You are contradicting yourself a bit here. If they are indeed as correlated as you say, then there is no increase of volatility. The only cost, theoretically, would then be in increased TER and trading costs.

In your portfolio, you did not include home bias portion. For the mustachians who decided against it, what is the main rationale? I personally would feel safer having 20-25% of SPI or SMIM in the porfolio. Is the the fact that strong CHF is bad for Swiss companies as well. Any advice?

I have Pillar 2a, 3a and Swiss stocks in both VWRL and WOSC. It’s probably a false sense of security to think that home bias will save you from the next financial crisis. If, however, you have reasons to believe that Switzerland will outperform the world over the duration of your investment than by all means, go ahead and home bias. I don’t know that, so similarly to @Bojack I choose to invest in globally diversified Indexes.

In the very long term this probably won’t matter that much as all markets are indeed pretty well correlated and we will all end up not very far from each other.

Looking at the last 5 years of FTSE, it sure looks like they are correlated => Small Caps would be useless and expensive.

But looking at the MSCI Chart since 2003, which you linked, it looks like it was growing faster 2003-2007, then dropped down to the same level, then started growing faster again. => this would imply higher volatility.

My rationale is: I do not plan to spend CHF in my retirement. I do not plan to retire here. So I don’t care how much my portfolio is worth in CHF.

My portfolio is completely bonkers (in a bad way).

40% KTM (from Austria)

20% UBS

20% Implenia

20% ABB

But what’s even worse are the fees I pay with UBS!

I’m in the process of moving my portfolio to CornèrTrader and then investing into low-cost ETFs. It’s actually cheaper to move the securities and sell them on CornèrTrader than to sell them at UBS and move the money

As I deal “well” with losses emotionally and my investment horizon is super long, I will not invest in anything but 100% ETFs.

2 posts were split to a new topic: Geographic distribution of S&P500

What do you guys think of VUG (Vanguard Growth ETF)?

Didn’t find anything in the forum search.

Considering that we pay taxes on dividends but not on capital gains, I find it very attractive. The TER is at 6bp.

Sector wise it’s seems to be a bit tech/consumer services heavy:

Technology 27.5% (VOO: 24.9%)

Consumer Services 20.4%

Industrials 14.2%

Financials 13.2%

Health Care 11.2%

Consumer Goods 8.7%

Oil & Gas 3.5%

Basic Materials 1.1%

Telecommunications 0.2%

But when I compare it with VOO (which tracks S&P 500 AFAIK) it’s not that much of a difference (sectors within the same order of magnitude).

It’s not a true mustachian fund, as it’s not very diversified.

Apple + Alphabet (google) + Amazon + Facebook make up 21.7% of the fund. This would explain why it overperformed S&P or MSCI/FTSE World in recent years, but do you think this is sustainable in long term?

After carefully browsing thru the posts on this thread and doing an analysis of my investment goals/risk tolerance appetite, I have fixed on the below investing/portfolio approach:

Broker: Degiro (will open an account on IB also once total portfolio crosses 60 KUSD on Degiro, currently at 20 KUSD)

Asset allocation - 100% stocks

Investment horizon - 25-30 years

Investment frequency - Monthly, based on target desired portfolio composition (usually invest 6-8 KCHF on a monthly basis)

US Stocks: 60% of which,

VTI - Vanguard Total Stock Market ETF (50%)

VBR - Vanguard Small Cap Value ETF (10%)

International Stocks: 40% of which

VXUS - Vanguard Total International Stock ETF (30%)

VWO - Vanguard Emerging Markets ETF (10%)

Would be grateful if you could provide your suggestions/opinions/criticisms on the above.

Thanks for reading and look forward to your inputs. Cheers.

One observation: Is there a particular reason you chose VXUS? I ask because it also contains 20% Emerging Markets. An alternative could be VEA (developped ex us).

I have no comment on your ETF choice, but 8k CHF a month for 25-30 years with an average annual return of 6% will result in 5.7-8.1m CHF, which will enable you to withdraw 340’000 CHF a year without reducing your capital if you save 25 years, or 490’000 CHF a year if you save for 30 years. Even more if you allow for your capital to reduce as you get older. That’s some retirement you’ve got planned there :-).

