Alright. I asked because i know that at my place some friend of mine negotiated the price down. For example from 1.7% to 1.5%. Now i‘m starting at that bank and was curious if i can get the 0.5% discount (they have this offer) on a negotiated interest. So that would mean i would get 1% and if i leave 1.5%, instead of 1.2% interest by applying 0.5% on the current rate. So when i leave my company, i would have a less attractive rate than my friend who negotiated it initially.

not sure if it was already mentioned but I think in any case it is worth repeating, what makes the application excellent?

would be interesting for me as well - I noticed that if you need construction financing (in my case a renovation) the rates seem to be higher, or not all lenders are interested, even if you bring >33% hard cash. I’m sure there’s some other factors?

It’s rather straightforward:

- your affordability ratio is below 33 %

- you have wealth on the side

- you have savings habit

- you have long history with the bank and no incident

The less risk the better. Each bank will implement its own pricing policy but those criteria are always important. Of course if you know the relationship manager or the branch manager well they have some flexibility to override pricing rules…

7 posts were merged into an existing topic: Your experience with Mortgage Brokers (First mortgage, Hypoplus, moneypark)

some thoughts on the BNS rate development in coming months

https://www.investing.com/news/stock-market-news/how-low-can-the-swiss-national-bank-go-3606201

They have currently other priorities and do not have volume goals this year.

Males sense to sort things out firstly with the CS books. Can be in 1-2 years different again; the last two years UBS was very competitive.

I believe this is the issue of being the largest. Having largest deposits, they have funds to have highest share of loans. So even if they are not competitive, most likely people need to take loans from them or else there wouldn’t be enough liquidity

Fall of CS is not good for Swiss residents

Having said that everything is a relative comparison. Most likely cantonal banks will be best competition in various Cantons and hopefully keep market in balance

Not so sure about that - at least for the forseeable future; their books are filled with new clients and NNA. They don’t have to fight anymore for a case, either you take their offer or you can leave. Nevertheless I agree with you; there are some banks - smaller ones - who are still offering very agressively.

This “lazyness” I see especially with ZKB (can’t blame them). How the situation looks in the Romandie, I do not know.

interesting article, thanks. Some thoughts:

Concurrently, the Employment PMI suggests that the labor market is softening, with unemployment expected to rise.

Anecdotally, the job market is indeed quite soft at the moment. I have two friends wo have been laid off and are currently looking for IT jobs, both very senior/experienced, and are struggeling.

The market is expecting the SNB to lower interest rates to about 0.5% by mid-2025. However, some experts believe this expectation might be too conservative. If inflation keeps falling, the SNB could be forced to cut interest rates even more, possibly all the way to zero. This would mean a real interest rate of -0.5%, considering inflation could drop to 0.5%.

this is a bit different to what the Swiss banks are publishing as their outlook - most predict a drop to 1.0% interest rate by the SNB by end of year and then flat from there. Ar you guys thinking there is a realistic chance we’ll be looking at 0% rates again?

strong Franc might push SNB to push down rates further. Current levels are hurting the local industry.

BCV was pretty clear to me they were looking at margins now, and not at volumes. If anything, they had more demands than what they were looking for. Other banks had the same discourse: demand is really high right now, but appetite from the banks is low.

Indeed because big players like UBS and Raiffeisen have turned off the tap since CS is gone.

IRS prices SNB rate at 0,75% buy the end of year and maybe even 0,5% next year but UBS keep saying Saron will be at 1% for the coming year.

Is it just to sell us fixed mortgages or they really believe what they say?

Of course UBS wants to sell more fixed mortgages at higher rates.

They will not straight up lie and say rates will go higher, as nobody would believe that.

But they have every incentive to say they stay higher. Also not by much, they surely retain some credibility. But 25 basis points go a long way at their volume.

Otherwise people could get the incentive to wait it out.

I would expect them to slightly nudge the number in their favor.

Just look at the swiss bond yield curve to get the market expectation in what‘s going to happen in a year.

No need for banks to tell it to you.

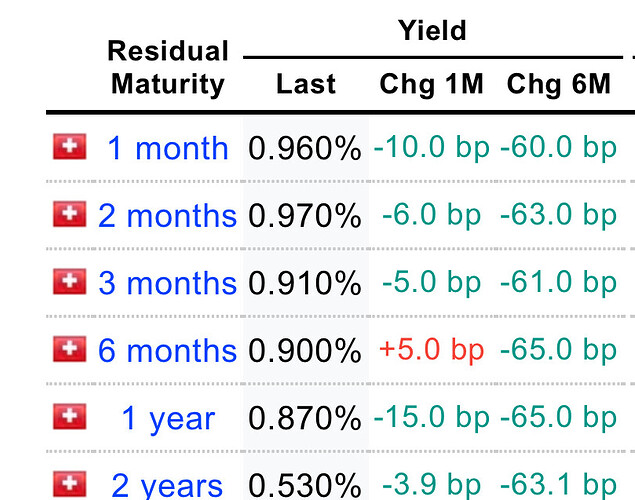

Can you explain a bond newbie how to read the yield curve and what the market expects in a year? It is inverted so the market expects lower rates in future. But by how much?

I did, and what confuses me is, why would anyone buy a bond today? The interest is lower than on my savings account.

Because bond interest is fixed for a longer duration while savings account is not.

Savings account interest should be compared to 1 Month bond yields at max because most likely banks give a month notice perhaps before changing rates.

Some reading material

Link

Agree, but I get 1% now, vs. 0.96 with a bond (1 month). And why would it be completely different in 2 years… Only reason I see is if you need exactly X amount of money in 3 years and you get there with a bond + you don’t want the risk of lower interest. IMO only makes sense when lots (e.g. 50k+) of money is involved.

Edit:

Thanks, will watch it before asking more questions ![]()

![]()

It’s roughly an expectation of the market for the average yield of the short term rate over the maturity time of the bond.

1 year at 0.870% would mean the average short term rate is 0.870% over the course of a year. Starting today at 1% (market already has a high expectation that SNB will cut the rate next meeting) will mean it’s gonna be at something like 0.75% in a year by market expectation

it’s more applicable to shorter terms of a few years.

There’s way more to it and I’m also not a total expert on the topic, but it tells you quite a bit about market’s expectation of the short term rate over teh next few years.

A swiss government bond is one of the safest investments on the planet. Your bank has more risk.

And starting next SNB meeting end of the month short term rate will be 1% also (basically guranteed, would be very unexpected if teh dont lower rates). The 1 month bond reflects that roughly, minus the absolute safeness of a swiss bond.