Around 15-20% each, but I dont really rebalance.

If you ask a technical trader he will tell you that there are patterns in the charts that represent human psychology and that can be exploited… fear and greed basically.

This is really all interesting, I suggest to split this thread and maybe I’ll ask more info about this larsson indicator.

On a funny note: @kraphael I wonder if no one ever told you that your nickname start with krap ![]()

(pronounced “crap” for the silly-humour-impaired)

Yes more or less that allocation, VIAC doesn’t let you pick any asset, but as close as it gets.

I’m honestly jealous now, how did you get to know him?

Should have been more precise with my words (non-native English speaker here ![]() ). I don’t personally know him, and “pretty well” was a bit of an exaggeration. I watched some interviews with him (the first one being about the German real estate market and his contrarian view to many other so-called experts), and I liked his approach and also his knowledge.

). I don’t personally know him, and “pretty well” was a bit of an exaggeration. I watched some interviews with him (the first one being about the German real estate market and his contrarian view to many other so-called experts), and I liked his approach and also his knowledge.

Still, you have to differentiate between the knowledge in his interviews and his GPO (Global Portfolio One - here). You pay 0.7% TER for GPO, and it’s basically a 80% stocks / 20% bonds portfolio with some tweaks. Mr. Beck is a mathematician. He created a set of rules for rebalancing of his portfolio. The rules are linked to discounted cashflow, and he’s underweighting US markets and overweighting e.g. Japan. Also, he’s implementing market timing - buying when stocks go down (decreasing the bond percentage) and rebalancing back into bonds when stock markets reach all time highs.

One of the flaws is that GPO was only made public in autumn 2019. Mr. Becks company used the same approach for wealthy customers before, but without a public available fund. Therefore, it’s difficult to compare if his approach is working long-term, or if he was lucky due to quantitive easing. E.g. during the March 2020 Corona crash, he increased the stock percentage to almost 100%. The main problem: what if the crisis was not only a few weeks, but the dragdown would have been 2 years? Then he would be invested 100%, but the stocks would fall further. Long-term that doesn’t matter, but if someone buys his GPO fund close to retirement it’s suboptimal.

You can find more information and reviews about GPO here and here

Both links are unfortunately only in German. The 2nd link is interesting if you want to set up the rule based parts of GPO yourself - the blog author shares all the code in R.

Is “Nasdaq, Inc” in your chart the share price of Nasdaq Inc (the company that provides the Nasdaq index)?

And that’s the reason why you shouldn’t blindly trust what a stranger posts in an anonymous internet forum ![]() Thanks for pointing it out @Barto

Thanks for pointing it out @Barto

Indeed, I used “Nasdaq, Inc.” instead of NASDAQ 100. Here is the correct version:

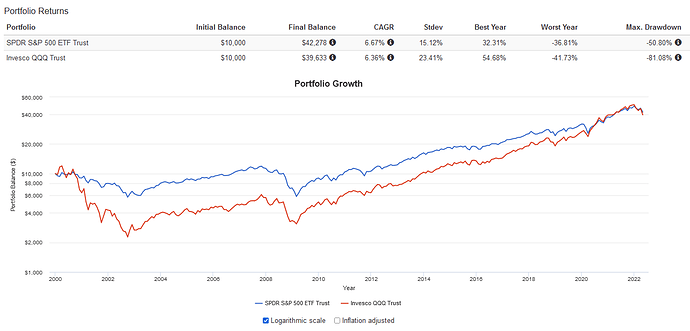

Turns out that tech stocks didn’t outperform S&P 500 over the last 22 years! Only slightly after the Corona crash in March 2020.

I guess this didn’t age well then:

…sure, if you pick your starting point right before the big dotcom crash…

It’s not me who picked the starting point, but the available historical data for SPY and QQQ.

On a side-note: please don’t take it personally (that’s what I can sense here). Still, we’re talking 22 years where Nasdaq index did not outperform S&P500. That is long-term.

On a 2nd side-note: I also had the impression (!) that tech stocks outperformed other stocks in the last years, but the data clearly shows that this was not the case. At least if we’re talking about NASDAQ 100. I think there’s also a NASDAQ 30, if I remember correctly. But NASDAQ 30 is just more concentrated.

Does it?

This does show that NASDAQ 100 outperformed S&P 500 quite clearly to me?!

Very consistently since at least the last big stock market crash (2008).

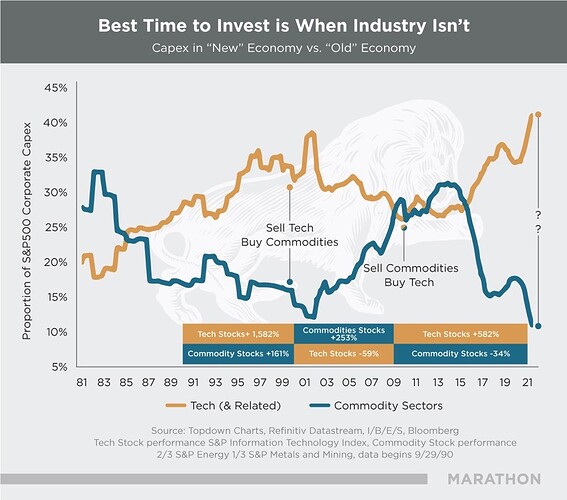

I am convinced that the big profits in the will be made in technology: Biotech, AI, blockchain, remote work,… these business models are just way more scalable than conventional businesses, unless oil goes to 1000 $.

I am putting (most of) my money here, the past is not the future

I wouldn’t put it as “always” - the dot com crash investors can attest to that.

But mid- to long-term, I agree that technology-focused businesses will tend to outperform most other businesses.

The late-90s / early-2000s dot com boom was just a period of grossly exaggerated valuations.

And I think the last two years, since the “COVID” crash, were probably showing similar signs of such exuberance (though certainly not as pronounced as around 2000) for many stocks in the tech sector. But we’re currently in the correction phase for that, with the tech sell-off over the last few weeks.

Let’s define “last years” first ![]() You are right that NASDAQ 100 closed the gap again after 2008, and therefore outperformed S&P500 by definition. And right now it’s getting hammered.

You are right that NASDAQ 100 closed the gap again after 2008, and therefore outperformed S&P500 by definition. And right now it’s getting hammered.

Yeah I remember how I knew when friends of mine started buying Tesla stocks last fall even though they have never invested in their lives that this party would soon be over. That’s when I sold 40% of my stocks

Intuitively I would rather compare the derivative / slope of the curves.

So Nasdaq strongly underperformed from 2000 to 2002. Then did about the same as the S&P500 until 2009. And then started performing slightly better.

If there are really proven and working methods people would just use them, and arbitrage all the positive effect away…

You just got lucky there. What if when you sold everything with your limit order, it quickly recovered instead of falling even more?

It can also gap open below the orders and not trigger them.