Try https://developer.edgar-online.com/docs .

However, i’ll give you a warning: since i have posted this strategy three years ago, the market has been getting more expensive and net-nets become rarer and rarer. It is hard to have a diversified basket of 15 good net nets nowadays (that is, excluding shady chinese companies or biotech companies).

Try usfundamentals.com (made in switzerland, btw) or simfin.com. Easier than parsing Edgar yourself.

Hi! How is the strategy holding up these days? If you don’t mind me asking.

Hello together,

First post here, im a follower of buffet graham etc but didnt believe net nets still works… Thanks for bringing this discussion up! I found some handfull of net net seems that stocks went down a bit this year finaly.

Im very interested in this strategy and was asking myself how are you guys doing? Im Zürich based and would be glad to get in touch with some value investors/mustachians as it seems that all my peers just dont like what I do or how I life :), anyways many thanks for thevinsights i would like to try this net net strategy with 10% of my Portfolio at first… Any news and updates are welcome!

There are some screeners in the net: serenety for exp. Which I find usefull to scann.

Stay safe and take care

AtS

As discussed in the beginning of the thread I used a Net-Net strategy from 2015 to roughly mid 2018. First I followed a thirdparty screener, then I built my own once i knew enough accounting, as I described above.

Over this period my Net-net portfolio averaged around 25% returns per year. However, starting from the summer of 2018, I was starting to get concerned that the total number of net net available worldwide was becoming too small and it was not possible to create a diversified portfolio of 15 such securities.

With Net-Nets you know that the portfolio is going to do well, but the individual positions have very different outcomes; some continue to go down, some stay at the same level for years, and other take off to the sky. Having too few such securities is taking a risk that your portfolio won’t contain any stock of the third category.

That’s why i decided to stop this strategy at the time, and I slowly transitioned to a more qualitative investment style.

However, given the latest market developments in March 2020, i would not be surprised if the market is proposing again a significant number of Net nets, I just did not have the time yet to look at it.

Happy to discuss if you have more questions ![]()

Thanks Julianek for your quick update!

25% p.a is reall not bad at all😬-

I understand your concern, I think i looked at netnets somewhere in 2018 and it was like almost 0…but now i rescanned quickly and found around 10-20 investable picks in the us alone some of them are the same you picked back in 2016/2017. How many stocks would yo consider to own so that this stategy could work for you? I think Graham talked about some 30 or so?

Thank you a lot!

Best ATS

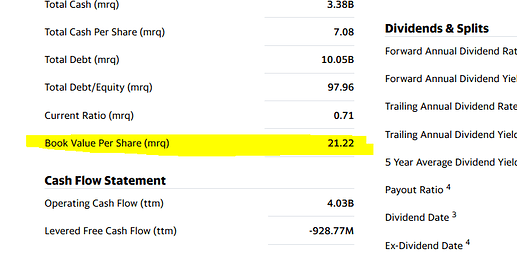

Interesting thread here, i recently discovered that Lufthansa has a Book Value per Share of 21.22 with a Share price of 7.58 as of today. This would mean that even if LHA goes bust, shareholders who bought below Book Value per Share could theoretically make a profit? I’m really concerned that there is a lot of goodwill in the Book Value, how could an outstanding investor tell? Addionally, what about dilution? If LHA floods the markets with additional shares, the Book Value per Share would come down?

(Yahooist Teil der Yahoo Markenfamilie)

Hi sdeg,

I have to say im not a big fan of only book value, there are to many unknow things like you said how much is goodwil (maybe you can find out in the earning report or so) how do they calculate the book value? not sure if they are really worth what they reported. They are in an asset heavy bussines (unless they lease the airlines). Lh has more debt than cash, so it is not a net net. The debt also seems to be as big as the equity… And the airline industry is in trouble right now (buffet exited as well in april).

Yes The book value per share would decrease if they give out more shares to finance their project/shortcomings… Not really a good sign unless its a growing company.

Best

ATS

Hi,

I just started to invest in net nets (currently 10% of my portfolio) if any one is still interested I can add more details or update my progress.

