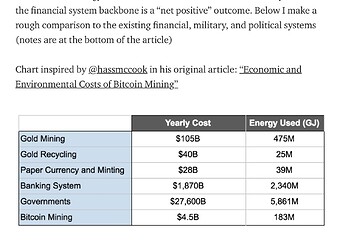

That graph is from an article on ARK’s web site. Their in-house “cryptoasset analyst” (whose Twitter ramblings we’ve had the pleasure with before) probably did a quick Google, took the first and most convenient table he could find and called it a day.

Because… let’s look at the “data source” they provide: Some guy’s blog post (well, ok, seems to be director of growth marketing at Kraken) on Medium. Indeed, the numbers seem to have been pulled directly from the table provided there:

And… that’s it, basically. There’s no details given, the figures are based on other research that’s only very briefly mentioned and linked to in the notes. ARK couldn’t even be arsed to quote the original “research” as the data source. Not that I am surprised.

So what underlying research is referenced in the notes then, as source for the energy consumption of the banking system? No problem, I’ll directly provide you link to the “initial research” here (page 20-22), provided by Hass McCook, self-proclaimed “Bitcoin Evangelist”

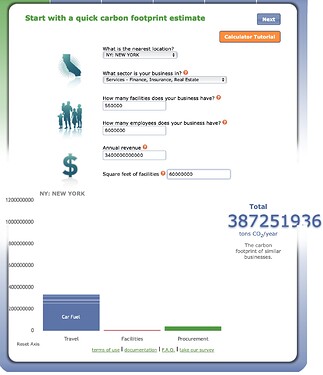

His initial assumptions in calculating the carbon footprint of the banking system (revenue, numbers of employees and branches, office/facility space per employee) indeed seem relatively reasonable. The author then proceeds to enter the data into the CoolClimate Network’s carbon footprint calculator provided by the respected University of California, Berkeley, to calculate an estimated carbon footprint for the banking system in terms of CO2.

And indeed, entering his numbers into the online calculator, I am ending up with very similar figures for carbon footprint of approximately or slightly below 400 million tonnes of CO2.

Now, here’s where it gets “funny” though:

-

The "initial research on which ARK’s graph is based does not actually calculate the energy expenditure for bank branches. He merely seems to apply the same ratio as the one between carbon footprint electricity generation with regards to ATMs (whose carbon footprint is pretty negligible). However, as we are going to see, the assumed carbon footprint for bank facilities doesn’t mainly depend on electricity.

-

Quote: “the governing factor of the model appears to be the amount of yearly revenue generated, as significant changes to number of employees and branches have little effect on the model output.”

Let that sink in: The carbon footprint of the banking system allegedly does not (according to the “research”) depend on the size of their operations!

If banks double their revenue, their carbon footprint would roughly double as well - and if they closed half of their branches, it would have only a small to negligible effect. So the assumptioon. -

So why is that? Well, of the 387 million tonnes of CO2 I am getting as a result, only 50 million are attributable to facilities (7 million) and procurement (43 million). 337 million - or 87% of the carbon footprint of the banking system is attributed to travel alone (air travel, public transit and commute):