It’d be interesting to see how the JEPx distributions do these months.

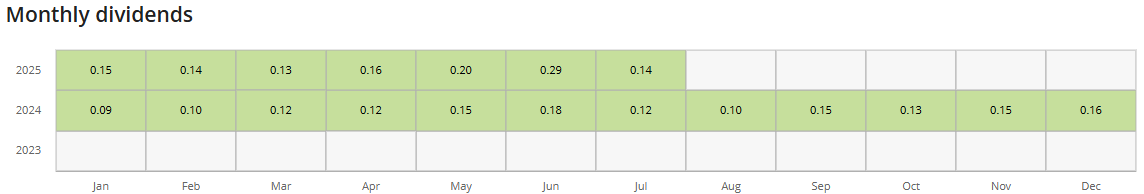

As expected, these products really do work exactly as intended and predicted - distributions went up during turmoil.

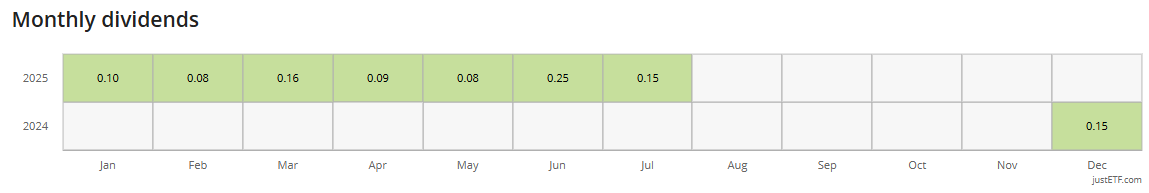

JEPI

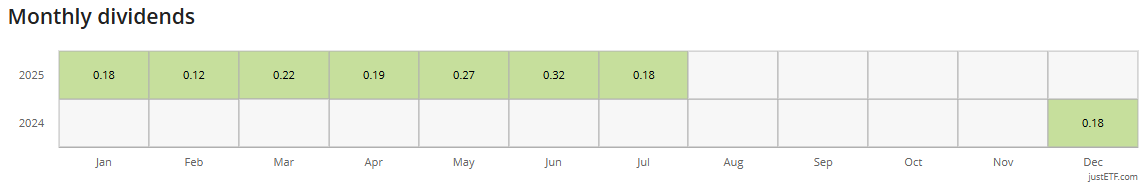

JEPQ

JEPG

Is that net of taxes?

IBKR told me this for July:

JEPI(US46641Q3323) Cash Dividend USD 0.39953 per Share

Similar amounts for previous months more or less.

No, this is just what’s on justETF in EUR as I am only looking at the UCITS versions. Don’t hold any of them.

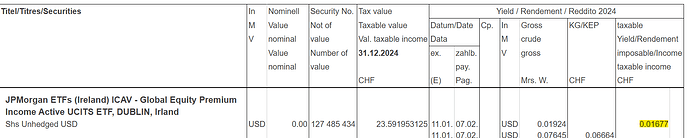

Most of the distribution (i.e. what is not dividend per-se) seems to be tax-free in CH for JEPG.

How is it going? I assume you will be abroad, soon. How is the portfolio working out?

Bought couple of months ago JEPI just for fun with a smaller amount but sold it more or less break even recently, whereas other titles exploded to new highs, in the meantime. Opportunity costs were too high, for me personally.

But I can imagine having a separate portfolio with JEPI somewhen in future - I feel like a junkie; JEPI is amazing and it generates nice dividends. But somehow, when being honest with myself, it does not suit to my strategy, SCHD or even CTA makes in my portfolio much more sense, for me personally.

@JEPG Can you please clarify, does this say that if the 7 Feb payment was 0.09569 (0.01924+0.07645), 0.01677 (ie ~18%) is taxable?

@THE5Z so with about CHF 43,000 you get ~3000/month? How’s the NAV in these funds, though? As you said, that amount is more than enough to live, and live well, in some countries. Can’t possibly be sustainable though, which I am sure you know already, so personally couldn’t see these funds anywhere in my portfolio for the long term.

0.01924 USD dividend makes 0.01677 CHF taxable.

0.07645 USD capital gain makes 0 CHF taxable.

So it’s 0.01924 USD taxable for 0.09569 USD total income, or, at reported exchange rate, 0.01677 CHF for 0.08341 CHF gross income.

Pretty sure you missed the currency label ![]()

I didn’t, I just didn’t factor it, still with the right currency this confirms that around 20% of the distribution month on month is taxable. It’s a good thing!

So, you’re buying ?

Disclaimer: I don’t own any JEPG nor do I provide any financial advice.

No, not yet, not in Switzerland, they are not something I need right now. I will definitely buy them well into the future when I am back in Greece where - currently - any capitals gains or dividends from UCITS funds are tax-free. Dividends/distributions and capital gains from non-UCITS funds are taxed 5% and 15% respectively (in Greece), so it’s still a good deal.

The NAV in any currency but USD is quite catastrophic. At the moment I mostly think it’s an high-end monkey-brain feeding product.

I’d agree with that for the YieldMax but not the JEPx products.

OK. So I’ll invest 172k and get 12k a month and retire now! ![]()

I mean…the way I see these is that once you get your principal back, which most of these suggest to do in 6-12 months, after that it really is free money…

@PhilMongoose you could. Even I could!

JEPI for example has a dividend of around 7-8% per year, not per month.

So an investment of 43’000 CHF will generate ~3000 CHF per year!

With an 8% distribution you will need 12.5 years to have back the principal (without considering taxes and NAV change)

![]()

![]()

![]()

![]()

![]()

Of course, I was referring to the products with per year distributions of 30-200%.

On the MSTY ETF: I was holding the one from the US but then realized, that for me (Swiss based), taxation is far from optimal; now I came across MSTY with Swiss Listing (Exchange Traded Product on Strategy 115% Covered Call Index | CH1447739751 | MSTY); it‘s mentioned that distributions are „capital gains“. Am not a tax expert and don‘t want to do the same mistake as before; anyone could help me out?

The distributions stem from the option premium, so I would assume this to be a capital gain as thats how they are usually treated. Here is some document I found about the taxation, search for “Optionsprämien”