Screenshot from german version here

No. You have to apply again.

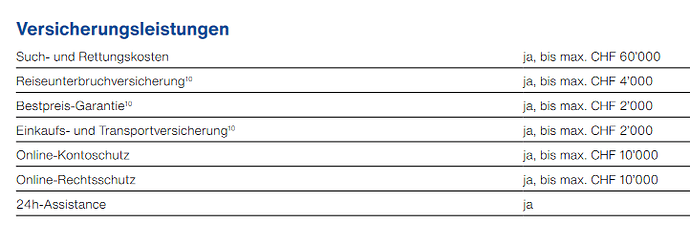

The travel insurances are those that should be dissected to understand what they are. The 1st is probably the same you have with an health insurance. The second seems to be again an health related insurance, unlike the Ikea ona irc.

@Daniel, CC insurance expert , what do you think? ![]()

Edit: heres a link for ikea: IKEA Family Credit Card Reviewed - moneyland.ch (the irony ahahah)

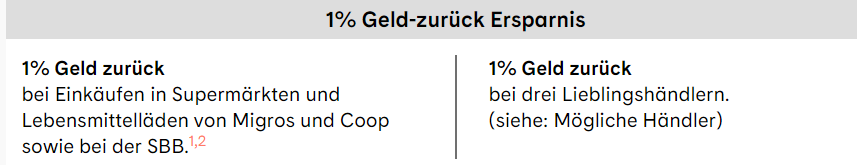

Well, Cembra is fighting back. Their new card offers 1% Cashback at Migros, Coop and SBB/CFF/FFS and 0.33% everywhere else. For people like me who shop at both Coop and Migros, it can have a use.

I’ll have to think about it but staying with them is tempting me.

Anyone here from Liechtenstein? Migros now only seems to accept people living in Switzerland ![]() I was hoping to get away from the eBill-less hell of Cembra.

I was hoping to get away from the eBill-less hell of Cembra.

Edit: I called them, and they do only accept Swiss residents. It wasn’t just an error in their form.

Checking the new Cembra Card as well. It’s NOT an alternative to Neon/Revolut, foreign transactions look expensive. But it looks like an alternative to the Swisscard Cashback Cards, since apparently you get 1% cashback on your 3 most favorite retailers (choose from a list) and 0.33% from all others. Meaning for domestic transactions the Cembra Card looks superior to the new Cumulus card.

One thing I don’t get: Is the 1% cashback temporary or permanent. It seems to be permanent on the one new card they offer, the Certo! Mastercard World, but I don’t find that information for the second, the Certo! One Mastercard World. Sidenote: Why on earth 2 new cards with similar names? Has everything to be complicated?

Does anyone have feedback on the ebanking and app for the new card? Last time I tried Migros Bank it was in the Stone Age (you had to install some kind of Windows application). Very happy with the new Cembra app that gives you an instant notification of charges, wouldn’t want to give that feature up.

I called Cembra and asked.

If you have an old Cembra Cumulus Card you can switch that to a new Cembra Certo Card quickly and get a temporary 1% Cashback bonus on ALL transactions until end-September. Thereafter 1% with Migros, Coop & SBB and 0.33% with all others.

No matter if you have an old card or not, you can apply for a Certo One Card, which gives 1% cashback on your 3 favorite retailers, permanently, and 0.33% with all others. You can choose from a list, on a monthly basis. You can set the 3 retailers separately on each of up to 3 cards linked to your account.

The list: Migros, Coop, SBB, Zalando, SWISS, Manor, Lidl, Decathlon, Aldi, H&M, Netflix, Spotify, Airbnb, Booking.com, Microspot, Digitec Galaxus, Ochsner Sport & Shoes, Interdiscount, Denner, Landi

So I’d say if you shop mostly from the above retailers the new Cembra card could well be the most attractive domestic card. It’s a Mastercard, not Amex as with Swisscard, you get cashback, not Migros points and you get that quarterly, not yearly as with Swisscard.

Migrosbank seems to go for foreign transactions instead, but fails in my view to be as attractive there as Neon/Revolut/Wise. Only real advantage over those would be ebill, i.e. I wouldn’t have to top up the account like I have to with Neon now.

And now a question: which of them doesn’t accept AMEX cards that gives 1% Cashback?

Lidl and Aldi for example.

Side note regarding Amex: They keep the 1% for max 1 year. It’s not like the other cards that pays it back at the end of the month. They pay once per year (and if you cancel the card, you lose it)

I still don’t get why there are two Certo, other than the possibility to switch the 3 1% shops.

It also look like they site is wrong, since it doesn’t say that the 1% is temporary.

Edit: Maybe I misunderstood @Myfirstme comment. Only if you go from cumulus to certo you get the temporary 1%, but if you get a new certo one it’s forever.

Still who is getting a new Certo-only?

Those sweet sweet 30 CHF for every customer that forgets to download and pay the PDF bill.

With the left one you temporarily get 1% on everything, after that it’s only Migros, Coop and SBB.

While with the right one you get 1% on 3 shops that you can choose.

Overall switching from the Old-Cumulus is kinda the worse option… since with the new offer you get a signup bonus and you can freely choose your shops.

IF I understood them correctly:

Old card switch-over (you must have a Cembra Cumulus Card): you get 1% on ALL transactions with everyone until end September and thereafter only with Migros, Coop & SBB

New card, you get that 1% only with your top-3 retailers (and a 50 CHF sign-up bonus)

EDIT 1: Was too slow

EDIT 2: Now the left card is better, from October the right one will be.

Only if you spend like 5000 CHF until October, because with the new card you just get the 50 CHF without even needing to collect the 1% cashback.

How did you argument to convince them?

True. If you wanted to optimize and assuming the sign-up bonus doesn’t change you could get both cards, the left now, the right later (or both now I guess).

Another small advantage of the left card, switching should be fast, with all settings as they are now (additional cards, direct debit).

I’m leaning towards the new Cembra offer… I’m on direct debit so the e-bill is not a big deal.

The cashback appears clearly better, also you will be able to combine 1% cahsback on Migros/Coop with the Cumulus 1% cashback so that’s 2% cashback on Migros/Coop, 1% on CFF and 0.33% everything else.

Only downsides that remain

- foreign transactions are expensive, but for that I use my French credit card with no fees

- Insurance offer appears better with Viseca/Migros → there is no insurance with Cembra apparently…

Likewise.

I’ve just ordered the new card and will afterwards cancel my old Cumulus credit card.

New Certo One Mastercard + Swisscard Amex will be my setup for domestic transactions.

So to sum up, there is now the new Visa offered by Migros, the new Cumulus card from Migros and Certo! from Cembra.

In the end, for a daily use, it seems to me that the Amex from Swisscard is still the best option (if 8 shops out of 10 accept the Amex card, from my experience it is the case).

In any case I would strongly advise against Cembra. I had very bad experiences with them and their administration is a disaster without a name…

Remain Cumulus VS Migros. Here Cumulus seems to me slightly superior in terms of offer compared to the Migros Visa card. Maybe Migros will update the conditions of their Visa card in order not to pejorate the customers who have cards and accounts with them.