Interesting discussion to follow, but I’m quite many years away from retirement, let alone early retirement… So, for now, I’m playing around with option selling with 2% of my net worth, generating a fraction of my salary. No idea if I’ll continue option selling into retirement for lack of any real hobbies, or if I prefer to pursue endeavors more worthwhile than squeezing the last CHF out of my portfolio ![]()

I stopped selling options as I felt I was getting into risk territory regards professional trader status once I reach RE

My situation

• I am a buy and hold investor, securities are held much longer than 6 months

• Very low transaction volume each year

On the other hand:

• After RE it is likely that >50% of net income would come from capital gains. My shares have 1% dividend yield, so I can’t live off dividends, and ideally I don’t want to as tax inefficient

• I already have a margin loan and the interest expense currently exceeds the taxable income from the investments in my IBKR account

Regards the last point, I closed mortgages on overseas property and moved the loans to IBKR to take advantage of the lower rates. I can argue that income from property covers the interest cost but I would rather not have to try and convince a tax auditor about it

Therefore I decided it safer to not be too greedy and eliminate trading in options as the lost income is small relative to the risk of being taxed on capital gains

I will need to review the set up again before full RE

Just wanted to buy back my CSCO JUN42.5P (103 days left with the option only worth about $31).

Swissquote wants a fee for $5.45 for this transaction! ![]()

This is about twice the rate from just a couple of months ago.

I suppose Swissquote noticed there’s a growing option mania and wants a larger slice of the pie.

I’m probably just going to let this option expire (probably worthless) even if I make less than 50 cents per day and continue to hold the risk.

I think I am also another step closer to moving my entire custody account to IBKR …

@larix.aurea @Your_Full_Name in case you use IBKR: how do you track the overall behaviour of each single security (if you do it) ?

I would like to know how the different individual securities I trade have performed, but in IBKR I cannot find a view (or a way to customise a statement) to achieve this (I think it is not possible)

The issue is that Options have specific names based on date/value and either put or call. Sometimes I sell a put, get assigned, hold the security and - in parallel - sell calls until assignment (wheel). Some other times I buy back my put before expiration.

→ I end up with a messy custom statement which includes, along the specified timeframe, all the ‘Trades’ and the ‘Option Exercises, Assignments and Expirations’…(I also need the ‘Trades’ section in the statement, to keep track of options which I have exited before expiration)

Of course, one solution could be to track everything manually with a spreadsheet (which I would like to avoid…).

Another one could be to try to use ChatGPT (I might test it in the next days to see what it can produce…).

Other ideas ? ![]()

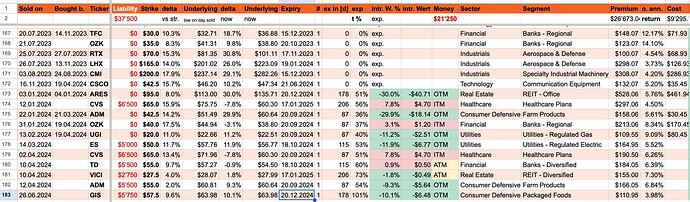

I use a (tab or two on my) spreadsheet. Something like this:

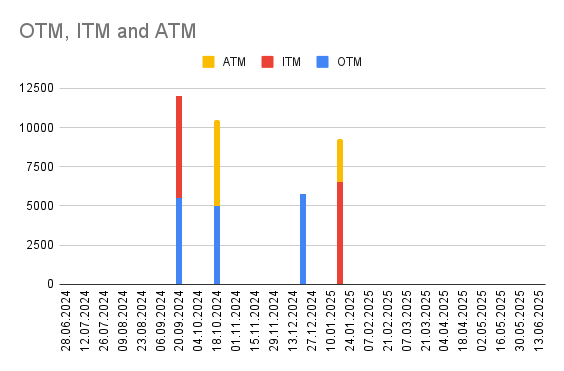

And this to visualize assignment “risk” over time:

Might be a little easier for me as I only sell CSPs.

Afraid not. ![]()

You can try custom activity template where you activate individual lots view for securities (not sure about the proper name). You can see when each lot was bought (or sold), at which price and its performance.

