I switched to 60% stocks and wait for the end of the bear market to go back 100%, if nothing happens no biggy, if it tanks another 10-20% I’ll gladly take the stocks of all the panic sellers.

If you can’t stomach the volatility delete the app and don’t look until you’re retired.

A post was merged into an existing topic: What’s your VIAC/Finpension 3A strategy for the next months?

It seems most people don’t understand the definition of “end”. How do you know when it’s the end?

Well you know it after it recovered to previous levels and you buy back in at a higher price?

I use the larsson line indicator to get in and out of an asset but there are many different techniques. there is nothing wrong with passive investing, but I want a bit more performance

Thanks for sharing, I was kinda lost in the ups and downs of the stock market. Now finally I know how to get rich ![]()

Yeah yeah sarcasm, I get it.

FYI: I have retired at age 47 and not because I DCAd my food money into a Vanguard ETF for half my life ![]()

I’m honestly happy for you, no offense. Just sceptical of anyone telling me he/she can read the market long-term. To me, it’s a random walk with some long-term upside

Sure, but there are plenty of proven methods that will outperform the MSCI world or similar indexes.

I won’t pretend that I am able to hit the top or bottom of every cycle perfectly, but derisking during bear markets (e.g. going into cash) and rising exposure during bull phases (e.g. using additional leverage or stock picking) helped me a lot to build my wealth. The market works in circles I hope we can agree on that.

Which ones exactly? As was said already there’s only a handful of people consistently outperforming the market over the long-term.

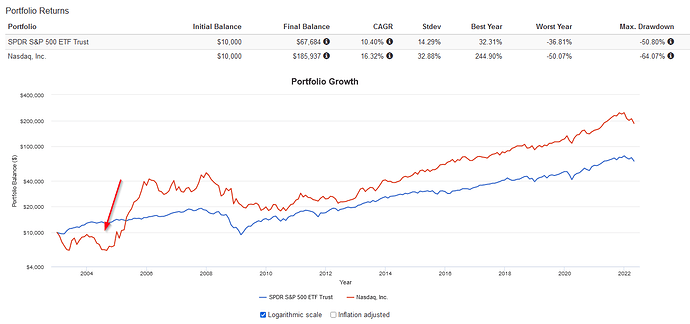

Technology indexes like Nasdaq always outperforms a broad market index like the MSCI world longterm because progress is exponential.

Leverage during upswings and rebalancing with uncorrelated assets like gold, energy or commodities further boosts performance (e.g. 60/40 with 3x leverage).

A system for “market timing” help you do even better (e.g. buy an extra 20% every time the market crashes 20%).

But maybe it’s just luck… ![]()

You are correct that NASDAQ did outperform S&P500 (I used SPY instead - data for MSCI World URTH on Portfolio Analyzer only go back until 02/2012) in the last 17 years. But it was not always the case:

We’ve seen a huge increase in tech stocks (FAANG), which helped to boost NASDAQ. Will it continue to be the case? We don’t know. There could also be a regression to the mean.

Are you talking about leveraging the 60% stock part of the portfolio? Or do you also leverage the other 40%? Also: are the 40% gold, energy, commodities?

Where do you take the 20% from? From the gold/energy/commodity part of your portfolio?

- You are right, since last fall I have reduced tech and allocated more towards energy and commodities (and yes Russians stocks, currently at -88%

)

) - Both, I have used leveraged ETF as well as taken some margin loans to buy more assets, at the moment I have reduced any leverage and exposure more towards cash and gold

- All time high, I have put some limit orders as soon as the market started to fall.

You know hedge funds would pay you millions for your skills?

If you don’t mind - I’d like to ask some more questions:

You hold cash as part of your asset allocation? And coming back to gold/energy/commodities: are those part of your 40%, or is cash the bigger chunk of those 40%?

Which ATH are you talking about? Stocks took a hit in the last 6 months (NASDAQ, S&P500). Gold also had it’s high in March. The only ATH (almost) I see is for crude oil.

What is long-term for you? I see in your other posts that you seriously started investing in 2014, that’s not long-term. I mean basically you have been investing during one of the biggest bull runs ever.

Don’t get me wrong, I envy you for your achievement and am really happy for you that you reached FI!

Well if you really want to know, I have different portfolios that follow differenent strategies.

The one with the limit orders is what I call the “Dr. Andreas Beck” portfolio, he is a he a well known hedge fund manager in Germany. It’s basically a global passive investing strategy with a twist. Here I invest only in the V3AA (Vanguard ESG Global All Cap UCITS ETF (USD) Accumulating) and bought it with a lombard loan of 3% (therefore leverage). ATH was this January at 5,67 $ and my buy order is set to 4.30 $.

The one with the big commodity commodity allocation is my “NZZ - The market” portfolio. My VIAC allocation is more or less “The market”

I have two other prtfolios: a “global macro” where follow Lyn Alden and one is “technical trading” following cto larsson.

Long term is for me since the beginning of civilisation. I believe that new and emerging technologies is where the biggest financial gains are going to be and that’s where I will put (most) of my money, again with a hedge towards commodities and energy.

Not really, I just try to copy their strategies.

Thanks for the more detailed information - much appreciated! I know Andreas Beck pretty well, and I like his approach (global portfolio one). I also really like him as a person.

May I ask you the allocation percentages for the portfolios you mentioned? If you’re not ok sharing the percentage, it’s also fine for me.