Thanks for the tip. I am going to try that, see if the bank accepts…

Does your point still stand (in every case) if we take opportunity cost and risk aversion into account?

If you have a fixed mortgage, you can invest more money in illiquid assets because there isn’t the chance that the mortgage rate will increase so heavily that you need to access your assets. If SARON means you leave more money in lower returning funds, this might shift the npv to the fixed mortgage.

Also generally you might be able to “sleep better” if you know that repayment isn’t an issue, doesn’t depend so much on market developments or decisions by national banks. Couldn’t it be rational for some people to value fixed mortgages more than SARON because of this?

Do you think it’s still the case?

Nothing changed. Saron might (and probably will sometime in the future) go to 2-4%. As stocks might crash by 50%. You have to look at the longterm picture.

I see it a bit different, but I get the analogy.

From my point of view, with stocks I can accumulate cash now and start DCA at one point on the way down and anyway we are talking about a “small” amount of money , while with the mortgage is way more difficult to do something similar and also global recession is coming so rates will stay high for a while.

In the long term I don’t see that rates like 2020 or 2021 are possible for the long term.

In EU the inflation is more than 8% and they are going to do the same as the FED did.

CH is not on another planet, so somehow we will be affected

I guess we can resume this discussion in some years ![]()

How do you know that? ![]()

It’s not me of course, that I know nothing (like John Snow).

Just putting pieces together from the major economists/fund managers.

The present conditions are pretty bad if you think about the highest inflation since 40 years, a major war, several viruses, supply chain issue, decreasing demand, energy problems, food crisis, and not sure if keep going :]

Hey, I know I should probably know this but I don’t ![]()

How does this change the SARON rates? We were thinking of a full SARON mortgage since we can manage fluctuation and seemed to be the right thing in this environment. Is this the right thinking? (Sorry for the very naïve question, still new to all of this!)

It depends on your risk management with a pretty big amount of money and where you see the economy in the next 5+ years.

Risk management is the key word indeed. I would also look at the spread between the two options. I still have 5 years until my renewal but if I would need to do it right now I would also do a SARON mortgage. But it’s always easier as long as it’s hypothetical ![]() it does need some balls

it does need some balls

Thanks a lot for your answers. The risk seems manageable considering the alternative fixed rates at the moment, but of course that could be biased thinking and a (very expensive) mistake.

From the methodological part, is SARON affected directly by the general interest rate? Or other factors in play may keep it at another level? I cannot seem to find the exact relationship.

Just short rates.

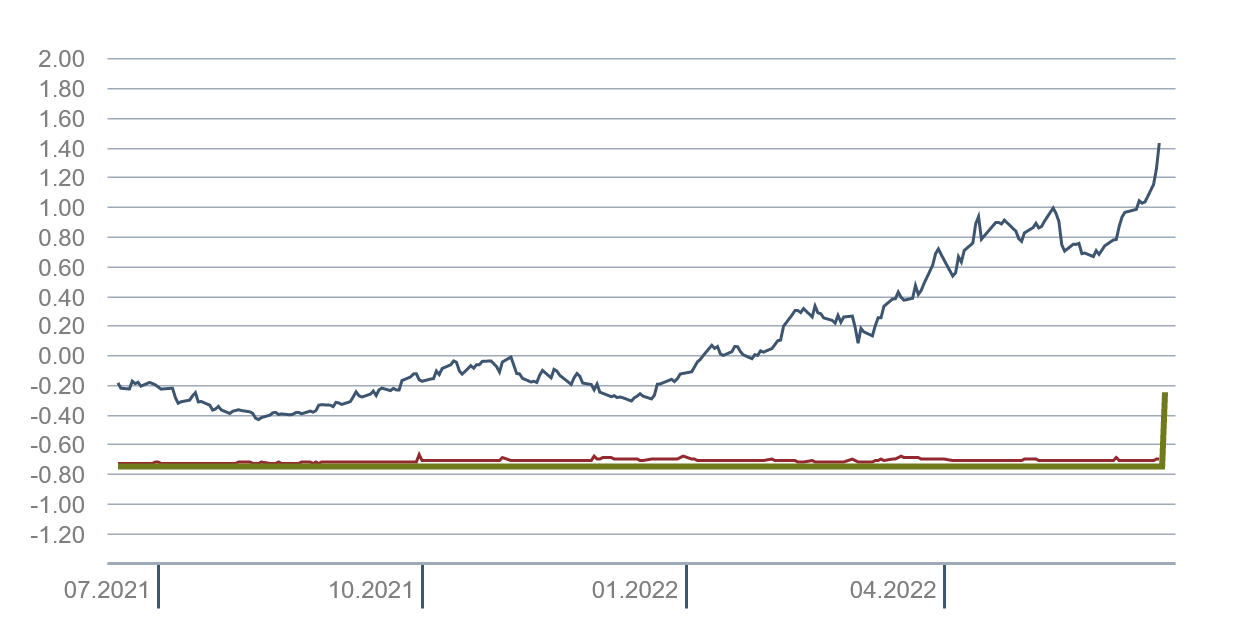

My simplified understanding is that SARON is a 30-day moving average of overnight interbank interest rate, which is itself strongly linked to the SNB Policy Rate (the rate that just went up from -0.75 to -0.25).

Mortgages based on SARON are generally at an effective rate equal to « customer margin » + max(0; SARON). So, as long as SARON remains below 0, the effective rate is the customer margin.

It would take another increase of at least 0.25% from the SNB to start changing the effective rate of SARON mortgages.

As with every decision you can make a mistake. I regretted for long time my 50% of the mortgage that I did for 10y fix for 1.23% but at the end it’s just money and I did not felt ready back in the day to go all into Libor

Does this mean that you can still get 0.6% nowadays?

About 3 months ago I entered my data in an online comparison service, and the best proposal for my case was below 0.6%.

Today, my account on this platform still shows the two best potential offers at 0.58 and 0.62%. I don’t know if it is “unchanged data from 3 months ago”, or if the system is smart enough to provide updated values automatically.

I’m tempted to say that the customer-specific margin should not really depend on the SNB Policy rate. So, a case as solid today as 3 months ago should get the same customer margin.

SARON is very closely linked to the SNB rate. However, banks use SARON but at least 0. So as long as both are below 0, an increase has no effect on your rates. Once SARON goes above 0, you should see any further increase directly.

We got offered 0.5% but only if we move our bank account, 3a, portfolio etc. Next best offer was 0.6%.

I’m fine with the bank account but want to keep my shares where they are. Anyone got 0.5% or better but managed to exclude his shares?

Yes, this is equivalent to my previous comment that :

“Mortgages based on SARON are generally at an effective rate equal to « customer margin » + max(0; SARON). So, as long as SARON remains below 0, the effective rate is the customer margin.”

Your two offers at 0.5 and 0.6% illustrate nicely that customer margin does not only depend on the mortgage and risk calculations, but also on the rest of the relationship between client and provider.

Which comparison website did you use?