Sorry, I should have been more specific in my post.

I have a lump sum cash of around 100 KCHF + which I have been hoarding for the past 2 years. Bad approach and something I want to rectify asap.

Instead of dumping the entire 100 KCHF in one go in the market, I plan to invest around 6-8 KCHF every month, with a view to targeting a specific portfolio composition, i.e. not doing dollar cost averaging but value averaging.

I assume that it will take me until end of 2019 to dispose of this lump sum.

Starting 2020 onward, I will revert to my usual investment approach of around 3 KCHF per month. This of course assumes that other life events do not block that, i.e. starting a family, house, etc.

Thanks @cray.

The only reason I am not choosing VEA is that I want to keep the existing developed percentages in VXUS and slightly want to overweight emerging markets beyond their existing percentages in VXUS.

Maybe I am wrong in my reasoning and if there is an obvious flaw, I would be grateful if someone could point it out.

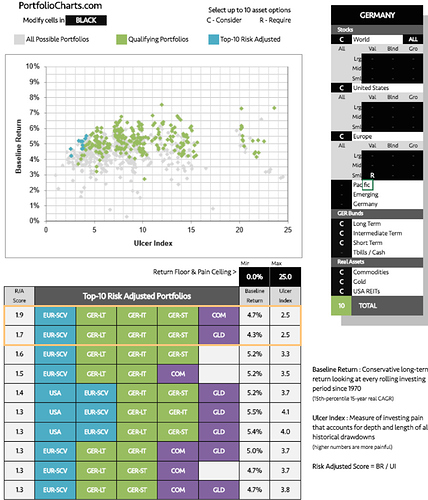

My need is a portfolio to rebalance once a year with a perpetual withdrawal rate…

(‘the maximum withdrawal rate that would have ended with the same inflation-adjusted principal as when you started’ Why Your Safe Withdrawal Rate is Probably Wrong – Portfolio Charts)

…of 4% because my only income comes from it.

And thanks to you, I discovered Portfoliocharts.com and the Golden Butterfly:

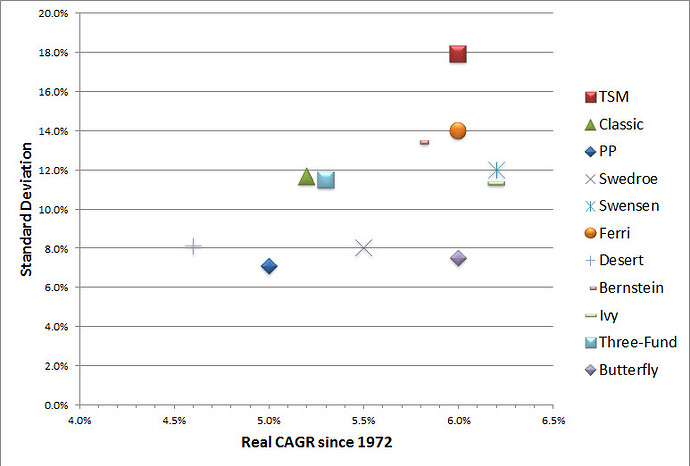

As you can see in the above image it has the highest real CAGR with the smallest standard deviation.

Besides all the above vantages (perpetual portfolio, withdrawal rate) according to Tyler (the guy who created the Portfoliocharts site):

The Golden Butterfly is built as an extension of the Permanent Portfolio.

The basic theory of the Permanent Portfolio is to select assets that do particularly well in the four possible economic conditions. Generally speaking:

Prosperity: stocks

Recession: cash (or commonly short term treasuries)

Inflation: gold

Deflation: long term treasuries

First question: is there anybody in this forum in my situation (yearly rebalancing, no income besides your portfolio, planning to stay in CH for some time)?

If yes, how are you actually invested?

What do you think about the Golden Butterfly?

