Hi Mustachians!

I’m new here, let me quickly introduce myself so you know where I’m coming from:

Background:

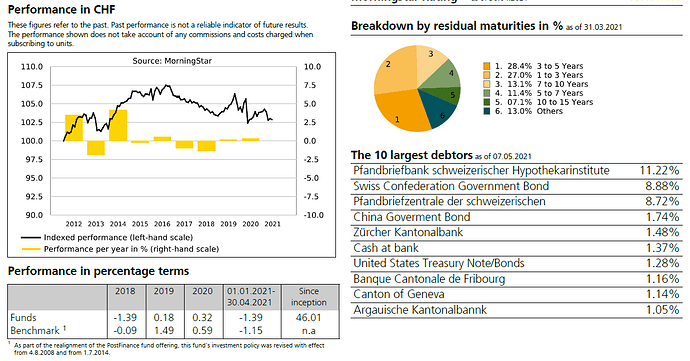

EU Citizen living in CH, close to my fifties and only learning about FIRE now. So I’m a bit late for the ‘RE’ part but very interested in working on my ‘FI’. Until now I’ve been very risk averse (due to family culture) so the ‘riskiest’ activity I did was to use my savings to buy ‘Postfinance Fonds 1 Bond’. Please don’t laugh. In the last years I’ve been slowly buying this bond based fund and it amounts now to approx. 55k. My issue with this fund is the current negative performance, I see it’s value decreasing every month and it is very frustrating.

Question:

I understand that when we talk about ETFs, the philosophy is to buy and hold, whatever the market does. Does the same principle apply to bond based funds (with a strong focus on Switzerland)? My financial background is non-existent so I’m wondering whether I should just treat this fund as a regular ETF and hold to it, or whether I should sell everything and use the cash for something else (note: I’ve already opened an IB account and used part of my savings to buy Vanguard ETFs).

Thanks a lot in advance for your thoughts! ![]()

Adding some more details on the fund below: