Check out Migrosbank.

Free EUR account But need a certain “Vermögen” there (>7500).

Sepa Transfers cost 30 Rappen, ok I know I know, that’s not free, but it may be as good as it gets?

I get free EUR withdrawals at Migrosbank ATM’s from my EUR account.

Thanks for all the information, much appreciated! I will check these alternative options.

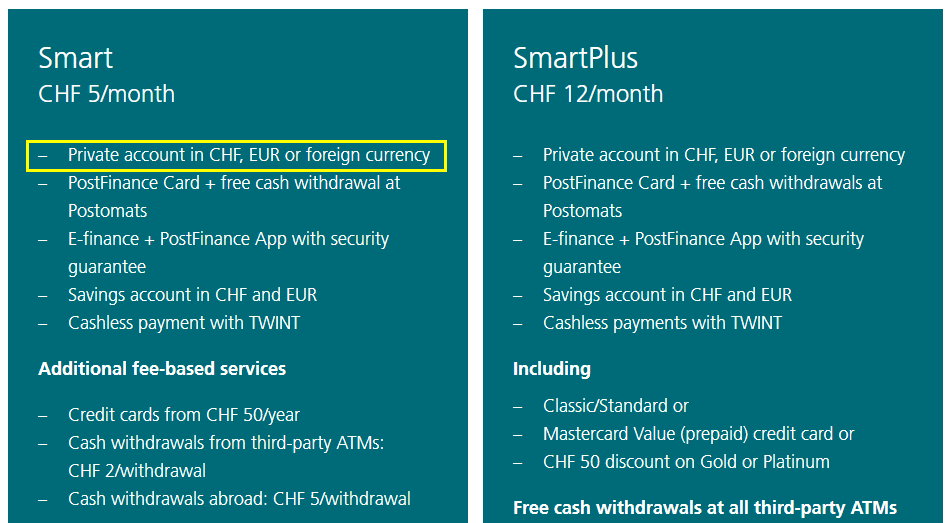

As a side note: As far as I have seen the new Postfinance banking offers do include accounts in only one single currency. It seems that it’s not possible to have multiple accounts in different currencies with the new banking package as it is the case with the old one (at the moment I have accounts with CHF, EUR and USD all included with my package). That’s one more disadvantage!

I think that’s incorrect.

I have a feeling you’re bitter about PF and try to see them only in bad light. Why do you even need to switch? To save 5 CHF per month?

Maybe he made a mix-up. You can have an EUR account, but you can’t withdraw for free from it if you are abroad. Different things, but for some use cases (mine) they go together.

It says ‘or’ and not ‘and’!

I switch because PF used to offer the perfect package for me for ‘free’ (with holdings of more than CHF 25’000 on the account) but some time ago they started to change their offers regularly which always meant for me ‘less for a higher fee’. I’m just trying to find a new solution. I posted my question and comment here because maybe other people are interested in alternatives as well.

In my last comment I just said that it seems that the new package doesn’t offer CHF AND EUR AND USD account within the same package. Or at least it is nowhere mentioned that you can have multiple accounts in the same package. In the actual package you can have it (I have it!). So, if they wouldn’t offer this anymore in the new package then this would be a further reduction of the services.

So what do you say? With the new package you can only have one? If you want EUR, you can’t have CHF? Seriously? I currently CHF & EUR, will I have to close one of them? ![]() If this is your understanding, then maybe give PF a call so they can prove you wrong?

If this is your understanding, then maybe give PF a call so they can prove you wrong?

So what did you effectively lose? They mostly changed conditions which apply to some stuff I don’t use anyway / don’t apply to me, so I wonder what you’re referring to.

In my understanding and how Postfinance communicates the conditions of the new product on their website there seems to be only the option to chose a package with an account in one currency but not a package with multiple accounts in multiple currencies (as for comparison, in the now existing “Plus” account they write ‘The private account plus comprises all accounts maintained under the same customer name or the same customer number’. Can’t read something similar in the new ‘Smart’ options).

