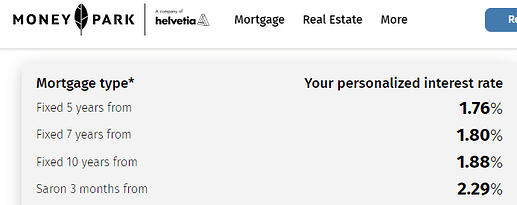

I am examining the prevailing mortgage interest rates. According to Money Park, SARON appears to be the more expensive option at the moment. I had always assumed that SARON would be the cheapest option. Could someone clarify why currently the fixed-term rates are lower? @Cortana ?

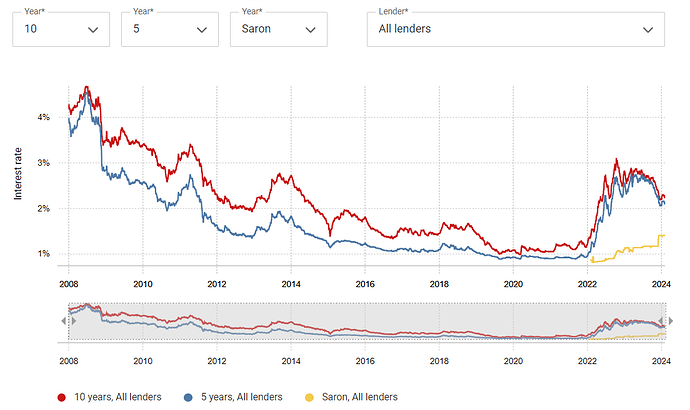

Depends on the interest rate curve; this can obviously change based on the market.

Swap rates are pricing in a decreasing Saron rate, therefore, fixed mortgages are lower (for the moment).

Personally I think it’s rather meaningless to compare rates for different durations. Instead, you can try to compare them with “free market” interbank rates to determine the markup in each case.

Here I have started to sum up the sources for the latter:

P.S. another reference I use is the best interest rate of savings account (duration equivalent of SARON) and of medium term notes (usually Cembra), which are duration equivalents of fixed term mortgages. These are the best rates that you can earn as an individual investor.

P.P.S. My first impression from these data after I made a quick comparison once, is that for durations longer than 5-6 years, the markup really goes up.

I feel that people were really missing the woods for the trees in this thread. 0.86% is a great rate and you have it locked in for 10 years? Why were people not just grabbing this with both hands?

Sure, if rates stayed low for 10 years then you’d pay 2.6k more each year on $1 million. But at current rates, you’re now paying 14.9 more per year wiping out 5.7 years of the theoretical savings each year it continues and probably a lot more stressful to boot.

We had historically low interest rates and the cost of insuring against rate rises was low. Just take the gift that’s being handed out to you!

Thank you @xerox5003 @Dr.PI - Does it mean the marked (banks, institutions, etc) anticipate a decrease in SARON rates? I’m considering purchasing a property and am currently unsure about the best option. I had the free consultation with Money Park, during which they suggested that I might opt for a 2-year SARON plan and reassess later. By combining my personal funds and pledging my 2 and 3 pillar, I will be able to meet the 33% requirement, thus eliminating the need for amortization

I suppose recency bias and the fact that they got greedy and perhaps felt it could keep falling. Absolutely crazy low rate!

It is hard to tell, what the “best” option is - you definitely can tell that afterwards ![]()

But yes, the analysts are expecting lower rates towards summer/autumn 2024. If you trust them and you have a good gut feeling, you can stay in Saron and then switch into a fixed term mortgage - maybe the rates are better in five, six months?

I fixed my mortgage in 2019. Honestly, I didn’t even bother looking at SARON. I was just looking for the best 10 year fix and also whether I could extend beyond 10 years without increasing rates too much.

1.69% the current SARON rate and the 2.29% above is including SARON + 0.6% uplift, is my guess. I’m very risk taking with some investments but when it comes to primary domicile, even ~1.8% seems fair.

Exactly, the problem with SARON is the uplift (part for the bank) normally around +0.4 - 0.7. Making then worst option than the fix rate.

Currently, you can get offers around 3-5 years fixed from 1.75 to 2, and SARON is 2-2.4. So it needs to drop to less than 1% to start to pay out somehow.

Just posting this here for those doubting SARON…

| Time Span (10 years) | Saron Mortgage Cost | Fixed Mortgage Cost | Advantage in Favor of Saron Mortgage |

