So I updated my portfolio to use Avantis ETFs with a small cap value tilt.

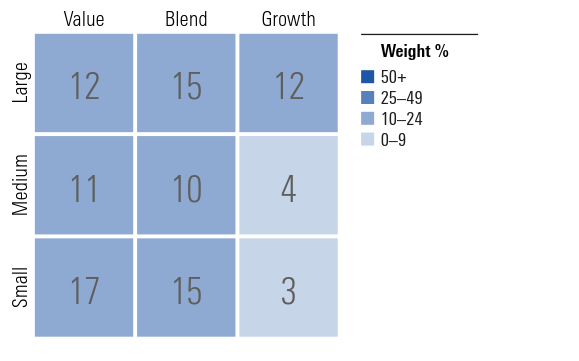

Morningstar style box (VIAC+Finpension is approximated with VT):

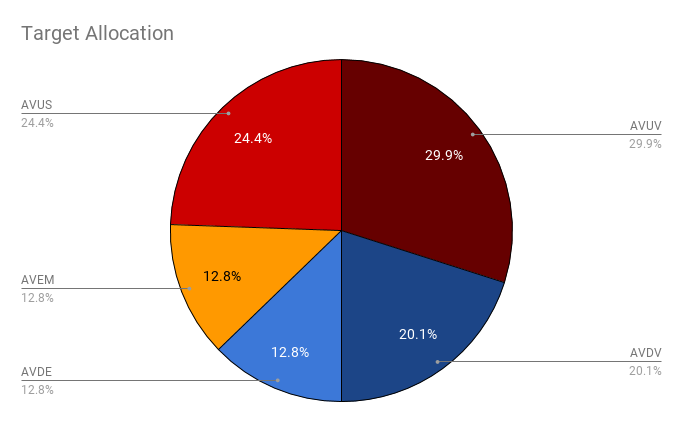

Taxable:

| Ticker | Name | Weight |

|---|---|---|

| AVUS | Avantis U.S. Equity ETF | 24.4% |

| AVUV | Avantis U.S. Small Cap Value ETF | 29.9% |

| AVDE | Avantis International Equity ETF | 12.8% |

| AVDV | Avantis International Small Cap Value ETF | 20.1% |

| AVEM | Avantis Emerging Markets Equity ETF | 12.8% |

Reference is MSCI region weights. Small cap value is 50% of the whole taxable portfolio. Cost is 0.26% per year.

VIAC+Finpension

| Region | Allocation | Fund | Allocation |

|---|---|---|---|

| Switzerland | 22.8% | CSIF SMI | 15.8% |

| CSIF SPI Extra | 5.9% | ||

| CSIF (CH) Equity Switzerland Small & Mid Cap ZB | 0.4% | ||

| CSIF (CH) Equity Switzerland Large Cap Blue ZB | 0.7% | ||

| World | 32.6% | CSIF (CH) III Equity World ex CH Blue - Pension Fund ZB | 28.7% |

| CSIF (CH) III Equity World ex CH Small Cap Blue - Pension Fund DB | 3.9% | ||

| North America | 22.4% | CSIF US - Pension Fund | 21.1% |

| CSIF Canada | 1.3% | ||

| Europe | 7.6% | CSIF Europe ex CH | 7.6% |

| Asia | 4.5% | CSIF Pacific ex Japan | 1.7% |

| CSIF Japan | 2.8% | ||

| Emerging Markets | 10.1% | CSIF (CH) Equity Emerging Markets Blue DB | 4.0% |

| CSIF Emerging Markets | 6.1% | ||

| Total | 100.0% |