And yes, I’ve asked the Postfinance customer service some days ago about this. But as usual (this also a reduction in services), the reply takes quite a while

About what effectively is lost you can find enough examples here in this forum.

I think ir won’t make sense the OR option. You can have both. IMHO.

I might be wrong though. I’m closing my eur account anyway so I won’t be able to help.

Just as a side note, that actually is a valid reason. I switched my account to ZAK 2.5 years ago (150 CHF saved so far, plus 25 CHF sign-up bonus) and my wife just switched hers (50 CHF bonus for us both), so 225 CHF saved so far, for not much effort and mostly the same services (in our case).

No problem - it’s not as if I’m writing exclusively to you here ![]()

Does anybody say you can’t have more than account per package or only one package per customer? Not really…

It says:

“The price for a banking package and for the paper option applies per customer relationship. A customer relationship can include several accounts. The fees are charged monthly.”

“Der Preis für ein Bankpaket und für die Option Papier gilt pro Kundenbeziehung. Eine Kundenbeziehung kann mehrere Konten enthalten. Die Preisbelastung erfolgt monatlich.”

I have a PF account with > 25K invested, and CHF, EUR and USD accounts.

I already got a letter that for me nothing will change.

It is on every kind of investment, for exemple if you have 25’000 CHF invested in VT.

From the last document I’ve read, it will only concern PF Fund and not other financial instruments like ETF, Stocks, etc.

Oh, you are right. My problem is that I only have Funds with them. For ETFs I currently use Degiro. I set-up the Funds for my kids when they were born as it was convenient (I programmed the standing order once in ebanking and never touched it again) and I wasn’t much aware about investing especially regarding TER and other fees that PF charges me, which will become even more costly next year. So, I see no other alternative than changing my bank account to Neon or ZAK and putting the money I accumulated in the funds in some ETFs in Degiro.

So much misinformation. I think PostFinance is really to blame for the way they communicate. It’s hard for people to understand. But no, it will not charge 0.15% custody fee on your ETFs and no, it will not charge you 5 CHF per money account. It looks to me like people just look for a pretext to switch, irrelevant if real or not.

Yes, I was wrong here, that’s because I only have Funds for my kids with them, sorry for the mistake.

Regarding the switch, it’s the other way round, I actually would really like to stay with them as it’s very convenient and I remember the pain last time I switched to PF about 5 years ago (set up all the payments again, tell my employer, new card, new user interface, etc. etc.). I already pay CHF 5/month anyway, as I have the Plus account with 25k in assets (but not all in investments/funds), so that’s not really the issue.

However, they already screwed me once with 3a + life insurance (lost 3’500 but finally got rid of this), already increase the price a couple of times in these 5 years (and take away some advantages of the Plus account with this new Smar package, e.g. taking cash on any ATM, which I will need to pay CHF12/month to have) and now start charging even more for the Funds they convinced me to set-up for my kids.

I know it’s also my fault, I am not experienced so I should have done my homework on investing and improved my knowledge before signing up for Funds and 3a Insurances with them, but that’s what I am trying to do now writing here in the forum and asking the opinion of people that might be seeing something I missed (like for example my mistake with the 0.15% fee).

Here how I see the new fees from PF.

If you want to stay with them because of convenience, you could invest 25’000 CHF this year with their 500 Credit deal in order to have a free account, except for their credit card (50 CHF each year). And then every year, you invest a lump sum or some trade in order to use their 90 CHF credit on their platform. The rest of your investment can be done on whatever broker you want.

I think that if they don’t change anything for the next 5 years, it is still a good deal if you don’t mind of their credit card fees.

…or have 25k in a 3a. With their TER it will cost you more than 25k in their funds, though…but at least you won’t see the money going out.

Could be, but I don’t withdraw cash from my PF account, I use another bank for that.

I have >25 K in ETFs on e-trading, there is no fee on that