|---|---|---|---|

| 1996 to 2006 | CHF 132,000 | CHF 297,000 | CHF 165,000 |

| 1997 to 2007 | CHF 137,000 | CHF 273,000 | CHF 136,000 |

| 1998 to 2008 | CHF 142,000 | CHF 229,000 | CHF 87,000 |

| 1999 to 2009 | CHF 136,000 | CHF 203,000 | CHF 67,000 |

| 2000 to 2010 | CHF 121,000 | CHF 264,000 | CHF 143,000 |

| 2001 to 2011 | CHF 108,000 | CHF 250,000 | CHF 142,000 |

| 2002 to 2012 | CHF 102,000 | CHF 255,000 | CHF 153,000 |

| 2003 to 2013 | CHF 101,000 | CHF 195,000 | CHF 94,000 |

| 2004 to 2014 | CHF 98,000 | CHF 218,000 | CHF 120,000 |

| 2005 to 2015 | CHF 93,000 | CHF 187,000 | CHF 94,000 |

| 2006 to 2016 | CHF 85,000 | CHF 183,000 | CHF 98,000 |

| 2007 to 2017 | CHF 71,000 | CHF 206,000 | CHF 135,000 |

| 2008 to 2018 | CHF 57,000 | CHF 222,000 | CHF 165,000 |

| 2009 to 2019 | CHF 54,000 | CHF 186,000 | CHF 132,000 |

| 2010 to 2020 | CHF 53,000 | CHF 176,000 | CHF 123,000 |

| 2011 to 2021 | CHF 55,000 | CHF 166,000 | CHF 111,000 |

| 2012 to 2022 | CHF 57,000 | CHF 109,000 | CHF 52,000 |

| Average of all 10-year periods | CHF 94,000 | CHF 213,000 | CHF 119,000 |

Notes on the table: Fixed-rate mortgage: It is assumed that a fixed-rate mortgage was taken out at the beginning of the ten-year period and that the interest rate is then fixed for the entire ten-year period (this corresponds to the character of a fixed-rate mortgage, it makes no sense to use the average here). Saron mortgage: The average interest rate for the respective ten-year period is used (monthly data). The costs therefore reflect the actual costs incurred if someone had a Saron mortgage (formerly Libor mortgage or equivalent predecessor model) in the amount of CHF 500,000 during the entire ten-year period.

Source: Festhypothek oder Saron-Hypothek - Was ist besser? (hypotheke.ch)

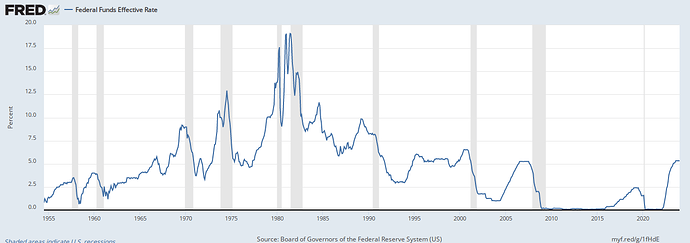

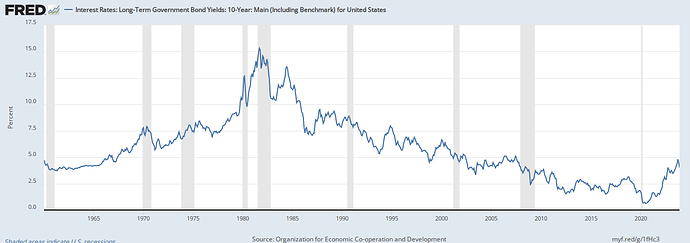

Then again, rates have been in a 40-year bear market since the early 1980s, not just in the US.

The older amongst us may remember times were quite different in the 1960s/ 1970s:

The yield curve is inverted, which does not happen too frequently. If it does, it forecasts recession with quite some certainty.

Past performance…

This highlights how people lost ‘situal awareness’ of where we were with interest rates. Relying on recently bias and simply mantras:

“interest rates always go down” => “floating rate always beats fixed rate”

Not realising where we were on the chart. You show the 10 year here almost getting to zero.

Sure, maybe some people did actually take this to the logical conclusion and say “you know what this is going to keep going down until it goes negative and the bank is going to pay me interest”.

Someone more sensible might have said “if this isn’t the lowest mortgage rates are ever going to get, it is damn well close enough that I should grab it now.”

Doesn’t matter if rates go up or down. Let’s think free and ignore that for a second.

Costs of a bank for a fixed mortgage:

- Risk costs (as in the mortgage holder not being able to pay the interest/repay the mortage)

- Liquidity costs (cost of the money either from the money market or through bank customer money)

- Interest rate change risk (changing liquidity costs)

- Administrative costs (Operations, IT etc.)

Plus margin (changes during mortgage duration)

Costs for a SARON mortgage

- Risk costs (same)

- Liquidity costs (less risky because of next point)

- Interest rate change risk (none → floating rate, bank can always refinance with no extra costs because of fixed margin)

- Administrative costs (same)

Plus margin (fixed but doesn’t proportionally scale with higher interest)

So the product SARON has less unknowns and gives you a fixed margin. Economically this product has to be cheaper than a fixed mortgage no matter the interest rate because it’s less risky (in the long term). There is no free lunch in locking in “cheap” rates as in the end the bank has to be profitable so some might pay less than market but a lot of others have to compensate that by paying more than the market but I guess that makes sense to everyone.

If you have a fixed mortgage you don’t have the “risk” of changing interest rate but you constantly have the risk of overpaying the market.

Please correct me if I’m wrong, just my two cents.

I do not think that this is necessarily true, banks can completely hedge this risk with interest rate swaps. Because of that, you can also look up the implicit margin by subtracting the swap rate (with the same duration) from the rate of a fixed rate mortgage. In my experience, these margins are not higher than the ones of SARON mortgages.

A SARON mortgage is cheaper than a fixed rate mortgage if the avg. rate is lower than the current market expectation over the time span, which is off course very hard to predict.

But the hedging has to carry additional costs no?

Costs / any premium (e.g. a term premium) are incorporated into the swap rate, the bank pays this fixed rate to another party and receives SARON payments for it. So yes, I guess there is some hidden hedging cost within the swap rate. No idea how high that is, but it looks like there are researchers that try to estimate it using various (non-trivial) techniques, e.g.: JRFM | Free Full-Text | Term Premia in Norwegian Interest Rate Swaps