I turned 30 years old recently. I’m working as a Senior Performance Analyst for an investment foundation. I just want to share my story with you and would be happy about any comments, feedback, bashing ![]()

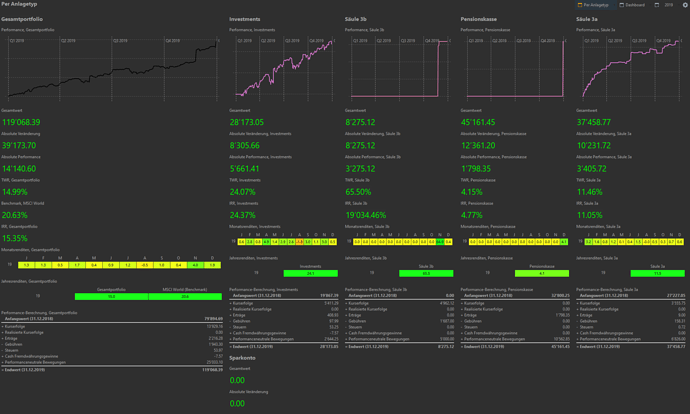

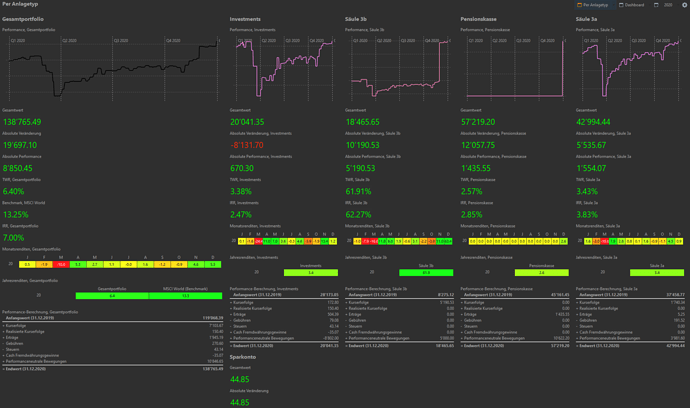

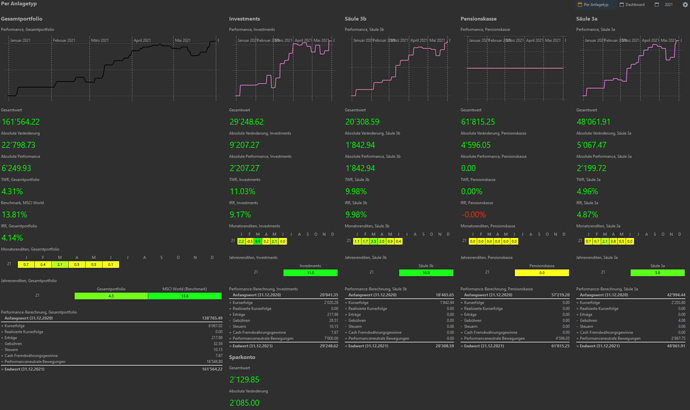

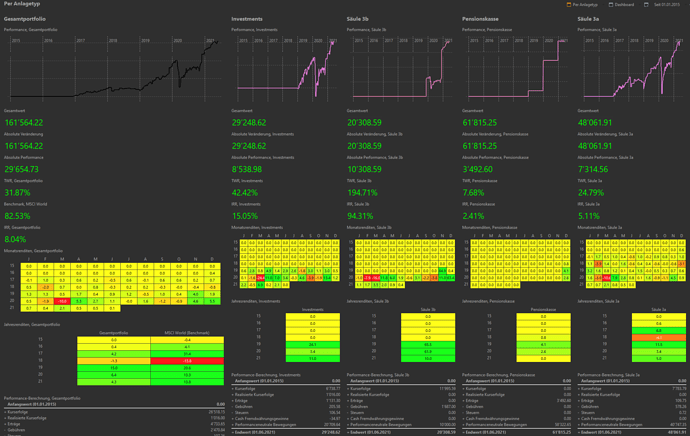

Net Worth Progression and Performance

I use the software Portfolio Performance to track my investments and returns.