My thoughts so far:

- it is designed for US investors, Tyler hasn’t yet discussed a ‘Germany version’ of it. Giving the recent Mifid II and the Estate US taxes, I’m inclined to implement it using Ireland/Luxembourg domiciled ETFs corresponding to the ones suggested by Tyler:

20% VTI (USTotal Stock Market)

20% VB (US Small-Cap)

20% VUSUX (US Long Term Government)

20% VFIRX (US Short Term Government)

20% IAU or GLD (physical gold)

But I haven’t found any. They say since Mifid II is recent, new ETFs are going to be issued but till then what?

-

Long Term/Short Term is the Barbell structure, but does the LT portion make sense in raising rates environment? (being a permanent portfolio, one shouldn’t care?)

-

How to hedge the USD/CHF and USD/EUR risk, at least for the bonds portion?

-

As said before, is 80% US market (20% is gold), but if you try to convert it a bit (40%) in International/European market then you can’t reach the appealing statistics of the GB (real CAGR and volatility).

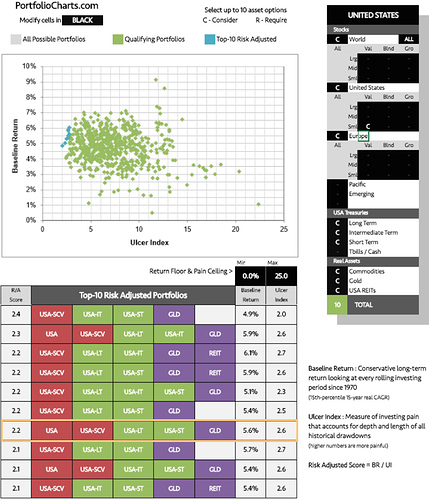

Using the Portfolio Finder:

The orange one is the GB. It’s Ulcer Index (another very important variable for me) is 2.6.

When I select ‘Germany’ and ask for a ‘Return Floor’ of min. 5.6% and an ‘Ulcer Index’ max. 2.6, there are no portfolios (considering World, US and Europe stocks).

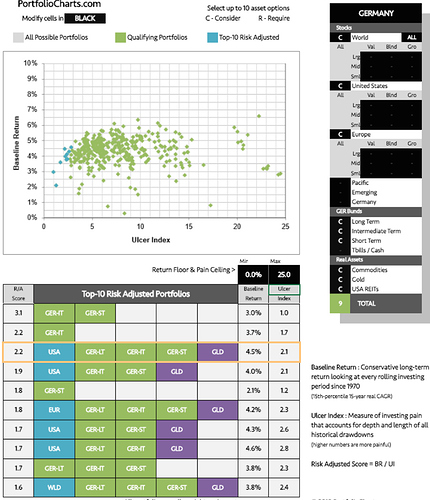

When I give no restrains i get this:

Where the Portfolio outlined in orange is the best approximation of the GB. So I should let go of 20% stocks.

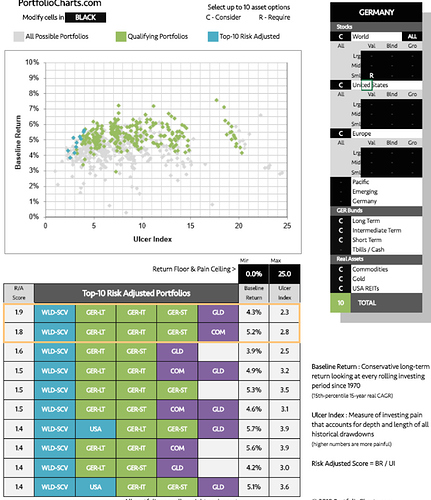

If I request World Small Cap Value (SCV is a distinctive characteristic of the GB):

either I give up the max Ulcer Index of 2.6 and I have Baseline Return of 5.2%, Commodities instead of Gold, 20% stocks instead of 40%, or I stay under 2.6 Ulcer Index, then: 4.3 Baseline Return, again 20% less stocks.

Finally, if I request Europe Small Cap Value:

This is the glass of water in which I’m lost…

Hi,

I’m not yet invested (currently getting informed about it all), but but it looks very interesting.

