Not your keys, not your coins.

From Relai you can buy and send to a hard wallet. Kraken is ok for off-ramp (in CHF).

IBIT only where not otherwise possible as on Viac 3a.

What do you mean with ramp off?

I could transfer my stuff from Kraken to Ledger, and start using Relai. Will look into this.

I dont necessarily need to hold the token itself, IBIT has an ok fee of 0.25%.

ramp off mean sell BTC for CHF. With Kraken you get your CHF to the account within hours (during banking opening times).

For relai buy directly to hard wallet, be sure you can sign your message with the software you are using (not sure if Ledger Live can do this). Sparrow Wallet can.

Bitcoin is freedom, IBIT has same limitations as fiat. Up to you…

If you don’t buy the BORG token (the in-house token) to lower purchase costs, SwissBorg becomes more expensive than Relai. However, with SwissBorg, you have access to other cryptocurrencies, bundles, and even cryptocurrency portfolio management. If you’re interested in buying something other than Bitcoin, the company has some interesting ideas, but the fees are expensive if you don’t own their in-house token.

Der Bitcoin ist aktuell so viel wert wie noch nie. Ein Mann freute sich über das Kurshoch so sehr, dass er allen Fahrgästen eines ICE-Zugs ein Freigetränk spendierte.

Translation in english

Bitcoin is currently worth more than ever before. A man was so thrilled by the all-time high that he treated every passenger on an ICE train to a free drink.

Which one of you was that?

Who takes over the noble duty in reminding people about how to handle crypto, when BTC is <-10% of ATH next time?

I feel like with stock ATHs, the sentiment in this forum is often ‘should I still buy, seems to expensive’. And each dip is seen as buying opportunity.

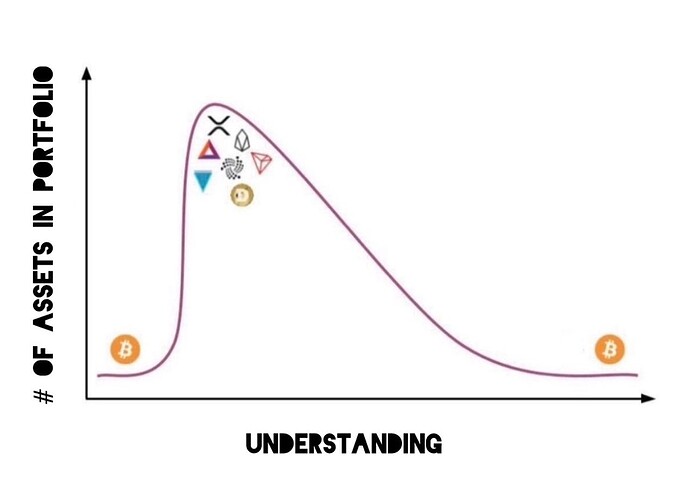

But with BTC, everyone just joins at ATH. ![]()

Honestly, I don’t see such questions a lot here. For Bitcoin at least, there is nothing to handle at any time. It’s very simple. You just buy and hold and spend when needed. There is no second best. Usually one don’t trade or time the market.

With stocks (and “crypto”) on the other hand you have to handle all the time (or at least ask and confirm bias). How do I know that? Well the Chronics and stockpicker forum is exhausting ![]() .

.

Dang man, that’s a very astute and accurate observation, leads me to think that what we have is two camps in both crypto (including BTC) and stocks:

Speculators

People who buy assets with a long-term plan to eventually, gradually or suddenly, sell higher than they bought to fund their life. I’m currently a speculator and frankly believe anyone not actually living off their investment is too if only because they need to believe but they don’t (can’t) yet practice.

Practitioners

That’d be people who can and do live off their assets right now. Hell, I know a couple of people who literally live off “crypto” (ie adopting your definition, meaning anything not BTC) by staking. They’d be the cryptobro equivalent of dividend investors.

To be fair the Chronicles thread is an ongoing banter/chat about what’s happening, I doubt most of people make structural changes based on daily news, so no real handling. The stockpicker thread is a valuable balancer to passive index investing. Some confirmation bias seeking is indeed present but not as much as you may suggest, as this forum is quite higher quality than others (or reddit).

Still, you hit the nail on the head on the sentiment, I think. As usual, this is not a troll post (I stopped those ages ago).

I think BTC is a speculative asset and so tends to rise in price when there is a lot of liquidity and coincides when people have funds to invest (e.g. stimulus checks) leading to pro-cyclical behaviour.

I think stocks exhibit the same, but as movements are more tame compared to BTC, doesn’t attract as much ‘get rich quick’ attention.

Nah, it is just a random number. And one million Dollars for a bitcoin is a nice price, one satoshi is one Cent then and that is it. After that it can go back to one Dollar.

Now, congrats for everyone who can stand the volatility until it reaches that million. That is less than 900% gain from now and really, that is not that much, seen it, done it.

I see no changes in opinion about Bitcoin here.

We’ll discuss again at 1M… ![]()

![]()

That might be another reason why we don’t read ‘buy the dip now’ for BTC here on the forum.

If you would post it, you’d get immediate backlash that would only stop once the dip is history again. ![]()

I believe opinions do not change just because asset is performing or not.

If that is the only variable then I would argue it’s completely wrong way of changing opinion as it fuels a bubble.

I believe opinions will change when use of Bitcoin becomes more main stream. After many years in existence and after changing many definitions, the use case has finalised to be „it’s a good investment because people think it’s a good investment“. We still don’t see the real use of the promised technology in any part of daily life.

Until this changes, it remains a speculative asset like Gold. In my view sometimes the word „speculative „ sounds negative but it’s not. I think it simply means that price of such asset is determined by supply demand only and there is no other way of valuing it because it only appreciates or depreciates when it’s sold and does not produce any Cashflow.

P.S -: I also think equity investing is also becoming very speculative these days. Most people I know simply invest because market only goes up. That’s it. Such behaviour also fuels bubble.

According to bitcoin maxi view, maybe. We’ll have 90% Bitcoin and 10% in speculative investments like stocks or RE (and those have to be high quality stuff, not like today as they survive just because of the money printer). Yes we’ll talk about 10% and which one are good to invest in ![]() .

.

Since I first heard the definition of Bitcoin it never changed. Your definition of Bitcoin is bogus.

You mean, you don’t see the real use of Bitcoin. I do.

The price of everything is only defined by supply and demand.

It does not produce any cashflow, you’re right about that. No currency/money does produce cashflow.

Great

Can you share what exactly the use of Bitcoin you see in daily life?

Sure. I pay rent with Bitcoin and I save in Bitcoin.

And paying rent using bitcoin is solving what problem that existed while paying rent in CHF ?

Don’t get me wrong but I was thinking we are talking about an actual problem that has been solved.

Don’t get me wrong but you just moved the goalpost and ignored half of my answer.