It’s indeed awesome. I’m feeling sad looking at it compared my own basic Excel skills ![]()

Thanks for the compliment. It took me some days to get it where it is. Right now everything is automated. Credit Card Payments, Invoices etc. do automatically get fed into the Excel and update the budget (actual figures). Further - the excel is also linked with Refinitiv Eikon and does update all investment figures automatically and calculates all margin thresholds.

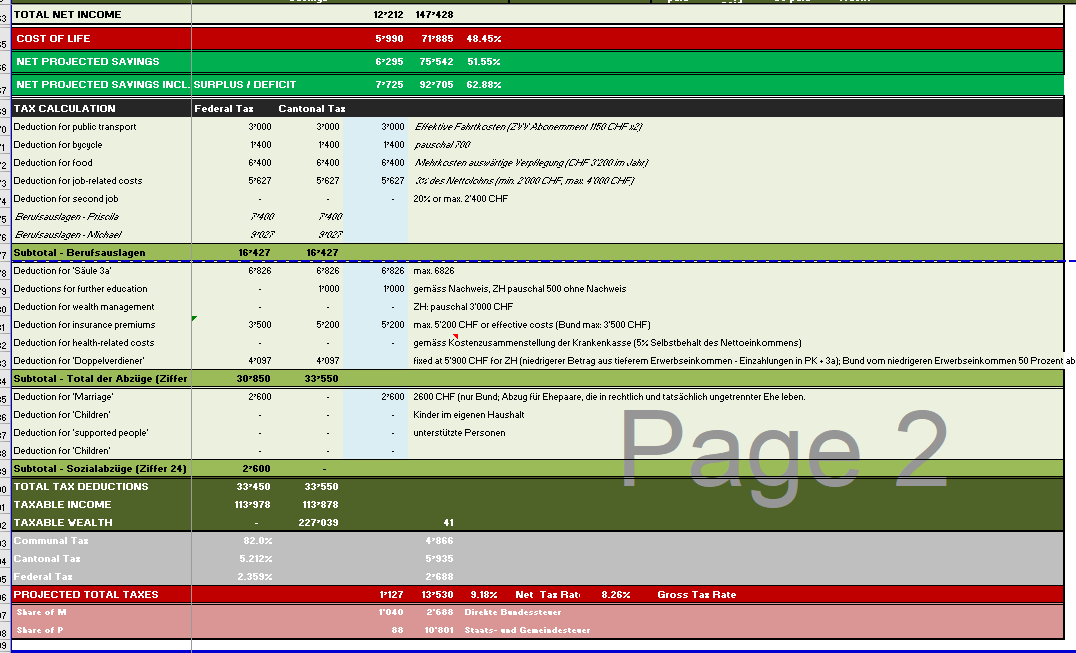

Below on the budget - I do also have tax calculations which reconcile 1:1 to the offical tax statement. For 2022 - I do expect total taxes of 13’530 CHF which is a net tax rate of 8.26% of total net income. You can also see the split into communal, cantonal and federal tax. Project monthly savings are 6’300 CHF excluding pension fund and excluding 3a contributions.

Finally got to sum up all expenses in 2021: a whopping ~140K CHF! (not counting taxes, pension funds contributions and investments of course)

We are a family of 4 with small children, living in the city to Zurich. A good chunk of my wife’s costs are not counted because she likes to pay them from her own account for fear of my mustachian judgment :).

I have not broken down the costs into categories, the only ones I know for sure are:

- childcare 42K

- interests on main residence 7K

That leaves us with about 90K CHF spent for a lifestyle which I would judge far from luxurious. I am shocked.

Can’t wait to know your fire number to afford it !

well with FIRE the childcare costs should drop dramatically (that is 1 MCHF for itself)

I feel you, last year we spent 120k excluding tax & investments.

Childcare 50k

Housing 20k

Credit card expenses including holidays 30k (we pay as much as we can per cc)

“Modest” lifestyle: no car, groceries & holidays in the neighbouring (low-cost ![]() ) countries

) countries

Similar situation here,

2 adults 2 kids

26 K CHF mortgage and other housing costs 150 sqm apartment in Zurich city (Kreis 5)

6K CHF childcare is now down since they both go to kindergarten/school. (2x Hort per week and occasional baby-sitter)

23 k grocieries

5k holidays

12 k fun money

car and computer stuff paid by company

Total expenses 92 K CHF

my wife works 60% and provides 45K into family account

We are a family of three with a 4 year old, both parents working.

