I thought 3 months is common. Or at least I got that.

3 months is ideal, but it seems it’s not that common as of Jan. 2025. I got offers with minimum 3 years lock in period. I think even Viac has a lock in period of 3 years.

It used to be normal, but it seems that lenders are trying to lock in borrowers now.

According to my experience only cantonal banks and UBS still offer it + Migros with a 6 months lock in

They want to lock you in longer because margins have increased a lot and they want to milk you as long as possible in case the market reverses…

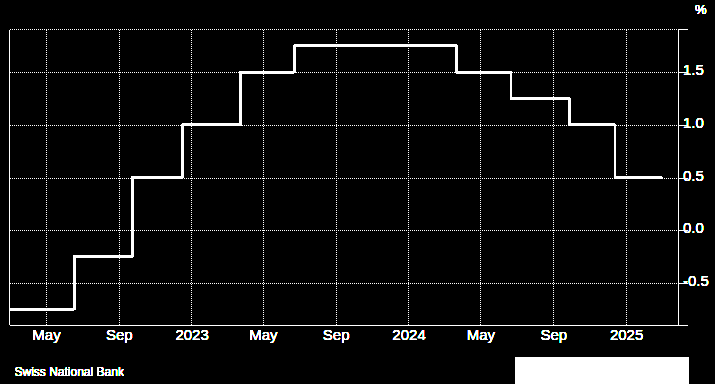

Update as of March 2025: the key4 SARON margin is now 0.94%

Not sure if this is because of the demise of Credit Suisse or other factors (someone mentioned Basel III regulations in another post), but it’s not going in the borrower’s favor.

Comparatively, you can get a 5Y fixed at 1.21%, so not sure that SARON is really interesting anymore. With SNB rate at 0.5%, probably going to 0.25% soon, that would mean that SARON is still 0.94+0.25=1.19%, really close to that 5 year fixed rate!

Well, the maximum upside is with SNB rate at zero, so you pay 0.94% while that lasts. Versus a 10 year mortgage at, say, 1.54%, you have a 0.6% advantage.

However, the maximum downside is technically unlimited, but with rates at, say, 4.54%, you would be at a 3% disadvantage.

Does it look like it might go to zero soon?

Just checked, had 1.05% bank margin! I suppose I do not fulfill the income requirements as I don’t work since 11 years. Anyhow, I asked the bank for a better offer as I could pay that back whenever I want. But margin loans are more expensive and the actual carry premium for my dividend portfolio is at 4.34%. That cashflow can only go up with “market dividends”, last year it was 6.08% and the year before 11%. The formula for carry premium is dividends + market dividends - tax - margin interest. So it is the net income with tax already deducted but I still can deduct the tax partially in Switzerland.

But anyhow, 1.05% bank margin is way too much. The land alone is worth 3-5 times the mortgage, so even if I violate the income rule they should offer me better terms.

0.25% in 2 weeks for sure.

Bank tried to call me, but I am out of Switzerland at the moment. Told them to provide me a written offer!

Just checked IBs margin rate: is actually cheaper than my mortgage rate. And of course more flexible. As I have portfolio margin with a theoretical margin multiplier of 800% I could easily switch.

So there is a sweet spot to lock in a good mortgage rate at end of march? ![]() That’s when we plan to lock one in

That’s when we plan to lock one in ![]()

Isn’t the margin now 1.5% for under 90’000 and 1% for everything under 900’000 CHF ? That would be still more expensive than most of the offers I see online (I might be wrong here). But still, your bank margin of 1.05% does not seem too high (or you have a much higher balance than I can imagine - margin between 900 kCHF and 46 MCHF being 0.75 %).

Everything is already priced in and it’s difficult to say what the market conditions will be in 2 weeks with the orange guy in the WH. On the other hand if the SNB doesn’t lower we can expect an increase of IRS rates.

I asked in the other topic: Anyone knows why rates are picking up so quickly? +0.4% in 1 month or sonfor fixed 10 years. And why it went down in January?

With the expected reduction from SNB next week, would they to back down, or not, since it “priced in”? If the SNB would not reduce, will it go upwards even more suddenly? Nobody knows, but what do the experts here think?

Also, a month ago the UBS predicted a sharp increase and decrease in January. Now they moved it to March, but don’t mention the January dip anymore. They don’t seem to really knows as they keep moving it. LZKB predicts that rates will just keep increasing steadily, with no dips or peaks. So far they both seem to be wrong.

Time and again I need to remember myself that these predictions are just plain shite, just there to appease the lenders confirmation bias.

The rate went up in February because of 2 things:

- Tariffs in the US will create inflation

- The EU / Germany are going on a military spending spree which will require a lot of debt to be issued thereby increasing rates on EU bonds

If rates outside of CH increase well by ripple effect they also tend to increase in CH. If the SNB was not to decrease its rate next week then there’s a high chance that short term SWAP maturities rates will increase. On the long term ones what matters more is the outlook and what they will say about inflation in CH in their decision announcement. As usual no one knows for sure what is going to happen, especially in this context where one day the guy in WH says 25% tariffs on Canada and the day after they are cancelled.

Ok, then I’m thinking to take a 2-3 years fixed and take it from there.

To be honest there’s no real difference in terms of risk between a 2/3 year fix and a SARON, unless of course you get a really high margin on the SARON which makes it more expensive than the 2/3 year.

Great insight, thanks. So outlook seems that they are not going to decrease in the next months?