Are 2nd pillar shared somewhere for comparison?

There sure are. Some pay the mandatory minimum amount and match your contribution 1:1. Others match it 2:1 and so on. There might be other schemes like profit sharing plans which contribute a certain extra amount into the 2nd pillar every year.

When there are major changes in the corresponding laws or projected returns the company may choose to inject more capital in to the pension fund. This is something no one can really predict but it tells a lot about the fund. I know of a case from a few years ago where the company and its owners decided to inject a 3-digit number of millions into the fund.

If you are changing jobs, checking out how the 2nd pillar is managed is really important.

The only part which differs a lot is pillar 2. Normally, the other ones are quite standard, just check your last employer salary slip.

Never said, it was a good deal ![]()

Incorporate and switch to a b2b contract. You can be that unskilled person instead and without having to pay any extra for it. Won’t do much about that those expenses have to come out one way or another from the gross

If the employers is fine with it, and the paperwork isn’t too bad, this would have the benefit of being to cash out pillar2 (and 3a?).

There was no UVG and no KTG contribution in previous employer payslips

It will depends on employer. As an exemple, my previous employer take in charge at 100% my UVG but also my 2nd pilar (this is quite exceptional).

Now when I applied for news jobs I always asked about 2nd pilar, UVG, etc., in order to negociate my newest salary  Of course, you will never know the real numbers until your first payslip.

Of course, you will never know the real numbers until your first payslip.

I strongly advice you to take your interrogation to the HR department and the Legal department of your new company if it’s not already done

You’re right to negotiate this point, but the number of HR and recruiter which have no clue about this topic is so damn high.

Good morning guys. I’m on the other side as an employer. Once you figured it out, it’s pretty easy:

- UVG = Unfallversicherungsgesetz (accident insurance law). There are two parts: BUV - Berufsunfallversicherung (work related accident insurance) and NBUV - Nichtberufsunfallversicherung (non-work related accident insurance)

- BU has to be covered 100% by the employer. NBUV costs can be covered by employer (many companies are doing it), but it’s optional. So the employee might have to pay parts of NBUV as well.

- BU part is ridiscouly cheap. At my insurance company, I’m paying 0.0702% per month. This is CHF 9.78 per month for a salary of CHF 12’350.- (= 148’200 per year == annual salary cap). The NBUV part is 0.9603% per month, which is CHF 118.60 for a salary of CHF 12’350.-

- KTG = Krankentagegeldversicherung (daily sickness allowance). Employer can pay it, but it’s optional. Premium is different for men and women (women pay more). It’s 0.51% per year for men, and 0.64% for women. 0.51% of annual maximum of CHF 148’200 is 755.82. I chose 90 days waiting period.

So we have total maximum costs per year of:

- BU = 117.36

- NBU = 1423.20

- KTG = 755.82

- Total = 2’296.38

Depending on the options, it might be a little bit more (e.g. shorter waiting period for KTG)

400+ CHF just for UVG/KTG being paid by the employee is ridicolous. Something is clearly not right here.

That would be a whopping CHF 4’800.- per year paid by the employee.

PM me if you need more assistance

PS: the CHF 2’300.- per year includes also the parts paid by the employer. BU is 100% paid by employer, and 50% of KTG also have to be paid by employer as well. So we’ talking about CHF 1’800.- which have to be paid by employee per year.

Yes I’ve seen it during my last interview, maybe for the next one they will have more clue on it ? Out of context if you have some advice on some question to ask about it, it would be awesome as I think that they don’t expect this kind of question from young worker.

Forgot about this part: 180.- for risk costs per month is ridicolous. Risk premium is usually below 10% of the mandatory part. No way 180.- are only for risk costs.

Depend a lot of the insurance, the numbers above are quite standard with big insurers. 1 - 2% of the salary insured on the BVG side.

thank you FIREstarter for your amazing explanation!

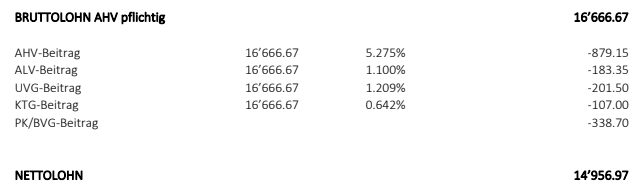

This is my situation:

I’ve asked for more info, and why the hell my contribution is not capped at 148k salary for UVG.

