Is a 0.25% decrease realistic for 10y now? Or is it priced in and no movement at all is to be expected?

Hi @Kilbim

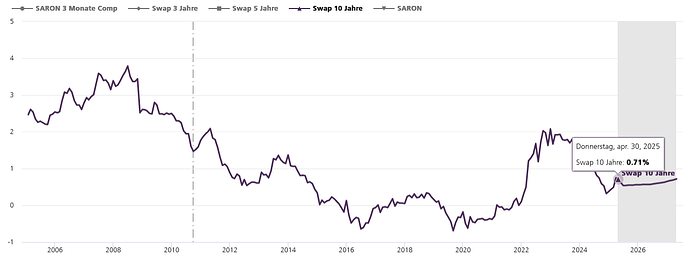

10y fixed mortgages are derived from swap rates + lender margin.

https://zkb-finance.mdgms.com/home/bonds/index.html

as @Cortana mentioned, the 10year fixed bottomed in December.

There seems to be little movement on the 10y over the past 24 hours.

If anything happens, does it usually happens immediately, or does it takes a few days? My bank reduced the 10y by -0.05%.

Also, can someone explain me this fucking graphic from UBS? Is the drop they predict from now to June realistic? They had this peak-and-drop in their graph since December (although they keep moving it). Looking at this graphic in December/January basically fucked me, if the drop is not happening

Source: https://www.ubs.com/ch/de/services/mortgages-and-financing/mortgages/interest-rates.html#interest-rate-forecast

I just remember UBS putting out charts showing interest rates rising and suggesting you fix all the way from 2011 to 2016, so I wouldn’t really make any decisions based on what they put out.

Yeah their interest rates forcasts are garbage.

I mean, this forecast seems to suggest they are decreasing a bit then increase again..

Wish I had knew this earlier ![]()

That’s their forecast but what would actually happen is only known to SNB . Maybe you should check forecast from multiple banks to get a view of average forecast

You should see it similar to Fed funds rate prediction. They are never right but that’s not the purpose. They are just used to show market perception

Don’t trust anyone’s chart, UBS is generally always wrong anyway. Their guesses are as good as ours.

Every day Mr. Market says “do you want a fixed at this price?” and then it’s up to you if it makes sense with your situation

And yet you are reading this thread ![]()

Indeed, my generosity knows no bounds! ![]()

If UBS, or anyone else for that matter, knew the exact path of those rates, they could and would trade and lever it accordingly and make gazillions. No need to run a measly mortgage business in that case. So yeah, they are just wild guesses with as much value as yours or mine.

Wild guesses and marketing.

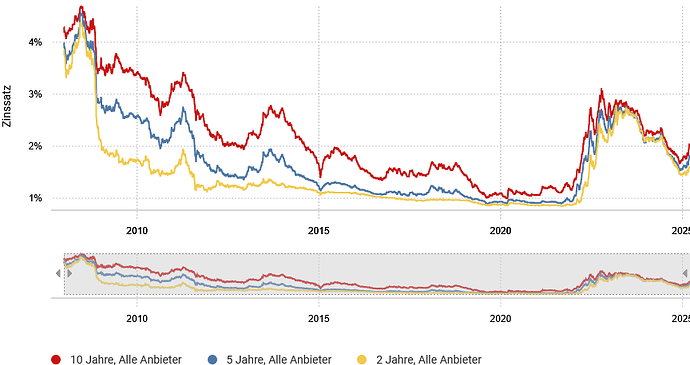

If I look at historical (advertised?) mortgage rates on Comparis they never went much below 1% (I see 0.85%):

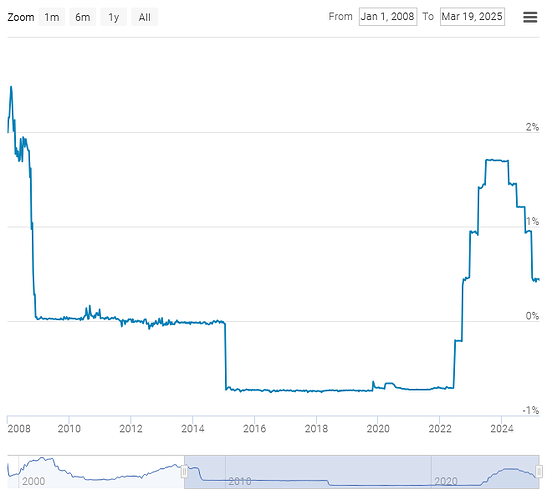

The SARON was around -0.75% though, as visible on global-rates.com. (I know the relevant metric was LIBOR before, but it should be similar enough).

Today, banks seem to bottom cap the SARON mortgage to 0% + margin. What do you think is the right move here? Get a SARON mortgage and convert to fixed once it can’t move further down?

That’s my plan, staying on SARON for now as the fixed are almost twice the price for 10year. UBS is playing games with their rates, they won’t be able to continue doing that when the SNB moves the rates to 0% in June. Anything at or below 1% is great for 10y fixed, right now SARON is 0.43%+margin so why fix?

I think this was always the case

Didn’t they just reduce the SNB rate to 0.25?

That‘s not how it works at all. Check the swap rates.

Both correct and that is the only reason why a margin credit at IB at the moment is cheaper than a SARON mortgage. Banks use a medium interest for SARON, so it is higher when interest goes down and should be lower when interest goes up. IB uses the day interest.