Thank you! I didn’t know they had a tool to compare with Neon. Honestly, though, I was more interested in the comparison for paying abroad when traveling (I rarely transfer (large amounts) of money abroad. I wouldn’t mind paying slightly more for having a single account with Neon).

Are the exchange rates really the same for paying? I remember reading somewhere that Neon uses MasterCard rates (which are less advantageous) while Wise uses interbank ones. Is there a materiality threshold to look for?

Neon goes back to 0% interests.

0.1 from november and 0% from december. All for spaces only. The main account is 0% already and will stay like that.

Time to move out money back to traditional banks.

Back to Yuh I would say, if I were y(o)u(h). ![]()

But do you have a source for the reduction? It’s still at 0.5% on their webpage…

They sent me an email about it.

I’ve got the same message by email.

Damn will move again my 1k emergency fund ![]()

On a serious note: do people really open new account to get a temporary click bait 1%? Is your time worthless?

LOL, thought the same.

I have a couple hundred ks in cash at the moment as I am waiting (and waiting, and waiting, …) for a building permit before the transaction can go through. I think in my case it kinda makes sense, 6 months at 1% vs 0.5% is 500. Not massive, but worth the 10 minutes to open a new account.

If it was 10k I wouldn’t bother.

It’s about CSS receiving your data (email, phone, name, age, …).

I don’t know if it’s worth the 20 CHF

Lead generation

I got spammed on my phone anyway. I am tempted.

(for the free 20.- not to switch to CSS)

Do tell us more

All the Neo banks are offering money to open free accounts to eventually lose customers to other Neo banks offering free accounts.

Meanwhile UBS has 5.8 Trillion dollars is assets under management ![]() and doesn’t offer any free accounts.

and doesn’t offer any free accounts.

Talking about leverage

Why have I not received an e-mail from Neon regarding the 0.1 / 0% interest (and yes I checked spam folder)? Also on their website they still advertise with 0.5%, very unprofessional. Meanwhile, Yuh still offers 0.75% (at least for now). Also, like every month on the 25th (and thereafter) Neon either has problems with logging in or payments are delayed. Feels almost like an Argovian peasant bank is behind the scenes, oh wait…

I really have to consider whether I will keep my account there, just for a decent FX.

I was wondering, how do declare those in the tax declaration? Additional income I guess? Are they reported in any tax documents the bank gives you at the end of the year?

Interesting question.

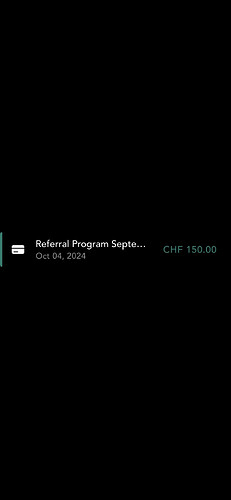

No, they are not reported in the end of years statement. Went this year with Yuh (CH 75), Radicant (CHF 50) and Alpian (CHF 150).

Yuh I already closed, Alpian I will close soon and Radicant is very fresh, so I want to test them, as well. But unlikely, it will replace my neon account.

Mail reason is, that I used neon couples of years back to set up various streaming accounts abroad - and I have seen it with friend, in case you are chaning the card nowadays, the streaming provider is asking in most cases for a national phone number (2-auth) and a national bank card.

So, I do not want to change a running system and I am quite happy with the FX only use of neon ![]()

Revolut I will skip, I had an account in the earlier days and the account blockings were scaring me off.

Revolut also have more scams in UK than Barclays. Says something

I only see CHF 75 for Alpian. Or do you mean the combined reward (75 for the new customer, 75 for the referring customer)?

It was an offer couple of months ago.

No combined reward, just opening the account and funding it with CHF 500, that‘s it.

- Customer acquisition cost 150

- Customer LTV 0

Not a good deal for Alpian but hopefully they got some new clients who will actually use their services