Just wanted to mention here that employers covering 100% of UVG and 100% of KTG do exist but it’s more of a rarity unfortunately… In my case my salary sheet does not have any UVG nor KTG as my employer pays 100% for both of it.

Either they’re a generous employer or you’re a prized employee - or both

The day I got a 80 CHF/Month raise by being picky ![]()

Dear RIP

I had to talk to the Ausgleichskasse because I have never had such a case. You are right, in case of a job change under the year the amount of CHF 148’200 is being calculated pro rata.

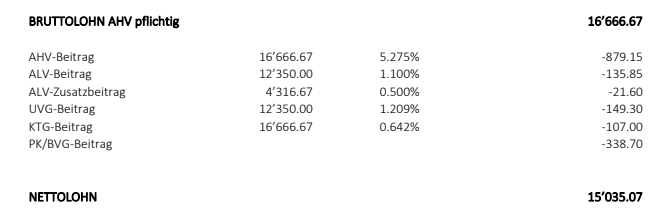

Attached I am sending you again the new payslip.

Pillar 2 will be attacked later, directly with my company ![]()

![]()

![]()

Congrats! Now stress them a little bit more and ask for contracts of UVG and KTG. I think you are paying 100% of both, according to your numbers.

I had a similar situation upon joining a start up with an American HQ. Was appalled at the accident insurance premiums being x10 the cost of adding it to my insurance myself but on researching found it was all by the rules…

Fortunately I was able to talk HR into covering it as well as the KTG premiums!

In theory, you would have gotten the excess paid money back latest by next year. Of course only if the company 1) notices and 2) is fair…

It’ll be tough…

Nobody would have ever noticed, nothing would have happened.

My PK/BVG it’s even higher than yours and I surely don’t make as much as you do. What’s the insurance?

it should be AXA, I’ll have a all with them next week. Then need to talk with my company and see what we can do

Still seems somewhat strange though… wasn’t it supposedly outsourced to “specialists”?

I mean, ALV for instance could (literally) have been googled within a minute or two (like as I did, just to make sure).

As mentioned above not all employers go far beyond the absolute minimum with their benefits. Obviously most of employees don’t bother, but actually they should.

Regarding UVG:

-

It’s obligatory for the employer to have. He must pay for the BU and can also pay for the NBU. But he also can let his employees pay for the NBU. (UVG Art. 91)

-

It’s a good thing to have. Obviously if you pay and nothing happens, then you could have saved the money. But in generally, the Pensions in case of invalidity or death (for wife and children) from UVG are quite high. Usually high enough to cover the living expenses without needing to lower the living standard.

Interesting facts:

-

UVG only pays Pensions to wives and ex wives (under certain conditions). If you are not married, you are a lot worse off. (Like in AHV)

-

UVG is a lot more generous for widows than to widowers (like in AHV).

Regarding KTG:

- This is not obligatory for your employer to have.

- But it’s highly recommended! If your employer doesn’t have it and you have a long sickness, then chances are that you don’t get anything for a lot of months until you are entitled for an disability pension. (In the beginning your employer has to pay you but nor for very long. - OR 324)

Regarding “Risiko” at PK:

- PK also pays Pensions in case of invalidity and death.

- The “Risiko” is paid to cover the costs of these pensions

- The employer must pay 50% of the costs. If he likes he can pay more – but he does not have to

- There are two diffenten ways to calculate these pensions. Depending on the height of the salary or depending on the amount saved in the PK. The difference can be substantial. Respectively the costs of “Risiko” differ a lot between different PK solutions.

Interesting facts for PK’s:

- The minimum required BVG is really shitty. The differences between BVG’s of different employers are HUGE!

- Most PK’s also have Pensions for partners even if they are not married (under certain conditions)

Happy Ending Update about BVG

I complained with the payroll company and they suggested me to meet an AXA representative to discuss pension options. I didn’t know what to expect, since we missed an important stakeholder around the table: the employer.

Anyway, I met the AXA guy and explained the pension system to him (yes, I explained swiss pension system to him), so that we can skip all the upsell insurance bullshit and jump quickly into my current contract. We changed a few bits, i.e. raised the savings portion from 10% (minimum contribution for age 35-44) of the minimum insured salary of ~60k (the salary between 25k and 85k) for someone earning more then 85k per year, to 15% my full salary minus the initial 25k (200k - 25k = 175k), which means 26k CHF/Year (more than 2k per month, more than what I was accruing at Hooli).

Plus we added a 100% (200k) death bonus for surviving spouse if I happen to die. I should have put more, like 3-400%. It costs nothing, really. Something like 20 CHF/Year per 100% split between employer and employee. But an ex colleague of mine back at Hooli told me “since I told my wife how much she would get in case I’d die, I let the children taste the food first”

I told my manager that I met this AXA person and we came up with a satisfying proposal. My manager apologized 100 times, he told me he didn’t work personally on this issue but delegated it to the payroll company, which is probably only familiar with handling low salaried people.

Yesterday my boss called me once more and told me my proposal was fine. He actually told me they wanted to be even more generous than that, and offered to split the payments 60% on them and 40% on me.

That’s amazing!

I knew it wasn’t my company intention to offer me a shitty package. But if I hadn’t noticed it would have gone by.

Lesson learned: if you “don’t care” about those things, you sign papers and end up screwed. My insistence and financial awareness brought me more or less 1.6k CHF/Month extra total compensation.

I’m quite sure if I tell my boss “hey, what are these UVG, and KTG things? I never paid them before. Please, take care of it as well” I can easily get another 300 CHF/Month bonus, but I think I got already enough

Congrats on your negociations! I have been told that a company can’t design a plan for a single person only but that they have to include several people at least (2+?) Has this aspect been addressed at any point during the discussions? It may very well not apply, I’m mainly trying to improve my knowledge of 2nd pillar coverage and options.

Wow that is quite generous. Congrats on the outcome. Once again this proves that attention to detail and knowing your rights pays off.

Congrats to the happy ending! You really need to check things in details, if you don’t want to get RIPped of ![]()

How did you calculate the 1.6k per month?

If I run the numbers, it looks like this:

- 15% of 175k = 26’250 per year == 2’187.25 per month for BVG

- split of 60% employer / 40% employee: 1’312.50 employer + 875 employee

- you pay 875.- instead of 338.70 before, which lowers your net income (but everything goes into pillar 2, which is more tax-efficient)

- your employer pays 1’312.50 now instead of 300something. Which is 12k more he pays for you per year. Maybe check with him to avoid having bad blood in the future.

I would mention this point anyway. We are talking about 3’500.- per year. I’m pretty sure the payroll company also messed this up as well.

What I care about is my take-home pay, which is net salary + total pillar 2 savings.

compared to “before” I got 80 CHF for ALV and KTG, plus the BVG situation which switched from paying 338 and getting 500 in my “P2 savings” to paying ~900 and getting 2.2k. (from +160 to +1.3k, ok I messed up by few 100s). note that also costs and risk premiums are getting paid 60/40

You’re right, but I guess I should have done earlier. I wasted time negotiating with the payroll company, I should have ask directly to my boss. Now it’s a bit too late.