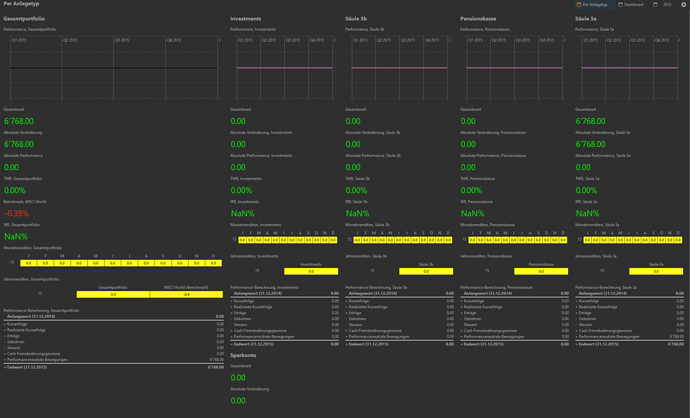

2015

My “Investment” Journey started around 6 years ago.

At the beginning of 2015 (23yo) my account balance was more or less equal to 0. My 2nd and 3rd pillar were empty and I just finished my bachelor in economics. I started working for small private bank as a business analyst. I didn’t really save any money apart from the full contribution to the 3a savings acount at my cantonal bank. I was not yet obliged to pay into the 2nd pillar.

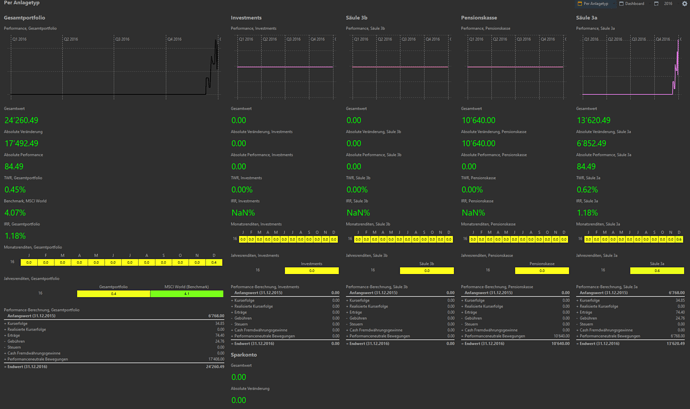

2016

My employer had a pretty decent pension plan, resulting in approx. CHF 10k total 2nd pillar contributions. I paid again the full amount to the 3a savings account and saved a little bit on a savings account.

At the end of 2016 I invested all my 3a savings (around CHF 13k) into two index funds (Index 45 and Portfolio 45) at Swisscanto.

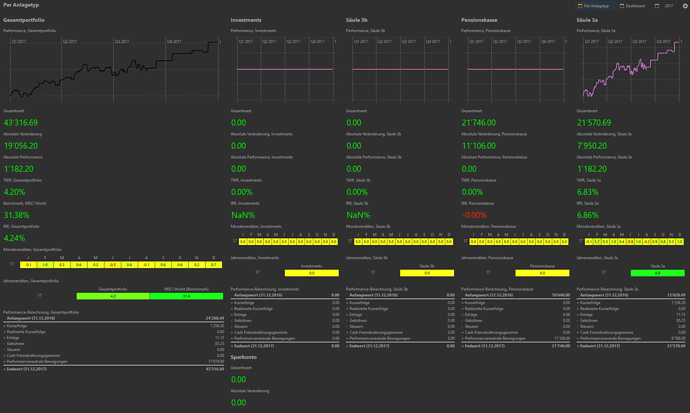

2017

2017 was basically the same as 2016, another CHF 10k contributions in the 2nd pillar and paying the full amount into the 3a account. All the 3a savings were automatically invested in the two index funds at Swisscanto.