Now that I think about it, also ALV should be capped…

Here the details:

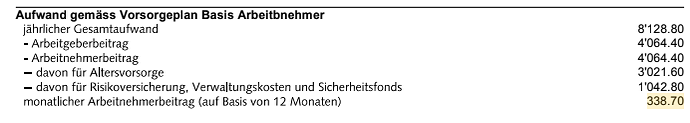

As you can see 338.70 per month, which is 4064 per year (both for me and my employer), 6k of which goes to actual money to my name - only the fucking minimum mandatory contribution for an old fart age between 35-44 with a salary above 90k per year - and 2k goes to Risiko, Verwaltungskosten and Sicherheitssfonds whatever the fuck it means…

I’m sincerely pissed off. But I don’t think it’s my employer’s fault… well… let’s say that I only talked and negotiated with people who care about research and cool stuff. I negotiated base salary, not all these perks. We have no HR department, just a girl HRing part-time. and since the company is not based in Switzerland they delegated the bureaucracy to an external company (agira).

My guess is that the external company has all the incentives to give me the shittiest and most expensive insurances ever. Plus they probably told the company “we will make you save money” and that’s why they gave me the crappiest BVG contract ever. probably the average “new employee” in Switzerland doesn’t even notice this shit and doesn’t complain… but they didn’t know they’re dealing with Mr RIP this time ![]()

It‘s not capped at 148‘000, though there’s a lower rate above that. See ALV-„Solidaritätsbeitrag“.

As SF already said: it’s not capped at CHF 148’200. You pay ALV1 up to 148’200 with 2.2% (1.1% each for employer and employee), and above you pay ALV with 1% (0.5% each).

I’m in a bit of a hurry atm. Will check your numbers later

Yes yes, I already knew it. But still, why the hell they didn’t use the solidarity rate on the exceeding part?

Is it a fixed-term contract? less than a year?

Checking your numbers I also have several question marks.

Regarding the missing cap at CHF 148’200: depending on which program your employer is using, they might not have a cap at CHF 12’350 per month. Considering you started in September, they might charge you the full percentages until you actually reach the 148k per year.

BUT: your employer would have to recalculate the cap at the end of the year, and give you some money back.

Regarding UVG+KTG: your employer seems to have more expensive plans than I have, but I have the feeling that he is billing 100% of UVG (BU+NBU) and 100% of KTG to you. Which is wrong! BU and 50% of KTG have to be paid by employer.

Not having a real HR sucks.

I guess that’s a very good assumption. I’m Paying about 1k for risk+managing costs, which is half of the costs you are paying. So basically 6k for minimum mandatory contribution (I have the same, but I chose it intentionally) and 1k for risk+managing costs.

You are basically having the minimum plan with really shitty risk costs, and the costs are split 50/50.

At Hooli, I guess it was a different ratio as well, not even talking about the total amount.

The problem is that you most probably won’t have anything to say which insurance company your employer is using. You might only be able to choose NBU and KTG for yourself (KTG is optional, NBU I would have to check again)

-

UVG is mandatory accident insurance and it is a good deal. If you become disabled due to an accident, you receive a benefit equivalent to 80% of your salary as an ongoing disability pension. It also covers medical costs resulting from accidents, which means you can put the accident coverage provided by your compulsory health insurance on hold (this lowers your health insurance premium). The coverage from health insurance does not include loss-of-income insurance. It only covers medical costs, which is why it’s so cheap. I dare say you won’t find a better deal than this with private insurance (80% loss of income insurance plus medical insurance for accidents). Either way, it’s obligatory for employees.

One thing you could do is have your employer compare their insurance with accident insurance offers from other insurers. If enough of your fellow employees believe that they could pay much lower compulsory accident insurance premiums with another insurer, you may just persuade your boss to switch. You can find more on this here: https://www.moneyland.ch/en/accident-insurance-comparison -

KTG is not compulsory and it only marginally benefits you as an employee. It covers your employer’s liability for paid sick leave requirements, so it primarily benefits your employer. However, depending on the insurance used, it may pay out benefits higher than the paid sick leave entitlements required of your employer. You can find more info on this insurance here: https://www.moneyland.ch/en/sick-leave-insurance