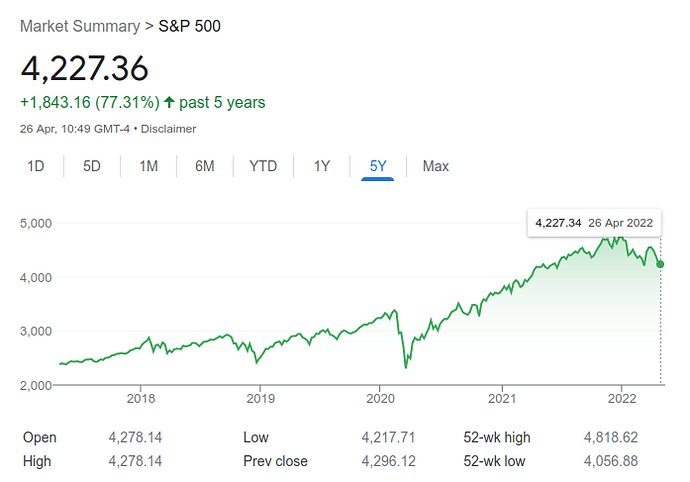

If you started in 2020, you might think you have seen a lot of things already. Please still keep in mind that this is 1,5 years of investing only. If you look at S&P 500 from a longer investment perspective, we are still very high:

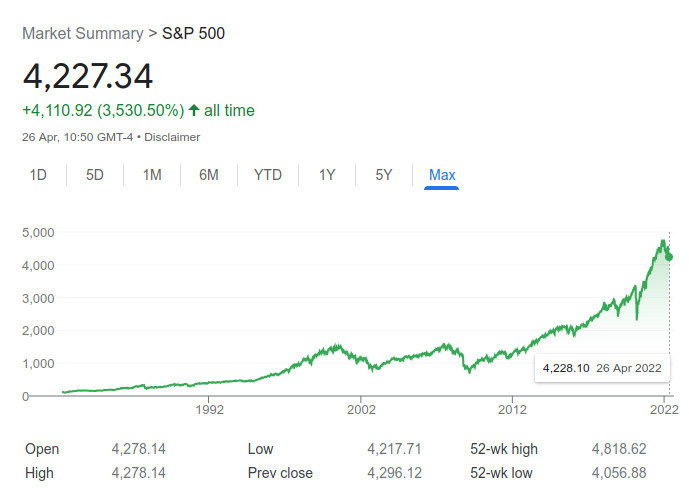

Even more if you go back 30+ years:

You said that you are prepared for 50+% crashed. Believe me, it’s different to see with your own eyes and feel your own emotions than to just talk about it. Again, this is not about me being the smart one here. I know how it felt in March 2020, when everything went south. Plus my own experience in 2007-09.

Personally, I’d be very cautious with investments on margin, but again that’s your own decision. It might work out for you, taking a higher risk.

Those graphs are misleading as they suggest that we are in a bubble. You have to look at it with logarithmic scales.

You are right that logarithmic scales are a better way to look at S&P500. Still, I wouldn’t go back as far as 1872. The S&P 500 we know today was only introduced in 1957. The original index was created in 1926, with 90 stocks back then.

I couldn’t find a better graph. But even if you look at 1957-today it looks linear.

I think that also the $$ involved and at which point you are in your FIRE path plays a major role.

It’s clearly easier to digest 10k turning to 5k if you are at the beginning of your career, much more difficult to see 1’000k turn to 500k if you are planning to FIRE in 2-3 years…

Agreed on the mortgage part (the leverage should apply to the whole assets, since you’d have to sell stocks (or any other asset, not necessarily the house) to come up with the required funds if you suddenly had to amortize some of it).

For margin: are we talking scientifically proven better pure returns or also risk adjusted ones? I would have no difficulty seeing the higher riks/higher returns relationship in this situation but can’t help but think that the risk profile of a 100% and 130% stocks portfolio aren’t the same. Any good article on that?

I would be very interested to learn about tax implications of this setup.

Can you point to some scientific proofs that this is actually the case? I get that using leverage will improve your returns (that’s economics 101), but the higher return is bought by higher risk. From what I read through the lines is that you are, to some extent, trying to follow Hedgefundies approach.

Yes, people owning a house are less diversified and have a higher leverage, but there’s a little difference when it comes to margin calls. The probability that your house price decreases sharply within a few weeks is really low, and banks won’t immediately ask you for fresh money. Using leverage on stock market ETFs, the probability of a margin call is much higher.

The article you quoted is written from a guy who’s owning NTSX (WisdomTree), UPRO (3x leveraged S&P500) and TMF (3x leveraged 20+ year US treasury). He’s also a big fan of the Hedgefundie approach. I would have to check again, but I think Hedgefundies first try massively backfired for him. Yes, I know that Hedgefundi used higher leverage than you are currently using.

If you have done your due diligence and are ok with your approach, of course go for it. Personally, I wouldn’t feel comfortable with the information from the optimizedportfolio website only. I’d rather see someone like Ben Felix doing a video on using leverage to gain higher returns over the long-term.

I second this. Would also like to see a good article explaining it.

Same here as well.

Couldn’t agree more. If you are still at the start of your investment career, losing 50% of your money hurts, but you’ll be able to make up for it by your savings. Later on in the game, that’s not so easy. Unless you are earning 1+ Mio per year ![]()

I checked myself if Ben Felix has some video on leverage, and guess what: he does:

For someone at the start of his investment career, it will increase return if you use leverage. So if you keep your margin cap at “1 year saving” I think you should be fine. Be sure to watch until the end for the warnings as well ![]()

I know those “theoretical” requirements, but: have you already declared your taxes since you are having a leveraged portfolio? Any unusual feedback from the twx authorities?