Let’s say that it’s less certain than some months ago mainly because of the uncertainty w.r.t inflation abroad. Also to consider is the behaviour of CHF vs EUR which decreased recently and could add some inflationary pressure inland if that continues.

According to my basic analysis of the 1y swap rate and 3M bond yield there is 50% chance of a 25bps cut on next meeting.

Volatility on CH bonds and IRS is huge since a few weeks!

UBS now sees it 50-50 for this week’s decision but still expects a decrease in SNB rate to 0.25 by end of June latest

This thread has been helpful.

The remaining mortgage my wife and I have left is 60% of the value of our house. That 60%:

- 50% = 10 year fixed and half of that 50% is being amortized over 5 years

- 25% = SARON flex

- 25% = SARON flex

The first SARON flex, we want to keep as we like having flexibility to pay down mortgage early

The second SARON flex, we’re considering switching to 3-5 year fixed. SOmething i’ll look at end of March in case the rates drop as expected.

The markup we currently have on SARON is 0.7% which realistically is too high considering the low risk for UBS so that will also be part of the discussion.

depends on where you get the news from. Money markets give a 72% chance of a 0.25% rate reduction this week.

Well it’s another 25 bp cut ![]() inflation expectation numbers for 2025 were cut again, however increased for 2026.

inflation expectation numbers for 2025 were cut again, however increased for 2026.

We’ll sign our SARON mortgage contract on Monday ![]()

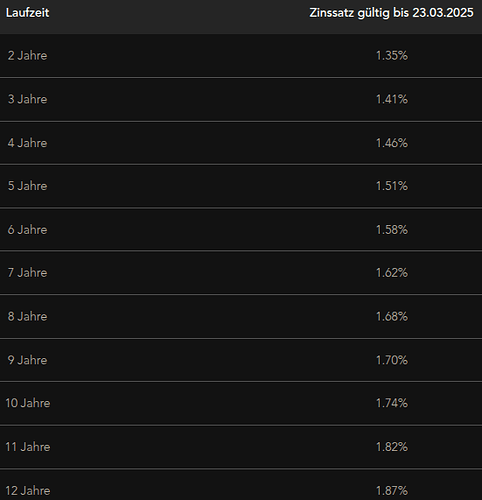

10 year rates are now up to 1.74%:

I’ll be curious to see next week whether the rate cut impacts this, but given that this was expected, I’m guessing it will not.

Probably because I converted USD->CHF last night ![]()

It seems it’s about 1% markup on 10 year SNB bond yield …is this standard markup or banks have increased their markups these days.?

I’m not sure how probable it is to get a SARON much lower than 0.65% now…

i just googled and found this place:

Saron Margin from 0.48 %

but no idea what that company is and what the terms would be to get that, or if it’s mostly just a marketing thing…

a lot of the rate brokers are showing 0.73-0.75% margin so it seems lenders keep padding the margin the last while…

Does anyone know anything different? Is 0.65% and below still obtainable?

The latter. As any good business does with any price change, banks used the end of the zero/negative interest phase, and the market disruptions from UBS devouring CS to increase their margins. And, unfortunately, it seems they play to repeat it once more as we trend back towards zero interest rates.

AFAIK only on LTV <60%, high affordability, and with promotional offers (new customer, first time buyer, high MINERGIE standard, whatever).

Basel III probably had a pretty big impact as well. At the very least it gave them a good excuse, not sure about the actual impact on the banks themselves.

Yes I think Basel III did also have an impact. Wanted to find out if its quantifiable how it affects different banks and found this article (in german) «Basel III final» – Chancen im Kreditgeschäft nutzen oder verpassen? - Orbit36

In essence, large banks like UBS, ZKB, Raiffeisen use their own credit risk models (probably because they have the resources), which means that low credit risks have a lower weight and therefore need less capital (especially for first rate mortgages). Banks that don’t have their own models use the standard approach with higher weightings and more capital. Basel III requires that all banks need to have a certain % of this standard approach, with larger banks having to now hold more equity and somewhat reducing the advantage of having their own model.

The article estimates that the changes lead to an increase of 0.15-0.2% increase in cost for first rate mortgages of large banks. Smaller banks could benefit from this new regulation as they are not affected as much or at all.

That would be unfortunate. I was hoping to switch my Saron to a 5 year fixed rate at a rate similar to my Saron prior to the cut. I’ll still give it a try by arguing that since originally getting our mortgage we have paid down a lot thus risk for the bank has reduced.

It seems to match my (very cursory) monitoring of rates. For instance Migros Bank SARON margin went from 0.8% to 1.0% between late last year and early this year.

Fixed rate mortgages reached their lowest point 2.5-3 months ago. There were offers around 1.1% for 5-10 years. Now it‘s closer to 1.3-1.5% again.

I’m glad I fixed mine towards the end of last year. I don’t need to worry about it for another 10 years ![]()