No, just that if you’re holding non-income focused products you’re not taxed on any on-paper or realised capitals gains (and dividends which are taxable are a much smaller part of total return), while if you hold income products the dividend distributions, which are fully taxable, are a far bigger part of total return. This is the argument against dividends in Switzerland.

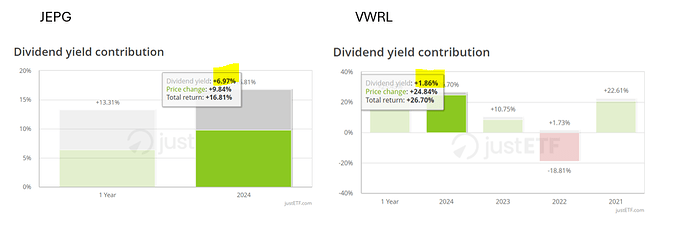

If you look at JEPG vs VWRL side by side, the highlighted part is the taxable part, 40% of JEPG’s return is taxable, while only 7% is taxable for VWRL.

I agree that VWRL and JEPG are different products, with different goals, and both work pretty well at what they’re designed to do, so it’s up to the investor to look at what they want to get out of it. Talking personally, in a situation where UCITS ETFs and their dividends are fully tax-free, and I have enough to invest in JEPG to fund my life, I’d ditch VWRL in an instant (maybe save some for my kids). Until then there’s no good reason for me to get JEPG.

I’m just longing for the day I will switch to these ETFs being what’s covering my living expenses and then some, but it’s far.