My second year as an options trader was successful until it suddenly wasn’t … but here’s what happened in more detail:

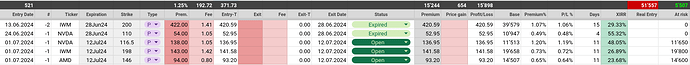

In 2024, I sold 75 contracts (14 calls and 61 puts) and was assigned 12 times. The average strike price was $170 and the average contract duration was 7 days (20 days for the stock I was assigned and able to sell later). Still at IBKR, the average contract cost was $1.05.

The lowest premium in 2024 was $40 for 1 GOOG 12Jan24 132 P, while the highest premium was $1,308 for 2 TSLA 28Mar24 165 P (which I closed for $30 eleven days later).

All trades were cash-secured within a USD 50,000 portfolio. From 1 January to 21 October I was up USD 14,400… I felt very smart, but then – suddenly – the wheel came to a screeching halt when I was assigned 300 AMD in quick succession (at $149.33 on average) and 100 KO (at $65), which I still hold at a current book loss of USD 8,800 (ignoring other trades on the same underlying). This is the exact result for 2024 as of 31 December (in USD, combining premiums and capital gain/loss):

| Ticker |

Result |

| NVDA |

4’091.06 |

| GOOG |

3’136.63 |

| TSLA |

2’776.44 |

| IWM |

1’476.78 |

| CRM |

1’058.47 |

| AMZN |

491.74 |

| UNH |

219.40 |

| ABBV |

99.94 |

| MSFT |

99.75 |

| AZN |

70.05 |

| SONY |

67.65 |

| KO |

-103.06 |

| AMD |

-7’021.19 |

| TOTAL |

6’463.66 |

I was made aware of the risks associated with options trading in this thread and I knew this could happen at any time. But despite this turn of events, the Internal Rate of Return of my options portfolio in 2024 was 24.4%, still higher than the IRR of my ETF portfolio (21.4%). These values are in my base currency (Swiss Francs).

My plan has been to move $5,000 from the options portfolio to the ETF portfolio every time it would reach $55,000. Starting the year with a balance of $56,500, I withdrew $7,300 in January, $5,000 in June and $5,600 in September. Now, I’m left with $3,400 in cash and $42,500 in AMD and KO.

So, what now? My plan is to wait for AMD and KO to recover (I am quite optimistic as both stocks have a price target well above my purchase price) and then to reassess what to do next: continue writing options or move everything into ACWI.

I’d be very interested to hear how your year in options went and/or what you would do in my situation.