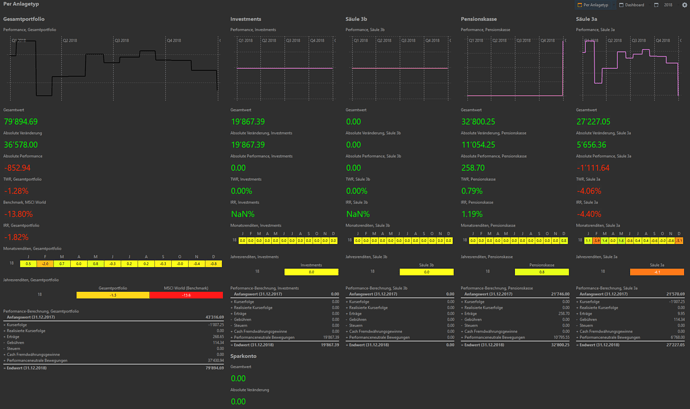

2018

I again paid the full amount into the 3a account and got another CHF 10k paid into my 2nd pillar. In October I had to change job, because my employer decided to close the Swiss branch. I received a severance payment of CHF 20k (after tax), opened an account at Swissquote and invested it into VWRL and UBS SMIM ETF. The markets were pretty bad in 2018 and all my gains in the 3a investments from 2017 were erased.

2019

Again full amount paid into the 3a account and CHF 12k contributions to the 2nd pillar. I bought shares of the company I’m working for at a 30% discount (can be sold earliest 2 years later). In addition I started a life insurance contract for 10 years, where I pay CHF 5k a year and my employer pays the same on top (I counted these 5’000 as performance, that’s why the return for this one is extraordinarily high). It’s fully invested in equities.

2020

Again full amount paid into the 3a account and CHF 12k contributions to the 2nd pillar. I paid CHF 5k for my life insurance contract. I got married in 2020, we moved to a new apartment, had to get new furniture and other unexpected expenses, that’s why I had to redeem CHF 8k from my investments in VWRL.

2021

2021 was good so far, I got a bonus and some money from friends and family for my 30th birthday, which I invested in the VWRL a few days ago. I also got a promotion with a slight salary increase and doubling in bonus. Regarding 3rd pillar, I opened 4 accounts at VIAC invested in the Global 100 Portfolio and I’m filling them up equally now. The 3a account at the cantonal bank will not be filled anymore and I’m probably going to use this one in the next few years for buying a house.

Since 01.01.2015

In general I’m quite happy with my progression. My returns are not that high due to a large part of my net worth being in the 2nd pillar with a return <3% and the 3rd pillar which was only invested for approx. half the period, in relatively conservative funds.

Expenses and Budget

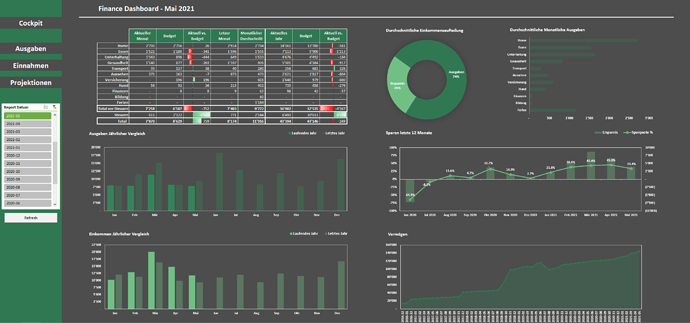

I started tracking my expenses in 2019 with beancount and I use an Excel sheet for some “nice” graphs.

Here’s an example as of end of May this year:

As you can see, we don’t live frugal at all ![]()

We’ve been travelling a lot and plan to do again once the Covid situation has cooled down. We also spend a lot on food (household things are included in this category as well, like cleaning supplies etc.) as we eat a lot in restaurants and we invite friends over for barbecue/cooking together almost every week. In addition our monthly rent is a brutal CHF 2’400, but we hope to reduce this heavily by buying a house in the next 2-3 years. I also spend an insane amount on electronics, especially Smart Home gear (still evaluating getting self-employed in this direction) and other new gadgets.

I don’t have any plans yet for FIRE. At the moment I’m putting the focus on heavily reducing our expenses. In addition I’m starting to look for buying a house and get educated in this topic.

That’s all, thanks for taking the time and reading all this boring stuff ![]()