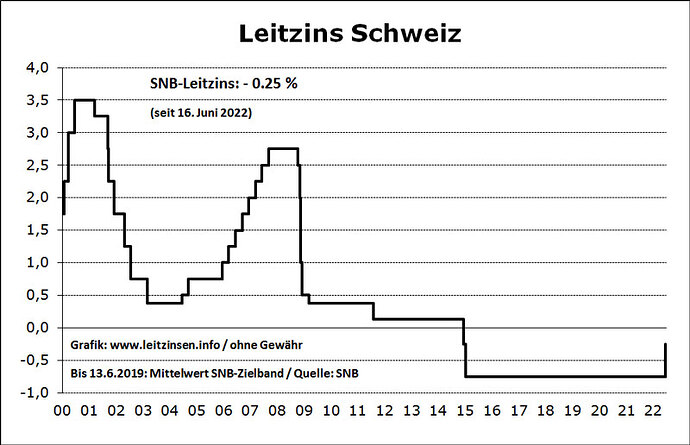

I think this will be temporary:

Last 20 years (especially last 10 years) were quite unusual compared to the rest of the century. But I obviously don’t have a glass ball and wouldn’t bet on how the next decades will look.

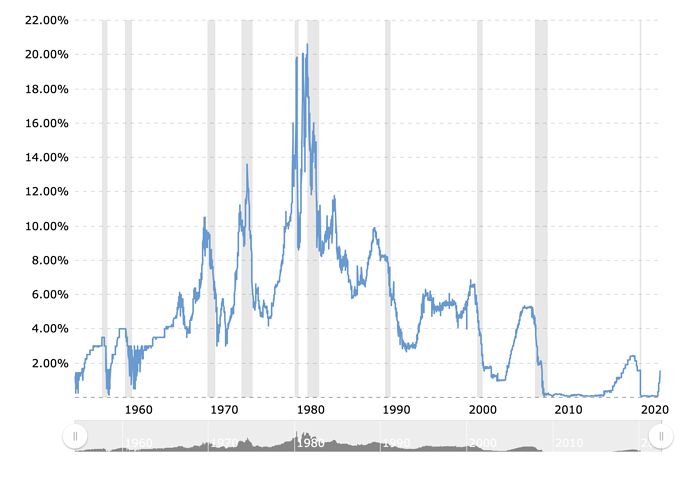

Compare with US long-term:

again a reality check on what’s going on around us

Czech base rate: 7.00% (used to be 0.25% until Nov 2020)

Poland base rate 6.00% (used to be 0.10% until Oct 2021)

Hungary base rate 9.75% (used to be 0.60% until June 2021)

USA base rate 1.5% (used to be 0.00% until March 2022)

There is really only one way this could go…

Not sure what you mean. Why did you pick exactly those 4 countries?

cause I can’t pick the ECB as they are still silent. ![]()

Eastern-EU is already f*cked, Southern-EU is protected by the Eurozone, I should’ve maybe added Turkey for contrast ![]()

20years turned out to be not even 1yr

Perfect example on how fast things can change lol.

SARON may save you money long term, because with fixed rate you buy certainty. For some reason, banks in Poland didn’t even offer fix rate until recently, and even now you can only get it for 5 years. I think fixing the interest rate under 1% for 15 years was a great deal, because how much lower can SARON get? What is the savings potential if you go with it? Now this option is gone and I wonder how long it will take until it’s again on the table. Personally, I wouldn’t take a bet worth 1 million CHF, on the future level of the interest rate.

Well if I bought the apartment 1 year ago and had to chose between 0.50% Saron and 1.00%, I would have gone with Saron. On a 700k mortgage that’s still a 3.5k/year difference.

Sidenote: For every increase of Saron by 1%, our interest increases by 7k/year. After taxes it’s only CHF 220 per month per person. So even a Saron rate of 2% wouldn’t kill me.

and soon you would be very unhappy with it. ![]()

Why? I won’t try to time the market and assume I know the future interest rates.

Just released new CPI: 9.1%

https://www.wsj.com/livecoverage/stock-market-news-inflation-consumer-price-index-june-2022

It’s not about a bet “if you know the interest rates in the future”, but with one you buy certainty that you can pay down the full amorization by the time the 10yr runs out, with the other, you don’t. And most probably it’s your own home, which is (warning: rich dad poor dad quote coming) not an investment, but a liability.

Future interest rates can only go one way from here, really.

If the ECB raises rates, soon the SNB will be out of negative territory as well, which WILL raise SARON for the medium term as well.

Nobody does this in CH, AFAIK.

Like I said: I look at it long-term. I’ll probably own RE till my death in ~50-60 years. Over that time I’m almost garantueed to pay the least interest with Saron. Higher risk, higher reward.

I expect SNB to rise their interest rate to 0.75% in the next 6-9 months. So CHF 700 per month in interest for us. Any further increase by 0.50% of the SNB will increase our interest by CHF 292 before taxes and CHF 218 after taxes.

I’ll be happy if SNB stays below 2.00% longterm.

Sorry I didn’t put it properly.

Full amortization I mean 15% of purchase price (down to 65%) then you just let it tick forever.

This sounds more like a “TWTR bet”, compare to the usual “play safe VT” move ![]()

I would never like to risk insolvency. Let’s consider a case like this:

You buy a house for 1’500k. 300k is your own capital and 1’200k is the loan. Current interest rate is 1%. So you pay 1k per month or 12k per year of interest.

Your Tragbarkeit is calculated at 5%, so that means 60k plus 10k maintenance, that’s 70k. Multiply that by x3, so you and your partner are earning together at least 210k.

Now interest rates do go up to 5%, you lose your job, you can’t afford to keep paying 60k per year. So you want to sell the house, but the max offer is 1’000k. I guess in Switzerland you can just hand in the keys to your flat and walk away, right? Or is it not that simple?

I guess what also could save you in such a case is inflation. If prices go up, and you don’t lose your job, your salary might also go up, so you might afford the interest after all. And after things have settled down, the nominal price of the flat will probably also be higher.

And how is a fixed-rate mortgage protecting you from all that? Eventually it runs out, then?

Me personally I don’t know any high earners that don’t go with Saron.

There is no real answer because we need to wait 10+ years to see how it will play out, then the calculation will be easy.

I just see at the moment a stagflation scenario, but also this one is a bet.

You are right, after 10 years of fixed rate, you need to take another decision based on the possible future scenarios, and it won’t be easy.