As of now i bought around 8 japanese stocks which are selling way below Ncav and are profitable and are paying a dividend… Sounds to good to be true…

I found two italian companies, and some us-american stocks… Unfortunately no Swiss company ![]() .

.

Lets see how this works out before putting more % of my portfolio into it.

Thanks and best

Ats

Instead of guessing about goodwill why don’t you just go ahead and look at balance sheet itself

http://financials.morningstar.com/balance-sheet/bs.html?t=DLAKF

The bulk of what you’d be buying are property plant & equipment. That’d be airplanes I think. With accumulated deprecation on the book so far of only about 45%. Any guess how much they will really fetch on the market in fire sale? Have you ever sold a car in your life? It loses 50% already the moment you take it out of dealership. And who the heck would even buy airplanes today?? And even a whopping $24B worth of them??? Other airlines have problems just as big as them.

@ATS90, thanks for your insights. Especially the debt situation… Would be interesting to hear about your net nets.

@kilyn, because according to investopedia.com goodwill, patents etc. are already excluded from the Book Value (https://www.investopedia.com/terms/b/bookvalue.asp). But the point is, can you trust the balance sheet and Book Value numbers…

Never bought a car (or airplane) by the way. LH had 763 planes as of 31.12.2019, 106 of them were leased (https://investor-relations.lufthansagroup.com/de/fakten-zum-unternehmen/flotte.html). In January 2020 they sold 7 planes to a japanese investment company and leased the planes back (https://www.juve.de/nachrichten/deals/2020/01/leasing-lufthansa-verkauft-flugzeuge-und-mietet-sie-zurueck). This is very common in the airline industry. But sure enough no one would buy over 700 planes I guess…

That’s called tangible book value when they’re excluded. Most sources I think include them. And it definitely always shows up in your shareholder equity: they overpaid when acquiring someone, the amount by which they overpaid compared to acquisition’s book value has to show up somewhere to make the books balance, and that’s the goodwill item. It is of course total accounting fiction and worth $0 in liquidation. The reason they could overpay could be non-financial (e.g. acquiring technology or market share) as well as financial: if book value did not correctly reflect acquisition’s true value.

But anyway it doesn’t matter much here as Lufthansa doesn’t have a lot of it.

Hi Julianek, i followed your other posts, amazing from where you come from, congrats!

Back again to net nets,

Why are you changing a working strategy?

I mean if you are beating the market with a difference of 15% you could still apply the net net strategy and stay in cash with the rest, or just look for arbitrage trading examples are fitbit deal or recently celgene?

I applied mostly a value investing strategy combined with Dividend growth investing, cummulativ I was never better than the market…but I did not bad. Most value stocks tend to be value traps as well, im holding to MO and PM (my biggest positions) since 2014 and they didnt really go anywhere (just an example) the dividend is nice…

So I was looking into net nets to take advantage of my small money portfolio…

Best

Ats

Can you list the stocks you bought? Thanks ![]()

Hi ATS90,

I changed for many reasons:

- As stated above, mid 2018 the number of net nets dried up significantly and there was no way to be diversified enough to not risk a significant permanent loss of capital. A basket of 15-20 Net nets performs very well on average. But with only 3-4 stocks, you never know if you are going to get an Energold Drilling (this net-net went bankrupt) or a Gravity Corps (this one returned 15 times the investment).

- Staying in cash indefinitely until there are opportunities again has too much of an opportunity cost for my taste

- I don’t plan to stay forever in Switzerland, and in most other countries capital gains are often taxed 20-30%. With the high turnover that a net-net strategy embodies, the after-tax compounding rate is less enticing. Therefore i did not want to be a one-trick pony and i started to research other opportunities based on long term compounding

- So what I do now is buying good businesses that i expect to compound at a high rate for a very long time, and where the compounding is not priced in:

- In the big caps/mid caps world, i delegate to Smithson (you can look my other posts why i think they do a very good job). The CAGR since is 19% since mid 2018, taking into account the rough H2 2018 AND the COVID-19 crisis

- in the very small cap world where institutional cannot go, I select myself good long term compounders with good business opportunities and selling at much lower prices than what you would find in bigger markets. To give you an idea of what i am looking for, Creightons PLC (CRL.L) and Judges Scientific(JDG.L) are two very significant holdings and mine: they have a very high return on capital employed, good growth opportunities at the same high-ish return, management very good at allocating capital, a long runway in front of them, and were available at a modest price (CRL was even trading at a P/E of 8 when i bought). If I did not make a giant mistake I expect to hold them for a very long time…

Careful with Japanese companies. Although the trend might be changing, historically they are over-capitalized (tons of cash on the balance sheet) but they never plan to distribute it to shareholders. The mentality is that once they hire someone, they hire him for life, so they need to be able to face any crisis.

