I used both valuu.ch and key4.ch, that I would call “brokers” rather than “comparison”.

After entering quite a lot of details about the project (location, size, price, target mortgage,…) and my financial situation (revenue and assets), I received real offers from un-named cantonal banks, pension funds or others; when following-up on an offer, the name of the provider is disclosed.

The service is free and non-binding,

I personally did not follow-up on any of the offers, but it was a very useful reference to discuss mortgage renewal with my current provider.

I just did the calculation on key4 for my case and the fixed 10years is 2.57% and the Saron is 0.83%

I have a screenshot of Aug 2021 and Saron was 0.65%

I used Hypotheke.ch as they have quite a good comparison tool which also let’s you play around with equity % and additional securites. I also like their no BS business model of just paying 119.- once.

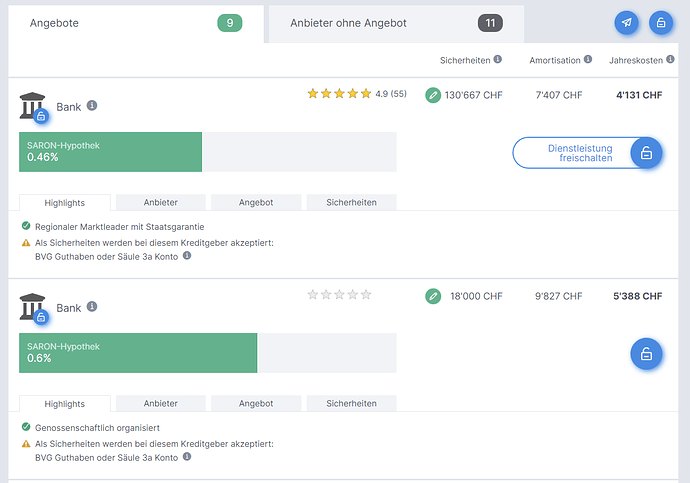

One tip if you are looking at Saron: if you drop below 66% LTV (loan to value) this will most likely unlock better SARON offers, as the banks have to post lower collateral to their books according to FINMA regulation. For example, I got a 0.46% Saron offer on Hypotheke.ch today with 66%, and 0.6% Saron with 67% LTV.

so would anyone still choose SARON, knowing well that the 10-yr-fix is expensive because that’s probably what the SARON will be converging to?

Yes, I just did.

My LTV is below 60%, and I have other assets that I could use to reduce the mortgage. So I have a plan in case the interest rate rises to a very unpleasant level, and in the mean time I enjoy the low monthly charges.

Of course I don’t know how the future will look like, but it may take years for SARON to increase significantly.

yes I would. right now, SARON is hell of a lot cheaper than a 10 yr fix (currently 0% + margin, e.g. 0.6%, versus ~2.5-2.8% for a 10Y fixed). The risk premium you pay for fixed mortgages ist extremly high right now. The reason for this is mostly based on a conservative risk model that the banks run, where they price further interest hikes in.

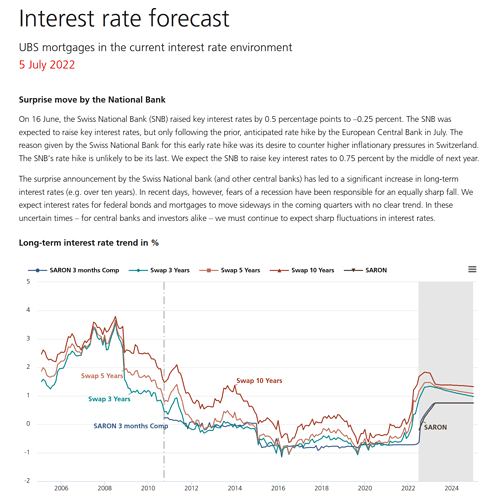

Even if SNB would rise their rate from -0.25% to let’s say 1.5% over the next 12 months, you would still pay less with a SARON (2.1% total). I would consider a rise over 1.5% unlikely and if so, temporary (UBS predicts 0.75% SARON till 2024).

The first increase happened suddenly.

UBS analysts said the 7th of June “0.25 increase in Sept 2022”, then the 16th of June was raised 0.5%

I think that right now it’s not a real good time to buy a house.

Price are still in a bubble and not crashed yet, and the rates did a massive jump compare to 2020 or 2021

I never understood people that buy something, but are not covered enough.

It’s like to play in Texas holdem the 100 bucks entry with 150 in your wallet ![]()

There was a long discussion regarding buying vs rent.

Anyway buy a house in 2010 (after the crash), even with a high interest rate, right now you were been seated on pretty good profit, but there are variables like: this is based on hindsight, would you sell and go with rent now, the age you have, your goals, etc

Maybe an alternative way to look at it could be:

What’s the likelihood that the SARON rate could reach incrementally 5-6% over the coming 10 years - so it turns out to be a worse deal over the period (than a fixed 2.5-3%).

Not 100% mathematically precise, but a good thought exercise. ![]()

There is a valuation that makes sense at 1% and another valuation that makes sense at 3%

A bad outcome be paying the 1% price and an interest rate of 3%

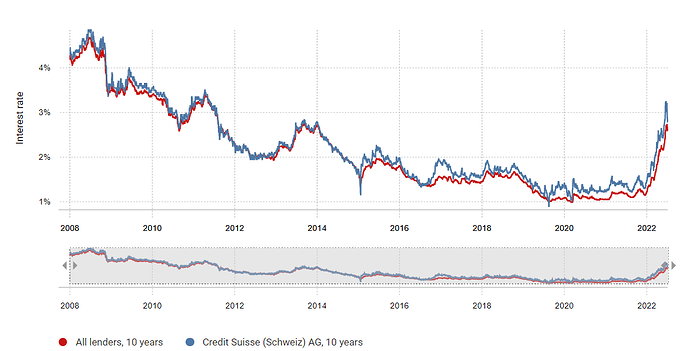

On the other hand it looks like 10 year rates have cooled slightly

Where can I get this graph?

I generated this specific chart from the “Lender” tab

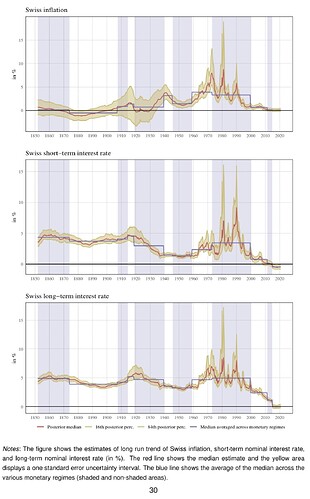

For a very long term view of the past, see the graph below copied from a publication by SECO.

I find it interesting that the distant past still has some relevance today: banks generally calculate mortgage affordability using a 5% « historical interest rate », that corresponds well to the rates seen in 1850-2000, except during the wild period of 1970-1992.

100%. 10yr fix is not what saron is converging and if it does how many years will pass.

I did my 10 years fix rate 8 years ago at almost 2% instead of 1% so mainly I have double in all that years.

but what was the average price increase of the houses in your area?

Almost double the price.

The small tranches got renewed in less than 1% so it is quite nice and in addition as the reevaluation I only pay the minimum amortization.

Let’s see where we are when I need to renew all in 2 years :S

So UBS “expects the rate to move sideways for years”, but at the same time “we should expect sharp fluctuations”… so basically they are saying that they don’t have a f’in clue. Expert-talk ![]()

I guess so, because the last forecast was 0.25 before September, but it’s the only thing we have

As recent hikes have shown, this doesn’t have to be like that. We might end up with very high interest rates due to high inflation.