My need is a portfolio to rebalance once a year with a perpetual withdrawal rate…

(‘the maximum withdrawal rate that would have ended with the same inflation-adjusted principal as when you started’ Why Your Safe Withdrawal Rate is Probably Wrong – Portfolio Charts)

…of 4% because my only income comes from it.

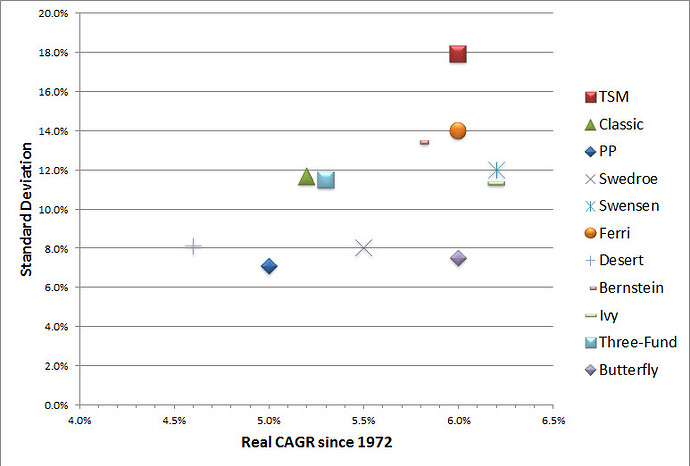

And thanks to you, I discovered Portfoliocharts.com and the Golden Butterfly:

As you can see in the above image it has the highest real CAGR with the smallest standard deviation.

Besides all the above vantages (perpetual portfolio, withdrawal rate) according to Tyler (the guy who created the Portfoliocharts site):

The Golden Butterfly is built as an extension of the Permanent Portfolio.

The basic theory of the Permanent Portfolio is to select assets that do particularly well in the four possible economic conditions. Generally speaking:

Prosperity: stocks

Recession: cash (or commonly short term treasuries)

Inflation: gold

Deflation: long term treasuries

First question: is there anybody in this forum in my situation (yearly rebalancing, no income besides your portfolio, planning to stay in CH for some time)?

If yes, how are you actually invested?

What do you think about the Golden Butterfly?

My thoughts so far:

- it is designed for US investors, Tyler hasn’t yet discussed a ‘Germany version’ of it. Giving the recent Mifid II and the Estate US taxes, I’m inclined to implement it using Ireland/Luxembourg domiciled ETFs corresponding to the ones suggested by Tyler:

20% VTI (USTotal Stock Market)

20% VB (US Small-Cap)

20% VUSUX (US Long Term Government)

20% VFIRX (US Short Term Government)

20% IAU or GLD (physical gold)

But I haven’t found any. They say since Mifid II is recent, new ETFs are going to be issued but till then what?

-

Long Term/Short Term is the Barbell structure, but does the LT portion make sense in raising rates environment? (being a permanent portfolio, one shouldn’t care?)

-

How to hedge the USD/CHF and USD/EUR risk, at least for the bonds portion?

-

As said before, is 80% US market (20% is gold), but if you try to convert it a bit (40%) in International/European market then you can’t reach the appealing statistics of the GB (real CAGR and volatility).

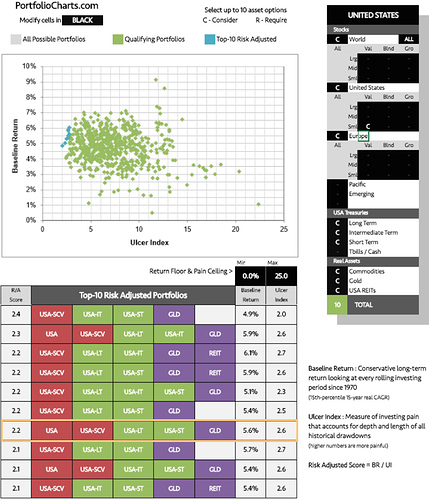

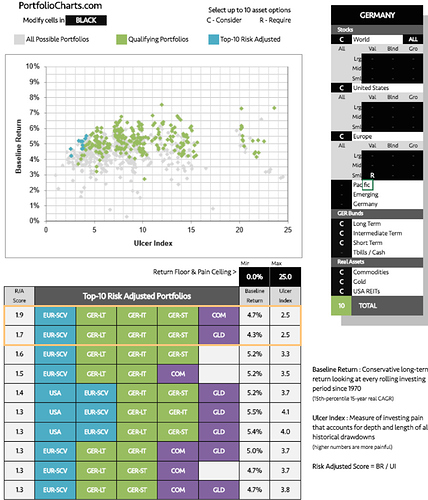

Using the Portfolio Finder:

The orange one is the GB. It’s Ulcer Index (another very important variable for me) is 2.6.

When I select ‘Germany’ and ask for a ‘Return Floor’ of min. 5.6% and an ‘Ulcer Index’ max. 2.6, there are no portfolios (considering World, US and Europe stocks).

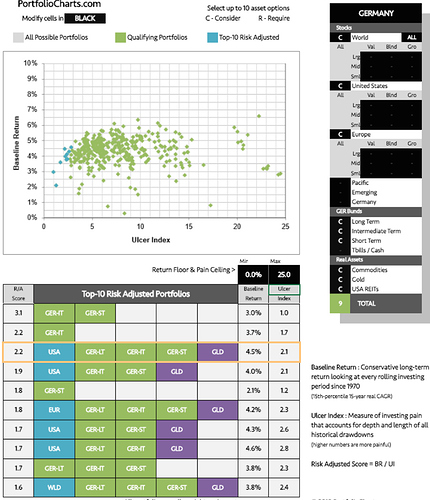

When I give no restrains i get this:

Where the Portfolio outlined in orange is the best approximation of the GB. So I should let go of 20% stocks.

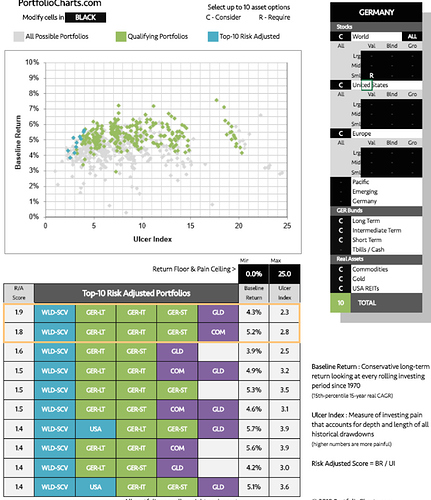

If I request World Small Cap Value (SCV is a distinctive characteristic of the GB):

either I give up the max Ulcer Index of 2.6 and I have Baseline Return of 5.2%, Commodities instead of Gold, 20% stocks instead of 40%, or I stay under 2.6 Ulcer Index, then: 4.3 Baseline Return, again 20% less stocks.

Finally, if I request Europe Small Cap Value:

This is the glass of water in which I’m lost…