My Monkey brain loves dividends.

I own some CHDVD for that reason (and a little bit of home bias). My Brain is now looking for something similar with monthly dividends.

I’ve seen some and one caught my attention: PFF. Does anyone have experience with this ETF or knows a better one? CHF EUR or USD are all ok. I’d prefer CHF but the market is small and I know there aren’t.

From the top of my head, a number of bond funds do this. If you are interested.

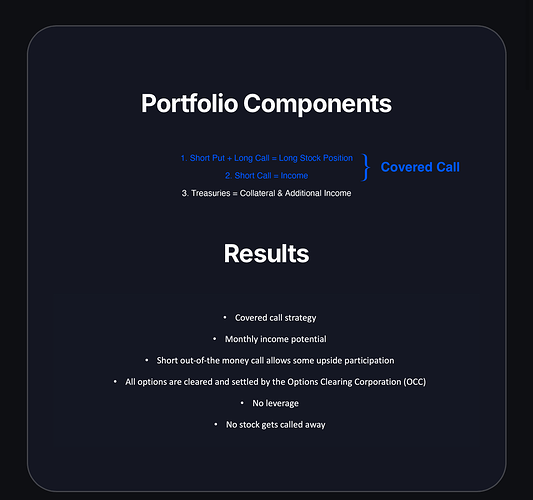

What about option income ETF’s? ![]() (like https://www.yieldmaxetfs.com for example)

(like https://www.yieldmaxetfs.com for example)

Noooo no monkey brain!

I didn’t know this one, but it looks interesting. Nice lowish beta. Don’t know if I’d have it because I only buy UCITS, I suppose you could claim the WHTs back from PFF given it’s US domiciled, right? It appears to hold 80% of assets in the indexed securities and do trading with the remaining 20%, like the covered calls funds.

Probably has both lower upside and downside than the covered calls funds - why would you prefer it over JEPI/Q/G? NAV has eroded since launch, but hypothetical 10k invested at launch and reinvested dividends have doubled the principal over ~15 years, which could be very acceptable if you want this sort of instrument.

Monkey brain doesn’t understand those complex stuff. Also monkey brain hates darkblue text on black background ![]()

I didn’t know that. By clicking around I’ve found the Emerging markets bond fund ( https://www.justetf.com/en/etf-profile.html?isin=IE00B2NPKV68#dividends ) Nice returns, but surely not shock proof.

No reason. That’s why I’ve asked for feedback here. Isn’t JEP[I,Q,G] a meme etf? ![]()

The erosion is bad but if it keeps paying more than it loses, it might be ok for MB.

Not at all in my opinion, they perform exactly as described and the manager is JP Morgan.

YieldMax and 0dte scheisse are meme ETFs in my opinion as they don’t hold any underlying asset.

Caveat I don’t have any of these income products, I just have FUSD which is the UCITS, more growth-oriented cousin of SCHD, it wouldn’t do for you though as it’s quarterly and doesn’t have a high yield.

I just long for the day I can sell everything and plug it into JEPG and ride into the UCITS tax-free heaven (Greece) ![]()

I bought JEPI a while ago because also monkey brain and beginner. They are totally ok (though underperform world index ETF). I buy around 1 VT per month with it. ![]() Monkey brain happy.

Monkey brain happy.

JEPG seems better than PFF, even if I don’t understand some (most) of the things compared. The most important are on JEPG’s favor though.

SPHD has higher volatility, lower dividend but higher performance

Please note JEPG is different from JEPI.

The second point is perfectly explainable by the design of the funds, as SCHD doesn’t write call options, and therefore grabs all the upside potential without cap, and the dividend distributed is an average of the dividends received by the underlying stocks, so it’ll likely always hover around 3-4%, but is growing as an absolute number as the fund is looking for steady dividend growers, yield will follow growth, therefore the % will stay put.

JEPI’s dividend will, again by design, be impacted more about volatility (higher volatility = higher options premia) and benefit more in sideways markets, while suffering in a slow grinding market decline. Of course in case of a market rally JEPI will lose much of the upside as up to 20% of the underlying stocks could be called away (and need to be rebought at higher prices). Am I just convincing myself that it’s not a good idea? Maybe…dunno, it’s probably more complicated than that under the hood (e.g., are they buying options against the S&P500, and how could they do that? by buying options against ETFs/mutual funds tracking the S&P500? That sounds unlikely given there are loads and all have different price/unit, or they are buying options against some or all - and which? - of the stocks in the S&P500), and is actively managed so the managers can react accordingly, dunno.

I get you, I use my ETFs’ dividends to buy BRK.B, and a couple of times to pay for my car loan - just to tell my monkey brain that my investing is actually doing something applicable to the real world. Makes me as happy as a pig in shit ![]()

And what would you actually do with the dividends? If you reinvest them anyways, would it not just lead to higher number of transactions?