Now activist investors are trying to change this mentality, but it might take a while to operate.

Beware to not confuse Net-Nets with all stocks trading below their book value. Although the former is a subset of the latter, Net-Nets focus only on the very liquid assets (cash, receivables and sometimes inventory if it can sell easily) minus all debts. We’re certainly not talking about factories or planes here.

Furthermore, LH trades below book value for a reason: it requires a huge amount of capital (like all airlines and automakers) and returns very little profits on this capital (way less that what investors would require if they had bought at book value). Hence the discount, which you can find in almost all airlines, automakers, and capital intensive businesses.

If LH was to be liquidated tomorrow, i am really not sure shareholders would realize the book value. Goodwill would evaporate, and planes would have to be sold at a discount as well if you want other airlines to be interested.

Hi,

I had used a very hard filter with screener.co, so no chinese companies, no real estate, financials or bio technology companies and mostly companies were the net cash position is at least half or sometimes more than the marketcap alone (esp. In Japan).

I dindt find a lot of net nets in the US:

-FLXS (Flexsteel)

-FRD (Friedman)

-TUSK (Mammoth Energy)

Italy:

-AUTME (Autostrada…)

-IRC Spa

Japan (just the tickers mentioned here, you will find all of them trough yahoo finance)

- 8904, 2055, 6335, 7235, 4957, 8995, 8139, 7537

All were below 67% NCAV, most of them are still today.

I was wondering how big the impact of IRFS 16 is on the screeners, I mean we could just say 75% of NCAV instead of 67% (as the liabilities get bigger due to the addition of leases and obligations as a liability)…

To lazy to calculate all financials for this adjustment manually…

Any thoughts on this? Is this new rule also valid for japan and so?

Thanks

Thanks for sharing. Personally I am a bit worried about this strategy since these companies are usually low market cap, receive less scrutiny and as a result their financial data could, potentially, be faked. But I guess that is the tradeoff risk one must be willing to take for Net Nets.

I might do the same with 10% of my portfolio in the near future.

Small update:

I guess I had some luck with TUSK & FLXS.

TUSK was up almost 80% at one time last week, but I didnt really know when to sell so now im down again to +47%, FLXS is now up 46%…

Still need some practice.

The rest is sleeping.

It seems that TUSK was triggered by traders and FLXS by Management starting a share buyback with a dividend cut ![]()

I still think net nets needs Diversication.

All the best

Hello together,

I hope you all are doing good and enjoy the suny weather  I do with my Motorbike

I do with my Motorbike

Small update:

I know have around 20 Net Nets around the globe most of them are in sleeping Mode despite that the sp500 is really doing well (thanks to FAANG) i always update the performance and check the Balance once a month +/- on the 15th, I will share the results here very soon to be more transparent and help out folks who might still try to use this strategy.

What I found interesting is that the japanese net net depsite the brutal undervaluation to fair value of marketcap=Net asset value, they are not really performing, they are more or less on the same Level as 2months ago.

The net nets in US and EU are more volatil it seems especially US net net tend to perform well for me but there are only a Hand or two full of buyable net nets

Stay safe and will update you guys shortly

All the best

ATS90

I heard of this strategy before and know of https://www.magicformulainvesting.com/ as a screener source.

But I wanted the raw data and tried to scrape the nasdaq API and the Yahoo API which both changed since the post from 2017. nasdaq is super weird which seems to block the SSL connection when trying to access it directly using Python (works on Chrome tho, headers? cookies? /shrug). However Nasdaq has a ticker list which can be downloaded over FTP. For the Yahoo API I’m still looking for solutions (scraping would be one of them)…