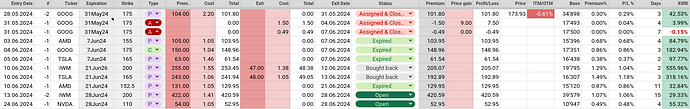

I do two things in parallel:

- I use a Google spreadsheet where I keep track of all options contracts (see picture). All amounts are in USD, as I trade only US options on IBKR.

- I also use Portfolio Performance to track my options trading in Swiss Francs. CSP sold are treated as “Interest”, if I buy back a contract I use “Interest charged”. Works very well.

nice post and nice result. Got a question maybe you can help

If you aim of premium of 0.5% of the strike price and (I am guessing) expiring in one month with all put being cash secured, then the annual return should be somehow 6%, even if all your capital is deployed all the time. You made 20%, this is amazing. There must be something I am missing.

@Your_Full_Name @larix.aurea thank you for the spreadsheet templates. I guess I’ll have to end up with something similar for the time being.

In fact, I aim for 0.5% per week or 1% for two weeks, that’s why I often go for underlyings with higher IV (TSLA, AMD, NVDA). Also, I don’t hesitate to buy back contracts to reduce risk and increase the return if possible.

I’m aware that I’ve been pretty lucky during the first 6 months of this year with only two assignments and a well-greased wheel. ![]() I made USD 6,000 (~12%) in six months and just transferred USD 5,000 back to my main ETF portfolio to take out some risk.

I made USD 6,000 (~12%) in six months and just transferred USD 5,000 back to my main ETF portfolio to take out some risk.

Happy trading! ![]()

ok. got it. 0.5% per week is like 26% annualised. It’s also hard to keep all capital nearly deployed but still be always fully cash secured. Do you track the notional value each day? The amount of cash you need if all your positions are assigned to you at once. Is it more or less fluctuating between 90% - 100%?

OK so taking inspiration from @Your_Full_Name and @larix.aurea spreadsheets and after some work I ended up with mine.

I leave here the link, it may be useful for others to use as starting point for their own and may even bring suggestions for improvements ![]()

VT ytd is 10.44% with no work from my side.

Sure ! I think the rationale behind options writing in this particular thread has already been expressed by the OP

I read this kind of threads with a lot of interest but lack of time to proper learning all. I think my “warning” about VT is needed for people like me that love the idea but feel bad that can’t really implement it straight away.

![]()

Can’t speak for @larix.aurea 's option strategy, but with CSPs only (and I assume things can also be accordingly calculated for their strategy), I spread out assignment risk over time and typically will only hold the amount of cash required at the next upcoming expiry. See my risk over time chart further above.

I.e. even with current total option liabilities of $37k my next upcoming expiry (Sept 20) risks assignment of about $12k. $6.5k of that liability is in the money ($CVS 65P) and will get assigned.* The remaining about $5k ($ADM 55P) is out of the money and I reckon I’ll buy it back before expiry for a profit.

In essence,** I need to hold $6.5k in cash between now and Sept 20.

* Unless I roll. Currently, I plan to get assigned as I still like $CVS at $65 and assignment at IBKR will be free of charge.

** Since these are American style options, assignment could take place before expiry, but this happens rarely and typically only a few days before expiry if at all.

Since I work with much shorter time periods (1-2 weeks to expiration) than @Your_Full_Name , I always have enough cash on my trading account to cover any assignment (hence cash secured puts). I also try to always have 90-100% of the cash “at work”.

I started with cash (margin) secured put selling but moved to credit spreads which hedges a bit the bet in case something happens over night. Out of the money options hedging the bet are rather cheap and limit the loss when things go south…

I did it only once (vertical put spread on SPXW).

I’m not a big fan of it, because if both options are assigned you end up with a realized loss and no security in your portfolio.

Of course it could be still worth it if you trade options on very risky stocks, which may go to zero (or on indices, which you cannot physically buy)

Want to learn here.

In practice, how do you make sure your “notional value” / “cash at work” / “The amount of cash you need if all your short puts are assigned to you at once” is between 90% and 100% of your cash amount? Too high (over 100%) would then be not cash secured. Too low (ex. below 90%) then you are wasting your capital and wouldn’t achieve as much return on the capital.

- What is the range you use exactly?

- Do you track this number manually?

- or Do you have this number given from the broker?

- Do you do something or opt out some action if you see this number is or going to be out of the range?