The key is the duration. Read above.

Expected rate cuts, are already priced in. We also currently still have an inverted yield curve.

3years later you see that a Saron rate was not a good choice back then ![]()

You clearly missed the point. There will always be times where Saron will be more expensive as there will always be times where you‘re losing money with stocks. It‘s all about the longterm game.

P.s. Are you also the guy who is telling people in market corrections that investing in stocks was not a good choice?

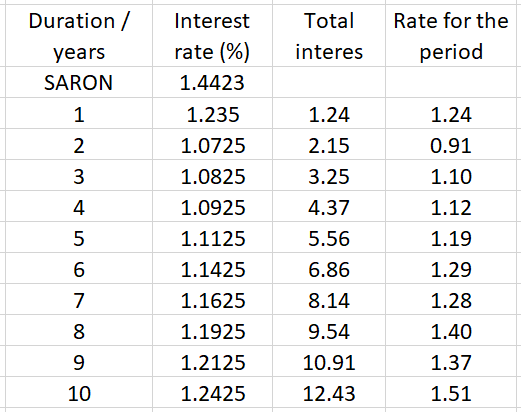

And here I have tried to decompose current rate swaps into expected interest rates per year going forward:

As you can see, again, after 5 years the rates go up without much reason → risk premium for lenders.

Depends on the provider and on its treasury. There are banks who are more expensive on the shorter end than on the longer end.

Therfore, it makes sense to get various offers.

These are not mortgage rates from a specific bank, but market rates. Nevertheless, I agree with you.

So I was wondering, IBKR offers e.g. for CHF 1M a blended interest rate of 2.259% which is lower than any Saron offering I see from Swiss banks.

So in theory, what would speak against such a loan? I understand the risk of leverage and the volatility of the principal might cause a margin call. However, if the underlying is low volatility and there is enough principal (e.g. > 1M) the risk should be low. Can the interest be deducted from tax income like mortgages?

it’s a bad idea to mis-match short term financing against long term liabilities.

Mind to elaborate. I‘m failing to see the difference between a Saron financing. I will have the liability in any case. My principal will fluctuate independently wheater I take Saron or margin except the bank doesnt check my balance on daily basis. And the risk of income failure to lose job is the same. Not trying to provoke but struggling to see conceptually the difference (except that bank wont check finances for 3-5 years)

I considered doing this, but I think there are a couple of additional risks:

- If IBKR goes bust, what happens to your loan? Will the new broker offer loans with the same conditions (probably not, many have much higher interest rates), could it even sell your assets to close the loan?

- Similarly, if IBKR decides to close the account on a relatively short notice (e.g. for compliance reasons, I think they can do that in theory), what do you do with your loan?

Another disadvantage is that you limit your future ability to take on short-term loans on your portfolio because you do not use your house as collateral.

To borrow 1M you need at Minimum 2M in Min vol. stuff like t-bills. And then we are looking at huge opportunity cost, as that stuff does not generate much return compared to stocks over the longterm (dont get swayed by current high interest rates)

Now if you want to have it in stocks, anything above 25% borrowed, risks a margin call, when something like 2008 happens.

So you would need at least 4M in stocks, to borrow 1M.

If you are that rich already, there‘s probably a bank that can give you a comparable Saron loan.

The mortgage is secured on the house. The IBKR loan on a portfolio that is marked to market every second.

Imagine you have a $2m portfolio, you borrow $1m and buy a house with it. Firstly, your stock portfolio is now encumbered while your house isn’t (an inefficient use of collateral).

Then something like 2020 happens, your portfolio drops 40% to $1200k for a couple of months. $800k of it is sold to maintain the margin. Now you have $400k of stocks and $200k of margin debt.

But good news, the stock market recovers after 6 months and your $400k portfolio is now worth $800k and you have $200k margin. But you are now down from $1000k equity to $600k equity, for you the 40% loss was permanent.

Had you had a mortgage instead, you would have simply ridden through this bump.

Disregarding the base rate and risks mentioned by others, IBKR could change the conditions or availability of margin loans without notice.

IBKR would just call the margin without blinking once your collateral is too low. I guess the bank would meet with you to work out a solution in case you would fall behind payments because of that.

I would (re-)start here. Have you compared and negotiated offers? 2.26% isn’t bad, but the big banks should be able to match that easily if you pass the bar on income.

I have a 0.5% margin on my saron tranche which at the current rate gives 1.95%. I think you just need to negotiate the rate. IBKR has good rates yes but only for short term liquidity needs…

Which bank is it if I may ask?

Crédit agricole

Historically SARON has been a winning bet 85% of time. And in case of selling you won’t get penalty paying back.

A mortgage broker is making much more with a 10y than with a Saron. Also you know the margin with Saron and it’s a bit harder with fixed duration. So I would make a parallel with passive/active fund.

Anyway if you’re very sure to stay forever why not get a 10y we can get 1.9% these days which is not so bad!

This one kind of summarizes from pros what we have discussed here.