Corporate bonds tend to go down with the rest of the market in a downturn. If you intend to sell these bonds (to buy equities when they go down, right?), you’re betting on the rates falling further (in crisis time, ha!) and bonds rising and that they’ll even be buyers for these, which is less certain for HY variety. If you’re after their high returns, you should be rather holding them to maturity to collect all those dividends, and have you looked at the spreads and default rates recently?

It’s an interesting point, but I’d be worry of any analysis that doesn’t take into account bond yields. CAPE has become very correlated to bond yields which have been falling for good 30-40 past years: Shiller CAPE Versus the Risk Free Rate, Charted - DQYDJ, so the cause of high CAPE could be as well just the historically low interest rates.

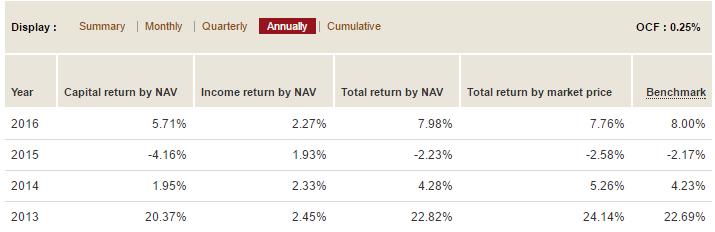

It’s a distributing fund, not accumulating, so there should be no troubles with it even though ESTV didn’t collect data on it. Accumuling funds not in ESTV list are a much bigger concern as then it’s your burden to prove what part was pure capital gains and what part was reinvested income, and if you fail, then potentially they may want to just tax you on all the gains.

sorry for getting all these partially harsh replies, but i join in for the most basic points you already read.

sorry for getting all these partially harsh replies, but i join in for the most basic points you already read.