Family of 3 renting in GE:

| Label | CHF |

|---|---|

| Rent and charges | 1524 |

| Additional charges for heating and water | 9 |

| Internet Fiber - no TV | 41 |

| Power | 40 |

| Serafe - Radio and TV | 28 |

| Genève - personal tax | 2 |

| RC + House insurance | 20 |

| Car rental insurance | 9 |

| Laundry | 33 |

| ASLOCA contribution | 36 |

| Deposit at the Bank | 2 |

| Bank fees | 8 |

| Daycare | 1897 |

| Health insurance for 3 | 768 |

| Groceries+take away+restaurant | 867 |

| Travel expenses (me) | 935 |

| Monthly TOTAL | 6 178 |

| Yearly TOTAL | 74 136 |

My wife will participate in 30% of our fix costs but 50% on the groceries, take away, trips …

I did not include personal expenses of my wife (travel cost, some groceries, night out …).

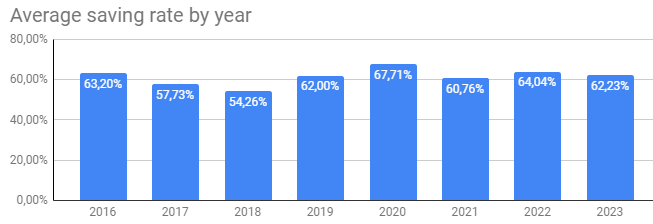

Final year with the saving rates above 60% … next year we’ll spend 12 months daycare and not 6 months …