I just noticed that in the latest verson of their app, they removed the small button to see the interest rates on their spaces. Nice.

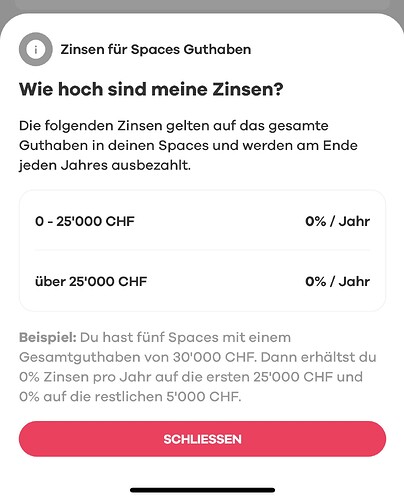

What interest?

This is kind of inevitable

it’s almost impossible to make money on banking side with free services if you are just a Neo bank but don’t give our mortgages etc.

Of course neo banks can use free banking as a hook to cross sell investment products. But then they need to compete with Saxo, IBKR, Swissquote.

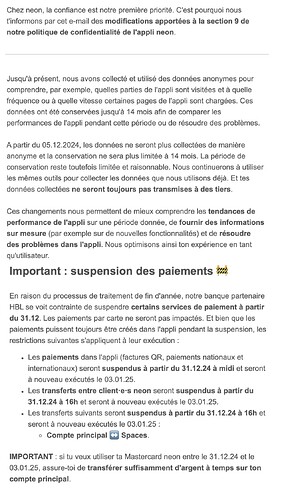

I wonder what’s going on over at Neon… after reading that article I went to check my mails, and what a rollercoaster.

First they announced that the data collected by the app is no longer anonymized, which I think is the first time I hear a bank doing that. Then they announce that all payments will be suspended from 31.12.24 until 3.01.25, even movements from Spaces to Main Account, which is absolutely insane. Did everyone also get these mails?

Isn’t it somewhat standard to freeze things during bank holidays (I think it’s the same with mainstream banks, like neon, can create a wire/payment but won’t execute until the 3rd)

It sounds more like a FYI for people who don’t know about banking holidays etc.

Same-day transfers usually are limited to before noon, with additional fees for post-noon executions. At least with ZKB as well, you’re also limited to 1pm for free transfers on 31.12. And no Swiss bank will execute orders on January 1st or 2nd.

I don’t know if it’s worth it to get worked up over not being able to transfer money between two accounts during holidays.

If I were a Neon user it would piss me off.

At Yuh you can transfer from savings to main account 24/7/365. And if you send money to another person at Yuh (or send money via Twint) this money can be used immediately. There is no friction between the savings part and the main account therefore I usually have very little money in the main part and transfer upon need.

But given that Neon has 0% interest in either part, one could argue the Spaces are anyway kind of useless (or mental accounting).

If you can only transfer between spaces and main during working days, there is no reason to store the spaces part not somewhere else, e.g. at WillBe.

I am wondering, how many heavy-users neon really has (speaking for me, I have all year round CHF 10 per month available to pay my ex-CH entertainment subscriptions and ca. CHF 3k during summer and winter holidays, each - not using any other services from neon).

So, for me personally I don’t care about the payment limitations during end of year. And as @assemblyrequired said, this is a standard procedure for quite a lot banks. If you have to seal an important deal, then your private banker will help you ![]()

But what I can agree with, is the whole “spaces” solution, which is similar to Zak and - in my eyes - super annoying. Would it have been difficult, just to generate another IBAN for a savings account, as any brick and mortar bank does?

I am curious to see, how this envolves - as well as for Radicant, Alpian and other Swiss neo-banks.

Well from Jan 1st the Yuh savings account will also be pretty much useless, 0.25% interest is basically a joke. But at least the other advantages remain compared to Neon.

It’s my main bank account and I also use invest (but also IBKR). I don’t use spaces as I don’t see the point of them. Also I normally have around 1-4k on it as I invest the rest. Transfers Neon to Neon or from/to spaces are normally 24/7 and instant. So these end of year limitations are special.

FYI: Neon still has the issue with the “SBB” Comment. I did check and it still show the SBB Icon.

Confusing!

Facepalming to the highest levels.

I stopped using Neon has my main bank after 25 referrals done and praising this bank.

I no longer tolerate delays every 25th of the month and with ZKB being free, I would rather use that one.

Good luck for the people staying with the bank

Wouldn‘t also use neo-banks als main account, honestly - ZKB is a very good choice.

Thank you, I will remain with neon for FX transactions during holidays ![]()

I noticed today the logo of SBB instead of my employer, just because the text in reference field was “SBB Spesen”. Funny, but I’ll survive it.

I’ll keep neon as main account. The best reason for me: I’ll see when I spend in EUR in Italy just seconds later the amount in CHF in the app. I’m every other day in Italy.

All other banks I tried was not the case (WIR you see days later, Alpian you see just EUR until settled)…

The “SBB issue” is not unique to SBB. I bought Reka credit from a relative and by adding “REKA” in the subject field the recipient of my wire is displayed as “Schweizer Reisekasse (Reka)”. Note that the debit note of the wire is correctly formatted; I see there the correct recipient.

Yes, the feature could have been better thought through but not a killer for me. I will keep using neon as my main bank account for payments (balance is anyway never much, as I invest monthly with IBKR).

Happens when the developers/product owners are trying to be too “smart” -

“oh you know what would be cool, if we did some regex and automagically assigned labels to content” without thinking through consequences.

What about Wise?

Haven’t tried yet… (or have to check if I have an old account… and I see I have one, because I had to open one while paying with neon abroad).

I will order the card and try it out.

Thanks.