2021 we spent roughly a 100k (excluding taxes).

Biggest expenses were:

- Rent: 27k

- Childcare costs: 21k

- Groceries: 13k

- Insurance: 12k

We both work.

Maybe if you are FIRE already when you have your first baby, otherwise I don’t see substantial savings.

Let’s say 1 kid krippe 4 years full time 120k then hort 2 years 12k. Apart of opportunity cost on 132k, how can I save remaining 868k by being FIRE when my kids starts school? If anything, I fear having more free time will make me spend more time and money on pleasures ![]()

I meant once you FIRE, you can take out the childcare cost out of the budget, which would mean 1 MCHF of money invested in this example according to 4% rule)

For this, it seems that most blogs say that most people need less, since :

- you do more stuff yourself and rely less on services

- no more formal workwear

- no more traveling to work every day

- holiday can be placed off season more easily, and not under time pressure anymore (meaning you could use slower transport without compromising vacation time.

etc.

Personal spending/a, 2 people no car :

- rent : 19k

- Health insurance : 5.4k

- All the rest, projected for this year (cc, doctors visit etc.) : 22k

This year we moved from Kt. Zurich to Kt. Aargau for professional reasons, which lead to higher costs for refurnishing part of the appartment. Estimated additional cost : 2-3k. Also already included is a flight to India which will happen next year for 1.3 kCHF.

It’s not 1M. That rule is for 40 years. I doubt you plan to pay for your children until they are 40yo. ![]()

I think he meant that children account for around 40k/year in terms of costs. So without them you‘ll need 1M less to FIRE.

I feel your pain.

I have move some accounts and stop to look at the finances for a while and then I found out that I was from 9k monthly expenses up to 15k.

After that I sit with my wife and somehow we are back on track… but this year has been painful on the savings part.

Well, now you are stretching general FIRE benefits/savings beyond childcare which are arbitrary imho.

There is this theoretical idea that to raise child costs 1M, but to pocket this you need not to have child.

If you have child the only substantial saving of childcare is kitta/hort, and the only way to stretch this to 1M I see 140k invested through 40y at 6% return. But then you need to be FIRE before childs birth or otherwise you are loosing potential 2x income roughly to kitta costs.

Sorry, still not following your train of thought how can you pocket 1M if you FIRE minus childcare.

Not picking up on you, but I was thinking how to change my FIRE math to reduce target portfolio or so.

I am not saying you can pocket 1 MCHF. I am saying that 42’000 CHF of costs per year represents 1 MCHF of investments to cover this costs every year (with a SWR of 4%).

Basically, I am saying that you should not include childcare in the calculation of your FIRE number (at least totally), but as a cost which will eventually disappear after some time or even not needed at all once FIREd.

Well, childcare costs will take almost 2 decades to fully “disappear”. Sure, you’ll stop paying the kita at some point (but you might want to send them to a private fancy kindergarten, etc…), but you’ll need a bigger flat/house, car, furniture, toys, books, clothes, food, train/flight tickets, bikes, etc for many years to come.

OTOH, having children is quite nice, hopefully in the end it’ll feel worth it having delayed FIRE for them.

Got it. Never thought like that since I’d like to FIRE still during childcare period thus costs were assumed long lasting and included in my number. But very valid point!

That sounds very bitter xD

My little girl is only 3 months old, but I already know that it was worth it to delay FIRE for her. I would give everything for her (and my wifes’) wellbeing and happiness, even if it would mean I could never FIRE.

The calculation is still wrong.

You spend 40k now for childcare. So by using the 4% rule, you can say that you need 1M invested to have those 40k next year.and so on.

The problem is that childcare costs around 300k in total, so you don’t need 1M but just 300k, or whatever the cost is.

Here is our yearly spending for 2021 (agregated from bank accounts and cc statements, so it’s not perfectly put in categories).

We are a family of four (4 & 1 year old kids in 2021) living in an owned Home somewhere in Solothurn.

all expenses without taxes: 71’181.- CHF

some categories:

childcare (1 day per week for both kids): 10161.- CHF

health: 12032.- CHF

house: 25893.- CHF (including renovations of 11000.- CHF, hopefully cheaper this year)

Car, phones and home internet are paid for by our business and therefore not included in the above expenses.