I think we are on a sideway market atm. So maybe JEP* are a good idea.

JEPG and JEPI are different, I missed that (actually I forgot. I knew that when I first checked them around the beginning of the year).

So I suppose as a complementary investment , JEP* are a good idea right now. Kind of Bond-ish? 60/40 VT/JEP* ? ![]()

On- or off-topic, but what makes you think that? VWRL has reached its previous ATH and the 100% US ETFs have rolled past it, so we’re still firmly in a bull market in my opinion. There are some important earnings reports coming up soon, this time last year we had a drop which then turned into 6 months straight up.

No idea, it really comes down to your targets/appetite. I don’t personally plan to go to the covered calls fund before I need income, but plan for myself to build SLICHA or CHDVD (which you have already) going forward to take some weight away from the US.

I’ve been conditioned, for good reason, never to consider stocks and derivatives bondish. In fact I can’t even get my own head around bond funds, while individual bonds, notes, bond ladders make more sense to me. I don’t have any though.

Thanks for your comments. I am mostly experimenting, but I’ve noticed that the JEP aren’t that bad in recession, which is the main point (apart for the monkey-brain thing). Buying VT would be better if the market keeps going up, but I’m now more neutral so here’s that.

1k on it seems a good way to take it seriously and see how it behaves.

Let\s say it has slowed down.

I have a tiny bit of CHDVD as well as Swiss Re and Swiss Life on Yuh to experience the thrill of getting a bit of cash once in a while. But other than that, I am not going for high dividend yield because you lose so much of your returns to taxes.

on a side note, internet is full of JEPG = european JEPI

and JPM’s website are definitely not helping…

Didn’t read through all of the post but just wanted to throw this into the mix:

https://portfolioslab.com/tools/stock-comparison/FUQA.L/JEPI

Dividends can be really fun.

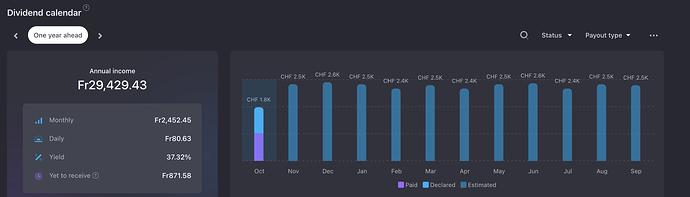

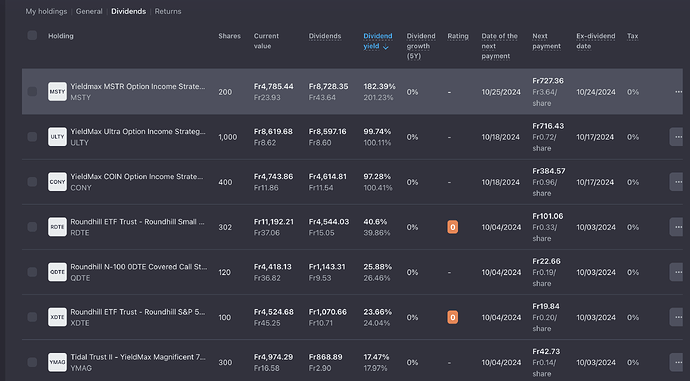

This is my high risk, high reward portfolio. In one year i am going to study abroad, and for that I need some monthly income. With around 3’000 CHF per month I can live a comfortable student live without much compromise, so that is what I am aiming for. And I don’t want to sell my normal portfolio, so I created this side portfolio mostly using the Yieldmax-ETFs mentioned by SwissTeslaBull and also some Roundhill ETFs (XDTE/RDTE/QDTE).

It seems to work and monkey brain is happy. But I am fully aware about the Risk, so I am using this only as an experiment to substitute selling some of my normal ETFs for my study trip next year. If it doesn’t work out and in the worst case I lose everything, I have still my normal mustachian portfolio.

Edit: To be transparent, here is the whole high dividend portfolio:

I think the chance to lose everything is quite small, it’s all too possible that these grind down their NAV to nothing, but assuming they don’t grind to zero until you have gotten your principal back from the crazy distributions, it’s becoming literal free money. Some people I am watching on reddit claim to be in that territory. Still I’d personally not touch these…things!

Edit: cognisant that calling it “free money” is trigger worthy, need to add that by the same thought process any stock that has grown beyond what was put into it is free money (when sold!) and even more so tax free in CH, need to stay honest with what I’m saying! But my monkey brain would think “wooo free cash”, indeed. Monkey can’t think objectively, bananas (cash) are worth more than banana trees (assets, securities).

To me this doesn’t look like monkey brain, but sheer lunacy. Considering you’re turning tax free gains into taxable income and losing asset value it looks more „tearing down the roof to stoke the chimney fire.“