Thank you guys for all the replys.

@badad

Thanks for the video, will watch it tonight.

@Bojack

It’s even less. If I assume withdrawal rate of 4%, I’ll need 1.3 million CHF for my current lifestyle. My goal is 2 million CHF though, so this amount is 2.5% of my FIRE target and probably 5% of the amount I’ll need to invest to reach that goal. Totally agree with the statement that one should avoid accumulating bigger chunks. I was just unlucky because I wasn’t invested before, so I started close to the ATH. My bonus arrived at the ATH and being able to invest pension fund money is also very rare. A lot of coincidences playing here. But I’m still glad that I got it out of the way. It doesn’t feel great but at least I don’t have any other big chunks to invest, only my savings rate of 2k/month.

@T78a

I’m doing that. My base salary was 66k 1.5 years ago, now it’s 85k. I’ll start studying in September this year (Bsc Banking & Finance at Kalaidos in ZH). So I’ll probably be close to 120k in 4-5 years. My savings rate will keep increasing over the next years and probably make a big jump after I’m finished with my Bsc.

@Wolverine

My takeaways is that I learned a lot about my psychology and risk tolerance. Being invested in stocks can be painful, but I guess we get the stock premium for enduring this pain. I just need to accept it and try to detach myself from all the noise and the value of my portfolio.

@yakari

I’m always telling myself “Buy and hold, stay the course, ignore news, look at your longterm goals” to calm myself down when I feel bad about the markets. I hope the more time passes the more I’ll burn this dogma in.

@rolandinho

I think I won’t do anything different in the future. The odds are clearly better for my approach, so I’ll keep lump summing my bonus and other windfalls. Over the longterm, I should win more often than I lose.

@San_Francisco

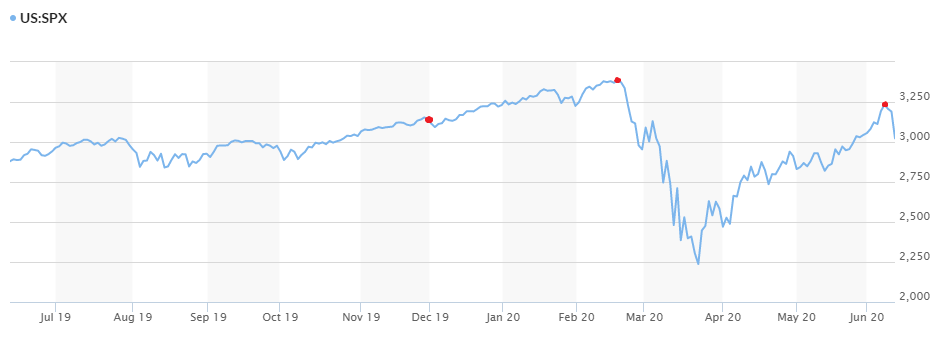

It’s funny that we had a lot of discussions about the whole situation. Eventhough you were probably right, I’ll just believe that I still got the moral victory here  But we’ll have to see how it plays out over the next months and years. It might be too early to call it today, at least for my Monday investment.

But we’ll have to see how it plays out over the next months and years. It might be too early to call it today, at least for my Monday investment.

@FIREstarter

I envy my clients that aren’t working for a bank. I know that I have nothing to worry about and that my investment horizon of 25 years is more than enough. But still I need to look at the markets on a daily basis because of my job. It was different when I didn’t have any own money in the market. Now I know how it feels!

@TeaCup

Won’t work anymore in the future. We had a 40 year bond bull market from 1980-2020. Bonds will decrease a lot in value when interest rates start rising again. So I’ve got no other choice than stocks. But that’s ok as I’m seeking the highest possible return without taking too much risk.

@1742

I wish I could make a standing order to IBKR like VIAC. Automatic investments without the need to login, that would be really great! I’m trying my best now to only look at my portfolio twice a month when I’m buying after payday and when I need to enter the end of month values in my Excel spreadsheet (I want to track it regularly).

![]()