I’d also be very interested in the way to implement it best, with respect to living in Switzerland, i.e. which ETFs to buy… (on deGiro)

I’m glad it also appeals to you. If I reach some new useful infos I’m going to let you know.

In the meantime also some feedback from the savvy posters here would be very useful and appreciated

@fedra I’m currently reading all articles on JustETF :

And I’ve also finished reading pretty much all from portfoliocharts.com/library/

I’ll use a lot of those information to decide what to buy…

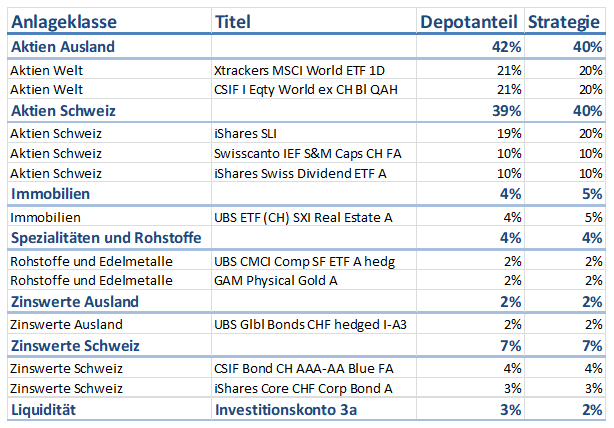

And here is my portfolio:

For 3a I’m (still) at VZ where I accepted their standard 80% Stock market allocation (Sorry for the German in the table. I believe it’s still understandable)

Is anybody else at VZ? Any views on the standard VZ portfolio?

I did a brief analysis of the portfolio and it seemed quite reasonable. If I would pick the protfoli myself I would have picked a simpler portfolio with fewer titles in order to keep it simple. But for me it is simple. I just chose the strategy with the maximal possible stocks and the rest has been done automatically by VZ.

Anyways I’m planning on moving to VIAC since you can have up to 100% stocks. I already opened the account and will make my 2018 contribution in VIAC (Thank you people for suggesting VIAC and offering the referral codes). Though I still need to figure out how the transfer from VZ to VIAC will work and especially how much it will cost me.

Anybody experience with transferring a VZ 3a portfolio?

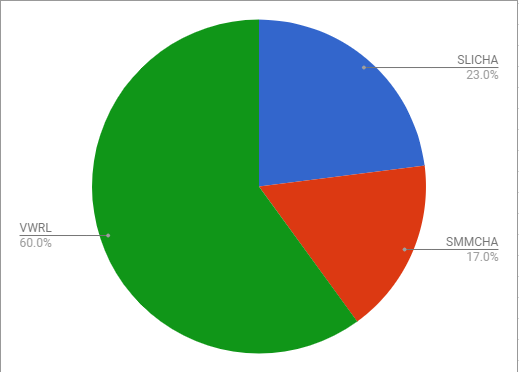

The target allocation (I’ almost there, just a couple of corrections left) of my other assets is this

Here I try to keep it very simple and have an approx. 50/50 balance between Swiss titles and Golbal markets (VWRL has about 8% Switzerland). This is because there is a scenario where I will stay “for ever” in Switzerland and I believe this way I manage the currency risk a bit. (Not completely sure about that though. Any thoughts on that?)

I’m still as swissquote with my portfolio. Also here I know it’s probably second best of the swiss brokers and I’m planning to move. But I need first to investigate the costs and gains of moving.

Is anybody else with swissquote? Has anybody any experience with moving from swissquote?

Anyone has any suggestions / feedback on my portfolio? Investments strategy - buy & hold long term (30+ years), IB-used with deposit of a fixed sum every 2 months for the next 30 years:

VTI - 40%

VBR - 20%

VXUS - 15%

VSS - 15%

VWO - 15%

As non-stock investment in parallel, I am saving cash to buy real estate (and rent it out) in originating country (CHF 150k - rough cost of an apartment with annual returns of about 4.5% from rent & increase in value, net of expenses & taxes)

You might want to scale in on the larger drops in the next few months or even longer, as you might end up buying at the top of the bull market which would be very problematic in the mid-term.